There’s more to any investment than a single number.

If you’re looking for investment income, the S&P 500‘s (^GSPC -0.02%) highest-yielding dividend stocks seem like the no-brainer choice. Not only are the index’s constituents the market’s biggest and most established names, but they’re also dishing out more income than most other options.

This simple strategy, however, comes with significant risk as the underlying dividends may not be built to last. They may only be high right now because the stocks behind them have been struggling.

With that as the backdrop, should you buy the S&P 500’s highest-paying dividend stocks right now?

The rest of the story

Cutting straight to the chase, the S&P 500’s highest-yielding names as of this writing are carmaker Ford Motor Company (F 0.36%), tobacco giant Altria (MO -0.84%), and drugstore chain Walgreens Boots Alliance (WBA -3.70%). Their forward dividend yields stand at 5.6%, 8.2%, and 9.6%, respectively.

Those are all impressive compared to the S&P 500’s average yield of 1.3%, but there’s more to the story here.

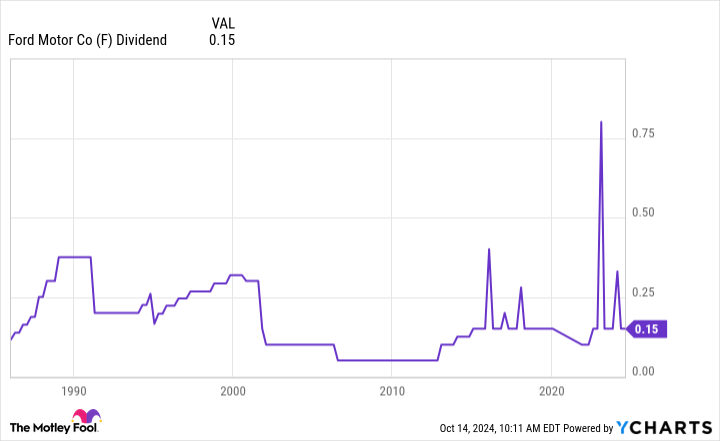

Take the aforementioned Ford as an example with its compelling dividend yield of 5.6%. As you can see below, its payout history has been less than consistent. The dividend actually hasn’t grown in years, when excluding the occasional special dividend. Long-term shareholders have seen the value of their quarterly dividends fall over time due to inflation.

Data by YCharts.

This inconsistent track record is reflective of the auto industry’s ongoing challenges, and Ford has seen sluggish growth in recent years while having to spend heavily on electric vehicle initiatives.

Altria has earned its reputation as a reliable dividend stock — it’s a Dividend King after all with over 50 years of annual payout increases. Unfortunately, its bull case also comes with an important footnote: Its core profit center is in the midst of a long-term decline.

Customers of the company’s iconic cigarette brands like Marlboro, Parliament, and Virginia Slims shrink in number with each passing year. Meanwhile, Altria has been slow to build traction with alternatives like vaping (e-cigarettes) and smokeless tobacco. A costly series of missteps around its Juul and IQOS investments mean cigarettes remain its bread-and-butter business. Without strong, steady growth for those alternatives, there will come a time when Altria can’t sustain its generous dividend.

That time is decades in the future, and Altria’s cigarette business is still generating a ton of cash. Just bear in mind that as the dividend’s expiration date approaches, the value of Altria stock is apt to shrink quite a bit.

As for Walgreens and its sky-high yield? The company is on the ropes.

While insurance reimbursement rates for all pharmacies continue to weaken, Walgreens is also struggling with company-specific problems like 2014’s ill-fated acquisition of European drugstore chain Boots or its more recent entry into the health clinic space.

Walgreens cut last year’s quarterly dividend of $0.48 to only $0.25 earlier this year in an effort to conserve much-needed cash. Given that the company is barely breaking even as it aims to shrink its way to success, it’s unlikely to be enough to change the chain’s fortunes. The $42.5 billion in long-term debt and obligations on its balance sheet is no small burden either, and management just announced 1,200 store closures with more to come.

To buy, or not to buy?

Despite how attractive a dividend might be, it’s necessary to have the company’s full picture. In fact, the higher the yield, the less reliable its underlying dividend is apt to be. Just as investors are willing to accept lower yields in exchange for more certainty, they require higher yields in exchange for taking on more risk. In this case, the risk is the prospect of a shrinking (or altogether cancelled) dividend payment.

Of the three S&P 500 stocks in question, Walgreens and Ford aren’t worth the risk for most investors. Altria’s only value to a portfolio is as a dividend vehicle, and even that value may have an expiration date.

Said another way, if sustainable dividends — and a bit of payout growth — are your core goals, look elsewhere. Slightly lower yields often offer far more reliability, and other companies are more likely to deliver long-term share price growth too.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.