Investing in stocks can be challenging, especially when it comes to selecting individual companies. The process requires extensive research, constant monitoring, and carries substantial risk.

For those seeking a simpler approach, Vanguard offers a compelling solution with its suite of 86 exchange-traded funds (ETFs). Among these various funds, the Vanguard Total Stock Market Index Fund ETF (NYSEMKT: VTI) stands out as a comprehensive option for investors looking for a diversified stock portfolio without the hassle of performing extensive due diligence and frequent monitoring.

Image source: Getty Images.

Why consider the Vanguard Total Stock Market Index Fund ETF?

This ETF is crafted to provide investors exposure to the entire U.S. equity market, encompassing small-, mid-, and large-cap growth and value stocks. Its broad diversification and low expense ratio make it an attractive choice for both beginners and seasoned investors.

The fund tracks the performance of the CRSP US Total Market index, which includes 3,674 individual stocks, offering unparalleled diversification within Vanguard’s rather broad fund family.

The Vanguard Total Stock Market Index Fund ETF features an exceptionally low expense ratio of 0.03%, significantly below the category average of 0.78%. This key feature allows you to keep more money in your account rather than giving it to a money manager.

Performance

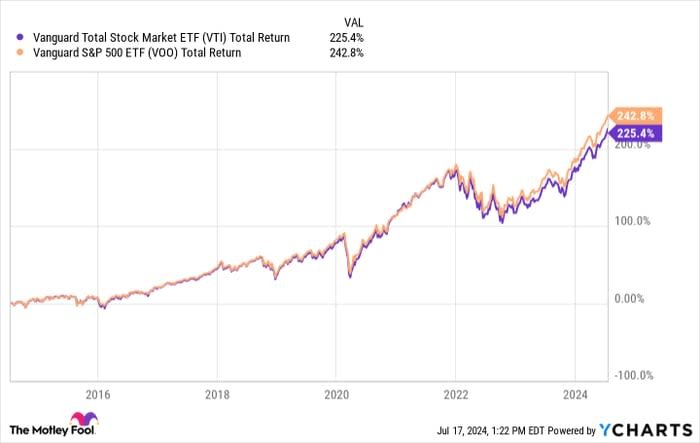

Over the past decade, this Vanguard ETF has delivered an average annual return of 12.1%. While the Vanguard S&P 500 ETF, which many view as a barometer of the U.S. stock market, slightly outperformed it during this period, the difference was minimal.

VTI Total Return Level data by YCharts.

This performance demonstrates the ETF’s ability to provide robust returns while offering comprehensive market exposure. In 2024, the Vanguard Total Stock Market ETF has gained 13.4%%, moving in tandem with U.S. large-cap stocks, especially those in the red-hot technology sector.

Risk profile

Vanguard’s risk scale ranges from 1 to 5; the Vanguard Total Stock Market Index Fund ETF carries a risk level of 4. This metric indicates a higher risk potential compared to lower-risk investments like bonds, but it also offers the possibility of higher returns, which is characteristic of stock-market investments. But to be honest, Vanguard rates all of its stock portfolios as “risky,” so investors may want to view this assessment within this particular context.

Top-five holdings and their weights

The ETF’s top-five holdings include some of the world’s largest and most recognized companies on the planet:

-

Microsoft — 6.34%

-

Apple — 5.86%

-

Nvidia — 5.51%

-

Amazon — 2.11%

-

Meta Platforms — 2.09%

These core holdings highlight the fund’s focus on technology and innovation, areas that have historically driven significant market growth.

Sector weightings

The ETF’s sector weightings reflect the broader market, with technology (35.1%), consumer discretionary (13.8%), industrials (12.1%), healthcare (11.4%), and financials (10.5%) being the most heavily weighted sectors.

This allocation strategy aligns with the fund’s goal of balancing value creation and risk management. It’s worth noting that the fund has increasingly tilted toward the high-growth technology sector in 2024, mirroring the market’s enthusiasm for artificial intelligence.

Key takeaway

The Vanguard Total Stock Market ETF is an excellent choice for investors preferring a straightforward approach to investing in the stock market. Its low costs, broad diversification, and solid performance history make it suitable as a core holding that can serve as a complete stock portfolio.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,281!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. George Budwell has positions in Apple. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.