Every week, the commodities overview reviews the latest developments on the commodities markets, and to gain a better understanding of the variations in the prices of energy, metals and agricultural commodities.

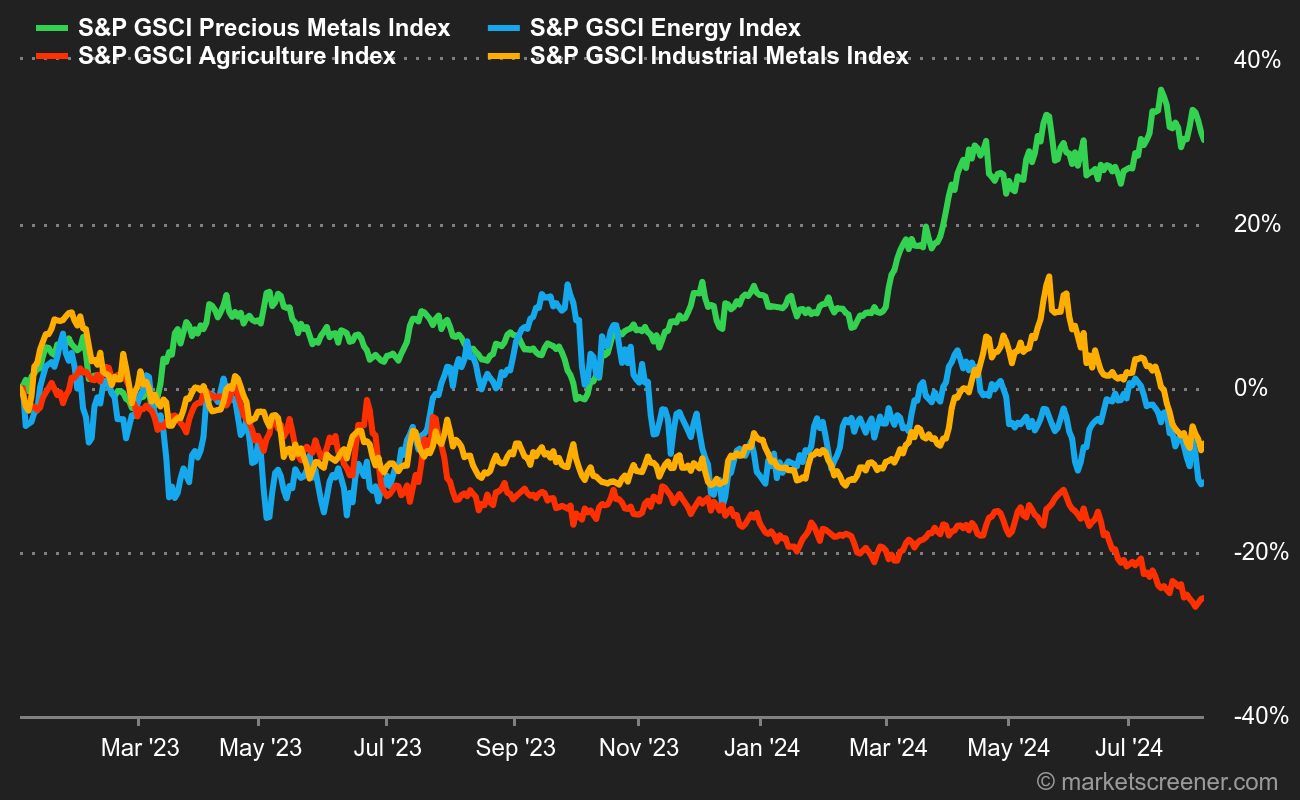

Energy : The price of crude oil continues to fall, marking the fourth consecutive week of declines. Last Wednesday’s buying spurt, triggered by a sharp rise in tensions in the Middle East, was not enough to reverse the trend. The death of the Hamas leader in Iran has rekindled the risk of escalation between Iran and Israel. For the time being, however, the market is relegating these tensions to the background and focusing on demand and the global economic slowdown. At the same time, the OPEC+ Joint Ministerial Monitoring Committee met and recommended no change in the enlarged cartel’s policy. In terms of prices, Brent crude is trading down at around USD 76.30, while US WTI is trading at around USD 73 a barrel.

Metals : Consolidation continues in the industrial metals segment. The latest Chinese statistics have done little to arouse financial interest in metals, explaining the lethargy of copper, which is trading in London at USD 8888 (spot price). Gold, on the other hand, is doing well thanks to a combination of rising risk aversion and falling US bond yields. The barbarian relic is close to its all-time high, trading at around USD 2420.

Agricultural products: Improved crop prospects in the United States are weighing on grain prices in Chicago. The lowering of yield forecasts in Ukraine has not changed the situation: prices continue to fall, with a bushel of wheat at 530 cents (September expiry) and a bushel of corn at 400 cents.