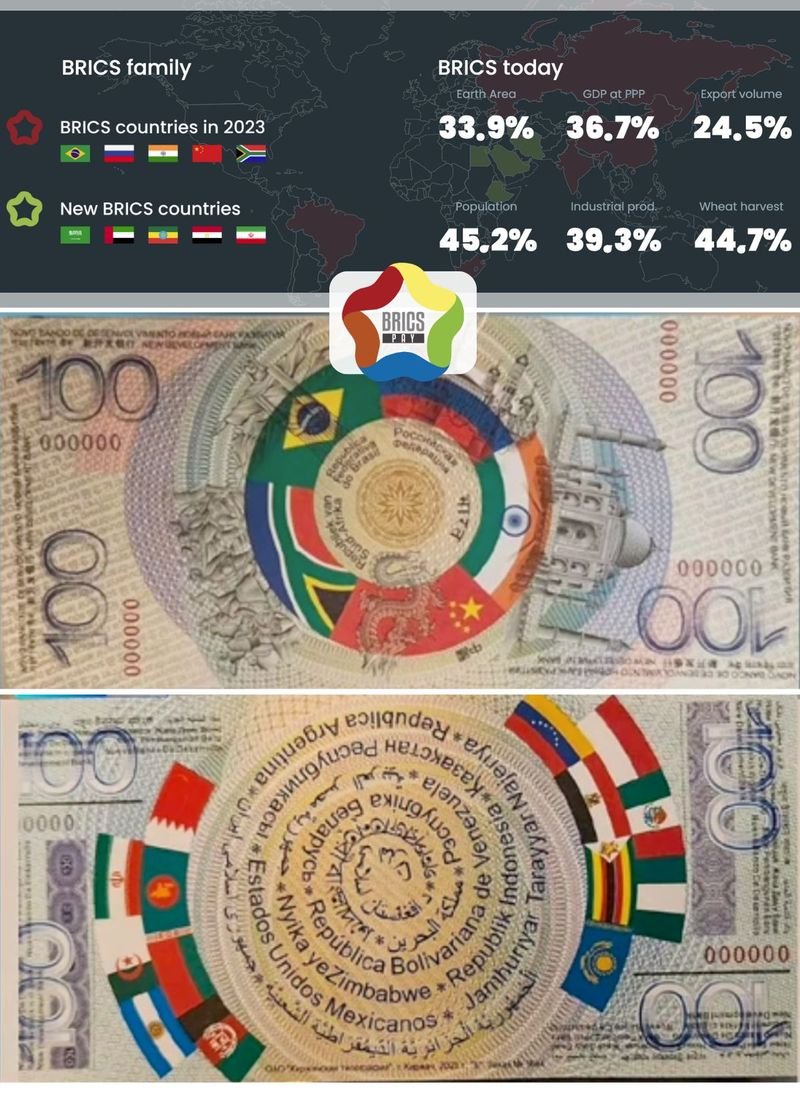

It is a BRICS-led international payment system, a digital currency platform being promoted by the bloc.

It’s sort of like a cross-hybrid of the euro, the common currency the European Union, and Bitcoin, the most prominent crypto so far. The idea behind a BRICS-issued common currency — “BRICS Pay” — is anchored by the creation of the New Development Bank.

BRICS Pay is aimed at serving multiple purposes, from trade and investment to microfinance solidifying BRICS’s commitment to a more self-reliant financial network.

What would BRICS Pay do?

This platform is intended to circumvent the US-dominated SWIFT system and strengthen economic resilience among BRICS nations.

It is believed that the use of national digital currencies would support investment and development, particularly in infrastructure and technology projects across the Global South.

It has been proposed that the BRICS New Development Bank should fund projects in areas like e-commerce and AI to advance economic growth within member states and partner countries.

Recent developments

At the 16th BRICS Summit (October 22 to 24, 2024, in the Russian city of Kazan), attended by around 20 leaders, President Vladimir Putin emphasised the bloc’s commitment to exploring a common digital currency as part of a broader effort to reduce reliance on the US dollar in global trade.

He pointed out that BRICS members—especially Russia and China—are motivated to shift financial transactions toward local and digital currencies to foster economic independence and reduce exposure to Western financial systems.

Will BRICS Pay be based on blockchain technology?

Yes. As part of this initiative, the Russian leader introduced “BRICS Pay”, a blockchain-based platform designed to facilitate secure cross-border transactions within the alliance.

With its blockchain-based infrastructure, BRICS Pay is not a centralised digital currency but a digital service allowing transactions in any member nation’s currency.

Benefits of blockchain technology

One advantage of using blockchain technology in rolling out BRICS Pay: it would offer a stable infrastructure for cross-border payments, as per Ledger Insights.

Another advantage: blockchain developers will be able to contribute to designing BRICS Pay as a secure and scalable payment platform.

By establishing a common platform for payments, BRICS nations can lessen the dependency on the dollar, according to Modern Diplomacy.

This shift, it noted, forms part of a broader strategy to create a digital currency platform that could serve as an intermediary for payments, potentially including other regional currencies.

What do economists say about BRICS Pay?

Research on BRICS Pay has explored recent developments and potential impact:

Studies emphasise that BRICS Pay could create a more efficient, secure, and inclusive alternative.

By using digital and potentially blockchain-based payments, BRICS Pay could enable faster, more cost-effective transactions between BRICS countries, according to Ledger Insights.

Blockchain and digital currency integration

Another study, conducted by SDLC Corp, examines the role of blockchain technology and digital currencies within BRICS Pay.

The integration of blockchain would enhance transparency and security in transactions.

China’s digital yuan initiative is particularly relevant here, as BRICS Pay could incorporate such digital currencies, increasing transaction flexibility and meeting rising demand for digital financial services.

BRICS+: Expansion

•Egypt

• Ethiopia

• Iran

• Saudi Arabia

• United Arab Emirates

This has intensified the push for transactions in local currencies.

Recent developments on BRICS Pay:

BRICS Pay is rapidly expanding within member institutions:

- India’s State Bank now has a BRICS Pay mobile app,

- Russia’s Sberbank and VTB Bank have integrated it for cross-border payments,

- China’s ICBC and Bank of China are using it to streamline international transactions.

Is there outside support for BRICS pay?

Outside BRICS, banks like the UK’s Standard Chartered have joined in, allowing seamless transactions with BRICS countries.

This progression underlines the BRICS bloc’s intention to create a resilient alternative to the dollar, making BRICS Pay a linchpin in their “de-dollarisation” strategy and a robust tool for cross-border financial independence.

Image Credit: BRICS Pay Technology Demonstrator

The expansion of BRICS has intensified the push for transactions in local currencies.

Notable developments

In December 2023, the Payment Association published an analysis: “Could BRICS Countries Introduce Their Own Currency for International Trade?” It noted that while BRICS member countries’ national economies vary widely both in terms of structure and performance, there’s been a notable increase in the amounts of trade with each other.

At the same time, the global geopolitical landscape has shifted dramatically in recent years, with the Russia-Ukraine war serving as a catalyst for significant changes in international trade and finance.

What is CIPS?

CIPS stands for Cross-Border Interbank Payment System, China’s version of SWIFT, the global financial messaging system.

This alternative payment system facilitates clearing and settlement services for cross-border renminbi (RMB) payments and trade.

CIPS was launched in 2015 by the People’s Bank of China (PBOC) to promote the internationalisation of the Chinese yuan. It’s designed to streamline cross-border transactions, reduce costs, and enhance the efficiency of RMB payments.

Challenges

While the idea of a BRICS Pay digital currency is getting greater attention, several challenges must be addressed:

The BRICS+ nations have diverse economic structures and development levels, which could complicate the coordination of monetary policy and fiscal measures.

Political will and cooperation:

A successful BRICS Pay digital currency would require strong political will and cooperation among all member nations. Experts point out that while the yuan’s global influence is growing, concerns about China’s capital controls, exchange rate volatility, and the country’s financial system could hinder broader adoption.

Infrastructure and technology:

Establishing a robust financial infrastructure and payment platform would be essential for the smooth functioning of a new currency. But this is not at all impossible as can be seen from the rise of cryptocurrency-based platforms, which is disrupting global finance.

One challenge for BRICS Pay is “interoperability” with traditional global financial systems, which is essential to its success. Would it work with SWIFT?

Regulatory hurdles across different BRICS countries pose a key challenge, according to Ledger Insights. This needs resolution before full-scale implementation can occur, with ongoing efforts to align these diverse legal frameworks.

The road ahead

Challenges remain: BRICS Pay is still in its early stages. It faces complex regulatory and technical challenges that require utmost collaboration among member states.

And it’s yet to be seen whether the BRICS+ nations have the collective will to overcome obstacles towards a robust payments platform. The devil is in the detail: How far would member-nations work together to push it? Who will guarantee the platform’s security, and how? What happens when or rules or protocols are violated?

Ironing out these kinks would immensely help BRICS Pay, and empower emerging economies.

When widely accepted, enabled by blockchain technology, it could potentially reshape global finance, and disrupt international payments as we know it.