This weekend in crypto, FTX settles its 2023 lawsuit against Bybit for $228 million, Sumit Gupta, the co-founder and CEO of CoinDCX, argued that central bank digital currencies (CBDCs) and cryptocurrencies like Bitcoin serve different purposes and can coexist, and Coinbase launched a new tool allowing crypto users to create their own AI agent in just minutes.

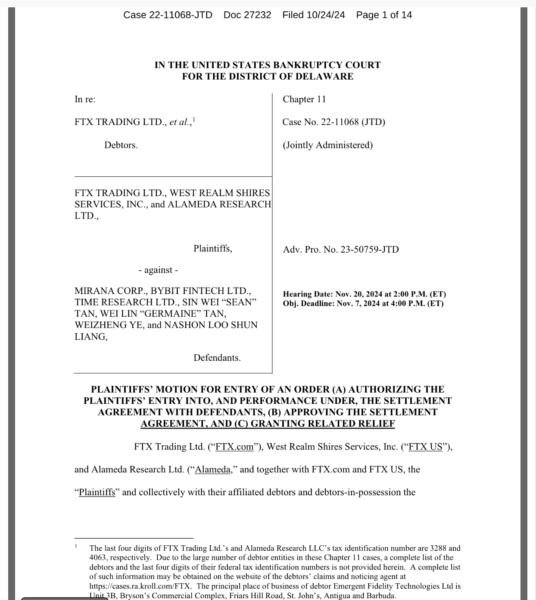

FTX settles Bybit lawsuit for $228 million

In an Oct. 24 legal motion, the FTX bankruptcy estate, the Bybit exchange, and its investment division, Mirana Corp, agreed to settle a 2023 lawsuit brought by the FTX estate for $228 million.

According to the legal filing, the FTX estate will be permitted to withdraw $175 million in digital assets held on the Bybit exchange and sell $53 million in BIT tokens to Mirana Corp.

Attorneys for FTX argued that while the claims made in the 2023 lawsuit were valid, continued litigation would be too expensive and time-consuming to maintain.

The settlement agreement is still subject to court approval before it is finalized, and a hearing is scheduled for November 20, 2024, at 2 PM Eastern time to ratify the agreement between the parties.

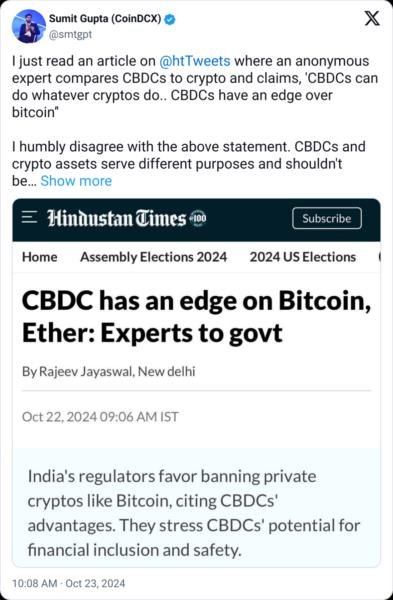

CBDCs and crypto should coexist, not compete — CoinDCX co-founder

India’s regulatory position on cryptocurrencies and CBDCs continues to fuel debate, with recent discussions suggesting CBDCs could have an edge over “private cryptocurrencies.”

In an Oct. 23 X post, Gupta argued that CBDCs and cryptocurrencies like Bitcoin (BTC) serve different purposes and “shouldn’t be viewed as competitors.”

His post prompted responses from the crypto community, with some warning that CBDCs could resemble “digital fiat,” potentially carrying the same inflationary risks as traditional currencies.

In an interview with Cointelegraph, Gupta said he believes both CBDCs and cryptocurrencies are valuable but serve different roles:

“CBDCs are issued centrally by the nation’s central bank, which ensures complete control over their issuance, supply and usage.”

Gupta added that “this centralization enables effective implementation of monetary policy, allowing for better management of inflation, liquidity and interest rates.”

Coinbase introduces “Based Agent” for creating AI agents in three minutes

Cryptocurrency exchange Coinbase has launched a new tool called “Based Agent,” claiming it allows crypto users to set up their own artificial intelligence agent with a crypto wallet in under three minutes. Once created, the agent can handle various onchain tasks, from trades to swaps and staking.

“Our goal here is to make it as easy as possible to start building your own AI agent,” Coinbase developer Lincoln Murr explained in a video posted to X on Oct. 26.

Murr explained Based Agent is a template that lets users build AI agents — a “bot” designed to carry out a specific task — with access to various smart contract functions.

Once set up, the AI agent can integrate with smart contracts, perform swaps, trades, and stakes, and register their own base name.

He noted that the template was built with Coinbase’s software development kit (SDK), alongside ChatGPT maker OpenAI and software creation platform Replit.