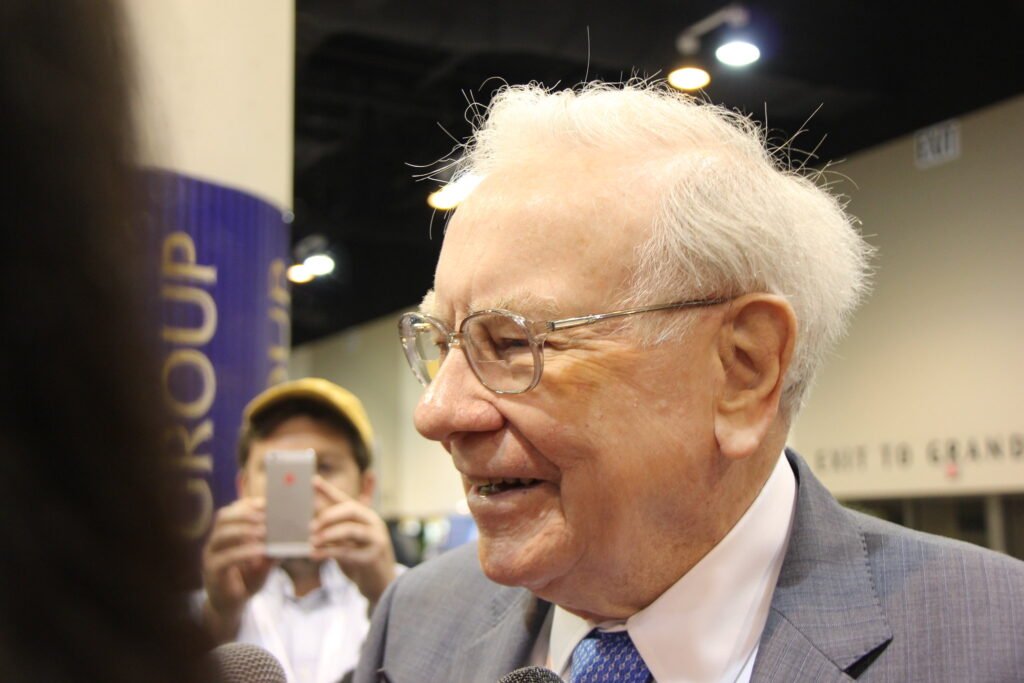

The late Senator Everett Dirksen once reportedly said, “A billion here, a billion there, and pretty soon you’re talking about real money.” With that quote in mind, Warren Buffett’s dividend income this year will be real money.

Technically, the dividend income will belong to Berkshire Hathaway. But for many, Buffett and Berkshire are practically synonymous. And they could make over $3 billion in dividend income in 2025 from these five stocks.

1. Bank of America

Buffett seems to have soured somewhat on Bank of America (BAC 0.28%). He significantly reduced Berkshire’s stake in the big bank last year. However, Bank of America (BofA) still contributes a lot of cash to the conglomerate’s coffers.

As of Sept. 30, 2024, Berkshire owned 766,305,462 shares of BofA. With the company’s forward dividend of $1.04, that translates to nearly $797 million in dividend income this year. Of course, if Buffett sells more of this stock, the amount of dividends received will be lower.

2. The Coca-Cola Company

The Coca-Cola Company (KO 0.63%) is one of Buffett’s “forever stocks.” He’s held it the longest of any other stock in Berkshire’s portfolio. In his 2022 letter to Berkshire Hathaway shareholders, Buffett wrote, “The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million.” That total should be even greater this year.

Berkshire has owned 400 million shares of Coca-Cola for a long time. Coke pays a forward dividend of $1.94. If Buffett doesn’t sell any shares (which seems to be a safe assumption), Berkshire will rake in at least $776 million in dividend income from the big food and beverage company this year. The amount will likely be higher, though. Coca-Cola is a Dividend King with 62 consecutive years of dividend increases. I fully expect the company will keep that streak going in 2025.

3. Chevron

Chevron (CVX -0.23%) is a more recent addition to Berkshire’s portfolio. Buffett initiated a stake in the giant oil and gas producer in 2020 when its shares were beaten down due to the impact of the COVID-19 pandemic.

Berkshire owned 118,610,534 shares of Chevron at the end of the third quarter of 2024. With the company’s dividend of $6.52, the conglomerate should make at least $773.3 million in dividend income this year. Again, though, the actual total will likely be higher. Chevron has increased its dividend for 37 consecutive years and could boost its payout soon.

4. American Express

Buffett wrote to Berkshire Hathaway shareholders last year that American Express (AXP -1.39%) would “almost certainly” increase its dividends in 2024 by around 16%. He was close. Amex increased its dividend payout by nearly 17%.

The legendary investor also wrote that Berkshire would “most certainly leave our holdings untouched throughout the year.” I suspect it will do the same in 2025. If so, Berkshire’s 151,610,700 shares of American Express with the financial services company’s dividend of $2.80 will add up to at least $424.5 million in dividend income this year.

5. Apple

Apple (AAPL -0.39%) isn’t the apple of Buffett’s eye that it once was. His position in the consumer tech giant is much lower now than it was a couple of years ago. However, Apple remains Berkshire’s largest holding. It’s also still an important source of dividend income.

The math with Apple is easy. Berkshire owned 300 million shares as of Sept. 30, 2024. With a dividend of $1 per share, that translates to $300 million in dividend income for Buffett and his company in 2025. This amount will change if Apple increases its dividend (which is likely) or Buffett sells more of the stock (which could happen).

Which is the best stock of the five for income investors?

The expected dividend income for Buffett and Berkshire from these five stocks in 2025 totals $3.07 billion. Which is the best pick for income investors?

I think income investors who aren’t billionaires will find several of Buffett’s major income producers attractive picks. Coca-Cola offers an especially impressive dividend track record along with a solid forward dividend yield of 3.14%.

However, my vote goes to Chevron as the best stock of the five for income investors. The oil and gas company has the highest dividend yield of the group (4.17%). It has also reliably increased its dividend.

Bank of America is an advertising partner of Motley Fool Money. American Express is an advertising partner of Motley Fool Money. Keith Speights has positions in Apple, Berkshire Hathaway, and Chevron. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool has a disclosure policy.