I’m a big fan of using dividend stocks as a way to earn extra income. But not all dividend-paying companies are reliable. Vodafone disappointed me recently by slashing its 10% yield in half, prompting me to sell my stake in the company.

Now I’m more careful about the income stocks I invest in. Currently, my top three picks are Phoenix Group (LSE: PHNX), British American Tobacco (LSE: BATS) and Legal & General (LSE: LGEN).

Here’s why I think they’re worth investors considering.

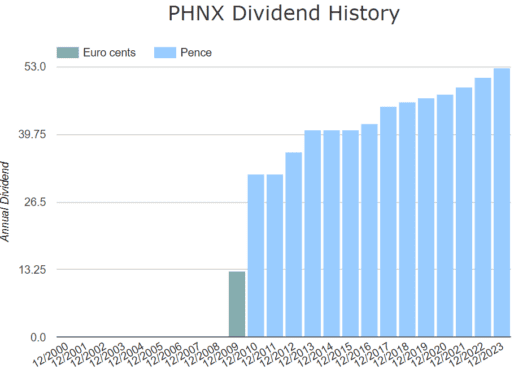

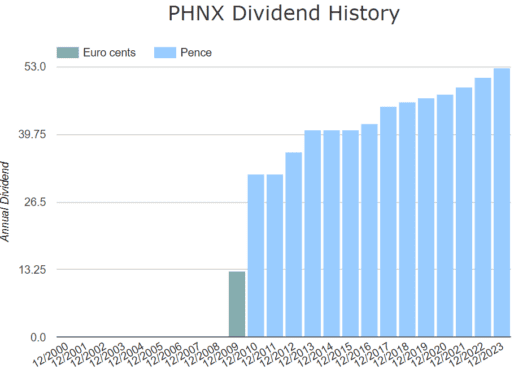

Phoenix Group

Phoenix Group’s 9.5% yield could soon be the highest on the FTSE 100 after Vodafone drops down to 5.2%. The insurer hasn’t been paying dividends for very long but has increased them annually for the past six years.

As one of the UK’s biggest insurance firms, it faces stiff competition from Legal & General and Prudential. Unfortunately, there’s one glaring issue, it’s currently unprofitable. Years of low earnings have pushed up its debt too, which is now almost double its equity.

That doesn’t sound very promising.

But a recent boost in revenue’s helped push the company back towards profitability. It’s likely to become profitable again next year, with earnings potentially reaching £280m by the end of 2025.

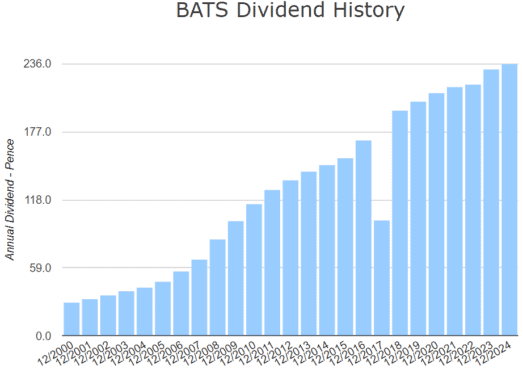

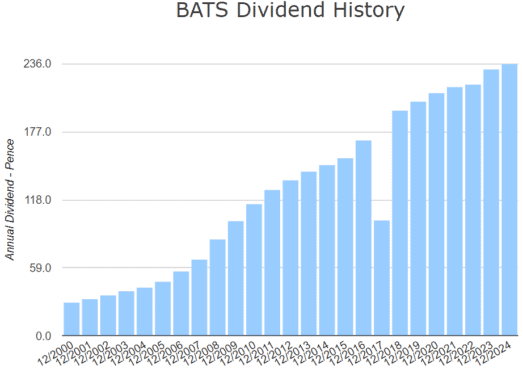

British American Tobacco

With an 8.5% yield, British American Tobacco could soon be the fourth-highest FTSE 100 yield after Burberry cut its dividend. Barring a brief reduction in 2017, it’s been paying a reliable and increasing dividend for over 20 years.

Currently, it’s unprofitable but forecast earnings growth gives it a forward price-to-earnings (P/E) ratio of 8.3. And with future cash flows expected to increase, the shares are estimated to be undervalued by almost 60%.

But tobacco’s a dying industry so it’s hard to have too much faith in the company’s long-term prospects. Not to mention the moral implications.

However, British American Tobacco is focused on shifting towards tobacco-free products as tighter regulations threaten its bottom line. Its Vuse product is the most popular vaping brand in the world, according to the company. It’s actively legislating for stricter rules and bans on disposable vapes and child-appeal flavours to help reduce underage smoking.

Legal & General

At 8.9%, Legal & General’s the third highest yield on the FTSE 100, slightly below fellow insurer M&G. But as a purely income-focused stock, it doesn’t offer much in the way of price growth. It’s only up 1.6% in the past five years.

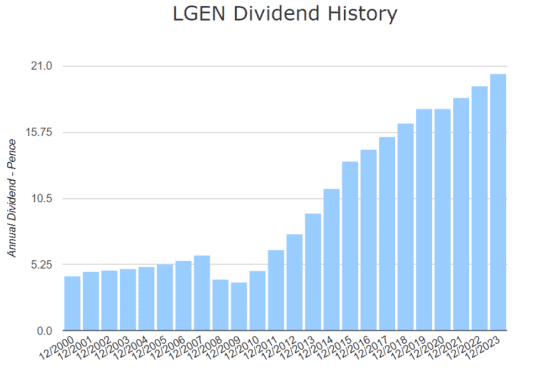

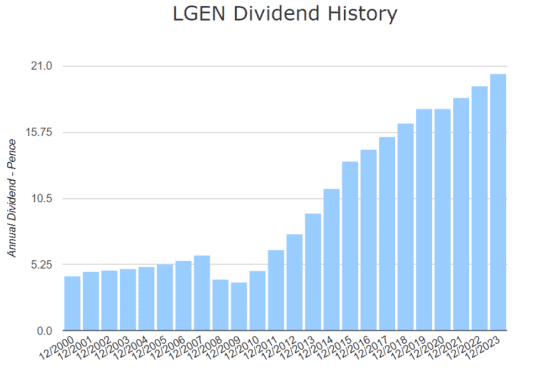

Payments are super-reliable though, having increased consistently since 2009 with only a brief pause in 2020. Its dividends boast a compound annual growth rate (CAGR) of 13.3%, with the yield expected to reach 10% in the next three years.

Like Phoenix, low earnings have pushed its P/E ratio up to 48 and left it with a lot of debt. If forecasts are correct, improved earnings could bring it closer to the industry average of 11. But with a debt load twice its market-cap, it’s a long way to go.

If it weren’t for the spectacular track record of paying dividends, I’d probably give it a miss. But in this case, I think the reward’s worth the risk.

The post Looking to earn income through passive investing? Here are 3 top dividend stocks to consider appeared first on The Motley Fool UK.

More reading

Mark Hartley has positions in British American Tobacco P.l.c., Legal & General Group Plc, and Phoenix Group Plc. The Motley Fool UK has recommended British American Tobacco P.l.c., Burberry Group Plc, M&g Plc, Prudential Plc, and Vodafone Group Public. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024