In India, gold in the Mumbai spot market was quoted at ₹1,24,155 per 10 gm

Silver is facing a supply shortage globally with a couple of government mints, such as the Canadian Royal Mint and Australia’s Perth Mint, stopping sales of products made with the white precious metal.

The development comes amid silver soaring to a record high of $53 an ounce early on Tuesday before easing towards $50.5 an ounce and then rebounding to $51.63 at 1945 hours IST. With a 75 per cent gain year-to-date, silver has outperformed gold in 2025. The yellow precious metal has gained about 55 per cent this year, with prices zooming to a record high of $4,140 an ounce on Tuesday before easing to $4,105.

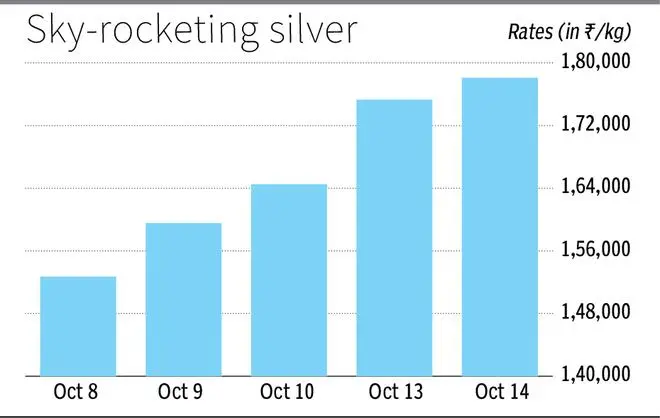

In India, gold in the Mumbai spot market was quoted at ₹1,24,155 per 10 gm. Silver was quoted at ₹1,78,100 a kg. On MCX, silver December futures ended the first session at ₹1,56,707 a kg, while gold December contracts finished at ₹1,25,244 per 10 gm.

Soaring silver prices have resulted in exchange-traded funds (ETFs) charging premiums of about 10 per cent, leading to Kotak, SBI, UTI, ICICI and Tata Mutual Funds suspending subscription to their silver funds. The subscriptions will likely open only after the shortage eases.

Rates for borrowing

“Global silver supply has failed to keep pace with demand for seven consecutive years, leading to a structural market deficit, which is forecast to continue for a fifth consecutive year in 2025. This structural shortfall creates a unique floor for prices,” said Motilal Oswal Wealth Management (MOWM) in a note.

Geopolitical risk, persistent inflationary concerns and renewed investor interest, evidenced by significant inflows into exchange-traded products (ETFs) — reaching 95 million ounces in the first half of 2025 — have provided the speculative leverage required for sharp price increase, it said.

The supply squeeze in silver has led to the interest rate for borrowing the metal from banks to over 30 per cent (the metal will have to be replaced with a 30 per cent interest) in major centres such as London, Zurich and Singapore.

Data show that silver holdings in the London vault have dropped by over 30 per cent to 24,851 tonnes as of September 30, 2025, from 35,667 tonnes in April 2020.

Mints stop sales

MOWM said the drain was due to massive inflows into consumer markets such as India, while there has been a sustained demand for investment in bars and coins from the US and Germany. Market participants in China have withdrawn 480 tonnes of silver so far this year.

The Silver Academy reported that US mint production of one ounce Silver Eagles is only 20 per cent of last year’s output. This has resulted in premium for the coins and delays for delivery. “What was once the backbone of retail silver demand is now barely a trickle — demand overwhelming supply in a spectacular fashion,” it said.

The Royal Canadian Mint has stopped selling 10 and 100 ounces silver bars that meet demands from institutions. “Never before has the Canadian Mint failed to deliver these bars to market. Today, buyers get a simple answer: ‘none in stock and no timeline for resupply’,” the academy said.

Australia’s Perth Mint has suspended sales of all silver products. The UK’s Royal Mint has limited silver sales to one-ounce coins currently.

Why the shortage

Bloomberg reported that investment managers are saying that there is “no liquidity of silver available” for spot delivery at the London Bullion Market Association. MOWM said silver ETFs in India have outperformed so far in 2025, surging by about 70 per cent. This led to monthly silver ETFs investments increasing by 180 per cent in August.

Trade analysts say silver demand has exceeded 1.16 million ounces annually but supplies have been 800 million ounces short annually over the past five years.

The supply shortage is because 70 per cent of silver production is derived as a byproduct of metals such as copper and zinc, curbing the flexibility in production.

The current scenario in silver is not a repeat of what happened in 1980 or 2011. According to analysts, including from MOWM, silver is being re-priced as a critical industrial and monetary metal. They warn that the global market could witness one of the most critical supply crises now.

Published on October 14, 2025