Market cycles have a significant impact on the performance of Best Dividend Stocks. Many investors choose when to invest or sell by watching for cycles of expansion, peak, contraction, and trough. Understanding how markets undergo these cycles allows people to maximize their returns, control risk, and maintain balance in their portfolios. Here, we examine the effects of various market stages on dividend-paying stocks.

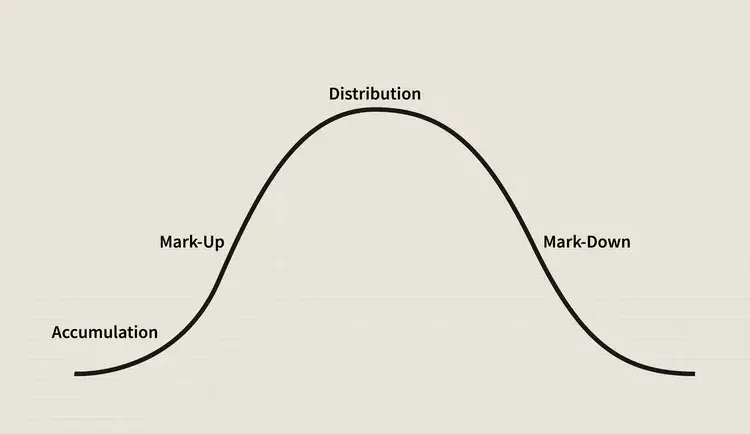

Understanding market cycles

Four distinct stages — expansion, peak, contraction, and trough—make up market cycles, which repeat over time. In the expansion phase, gross domestic product growth, employment, and corporate profits tend to rise, increasing bullish market sentiment. Conversely, peak phases occur when growth rates flatten out, valuations are stretched, and investor enthusiasm is at its apex. Declining earnings forecasts and tightening credit conditions precipitate price corrections and elevated volatility in the contraction stage. The trough phase is the lowest point in the cycle, where pessimism peaks and conditions are most favorable for recovery. This understanding helps investors anticipate changes in equity performance and dividend sustainability. However, best dividend stocks show different levels of resilience and yield profiles based on their cycle positioning. Analysts can calibrate expectations and devise timing strategies that align income objectives with prevailing economic climates by mapping each phase with characteristic market behaviors. Interpreting subsequent key phase-specific effects on dividend equities requires this foundation.

Expansion phase impacts

During the expansion phase, share prices are lifted by favorable economic conditions and improving corporate earnings, usually leading to lower dividend yields on valuation grounds even as payouts rise. Healthy balance sheets benefit the best dividend stocks, as companies may increase dividends, an indication of confidence that cash flow will remain stable. However, higher stock prices squeeze yields, making less yield-sensitive investors balance total return potential versus income goals. Utilities and consumer staples are slow to appreciate in price but pay out reliably, while financials and industrials may grow more quickly but also have the potential to increase payouts. The market breadth widens and liquidity increases, drawing new capital into dividend-paying equities. Analysts watch payout ratios, free cash flow trends and dividend growth history to determine which issuers can afford to raise their payouts without overleverage. Combining yield expectations with price momentum analysis can help investors pick up or accumulate shares prior to valuations peaking. Therefore, the expansion phase balances yield enhancement and caution to avoid valuation-driven yield compression.

Peak phase dynamics

Valuations often rise to high levels in the peak phase, as investor optimism grows and growth expectations become overly ambitious. In this environment, yield contraction and slow payout increases are consistent with caution over future earnings for Best Dividend Stocks. If corporate earnings don’t match forecasts, high dividend yields relative to market averages can suggest undervalued opportunities or payout risk. Participants often evaluate dividend coverage ratios, debt levels, and cash conversion cycles to determine whether issuers have sustainable distributions. Adverse surprises lead to a higher risk of dividend cuts, particularly for companies with aggressive payout policies. With volatility spiking and price volatility amplified, defensive sectors with resilient cash flow could outperform growth-oriented dividend payers. Trim positions in overvalued issues and reallocate to quality names with lower drawdown potential. The combination of fundamental dividend analysis with valuation metrics allows stakeholders to carefully mitigate downside risks presented during market tops and position portfolios for the ensuing contraction phase.

Contraction phase effects

During the contraction phase, declining corporate earnings and tighter monetary conditions negatively impact equity valuations and dividend payouts. With yield expansion as share prices fall quicker than distribution cuts, Best Dividend Stocks are attractive entry points for income-oriented investors. But they, too, can become vulnerable as payout ratios rise and cash reserves fall, leading some issuers to stop or reduce dividends to preserve capital. Higher leverage companies are more adversely affected as credit spreads widen and borrowing costs increase. Names with good defensive characteristics (e.g. strong free cash flow conversion, prudent payout policies) tend to outperform those names that lack sufficient balance sheet flexibility. It is often in favor of essential services and consumer staples, where stable revenue streams provide a foundation for sustainable dividends. Investors should conduct rigorous fundamental analysis on balance sheet health, payout coverage and liquidity metrics to separate the wheat from the chaff. Proper due diligence during the contracting phases can ensure a consistent income while managing the drawdown risk.

Through phase considerations

During the trough phase, the market is at its lowest ebb, with widespread pessimism, depressed valuations, and sometimes stagnant or lower dividend levels. Instead, paradoxically, this stage of the market cycle provides compelling opportunities to amass Best Dividend Stocks at attractive prices, if investors pay attention to issuers with solid fundamentals and long histories of sustainable dividends. Normalization of dividend growth is supported by the revival of risk appetites as economic indicators start to stabilize and monetary stimulus measures start to take effect. Key metrics to look at are dividend yield compared to historical averages, consistency of free cash flow, and the company’s ability to maintain payments during downturns. Systematic and contrarian investors can use them to find undervalued issues with attractive yield-to-price ratios, anticipating price appreciation ahead of recovery and dividend restoration. However, patience and selectivity are needed as not all firms will survive the storm, and market sentiment is initially fragile. A margin-of-safety framework and a focus on high-quality issuers mitigate potential downside and enable portfolios to participate in the trough’s progression to the next expansion phase.

Strategic positioning for dividend resilience

Dividend portfolio allocations should be tailored to economic conditions for strategic positioning across market cycles. In downturns, focus turns to high-quality issuers with conservative payout ratios, steady cash flow and manageable debt levels. Investors may want to add exposure to dividend growers that can generate both yield and capital appreciation in expansion periods. Diversification across sectors and regions helps to spread the idiosyncratic risks of particular industries. Aligning with cycle timing, alternative income sources like real estate investment trusts and infrastructure trusts can also add to yield stability. Portfolio metrics such as yield on cost, distribution growth rates, and coverage ratios are reviewed on a regular basis to allow timely rebalancing to anticipate cycle transitions. Economic indicators and valuation thresholds inform tactical adjustments to preserve principal while optimizing income streams. Ultimately, a disciplined, cycle-aware strategy allows investors to effectively tap into the potential of Best Dividend Stocks, while balancing risk and return between varying market conditions, in order to achieve sustainable, long-term income generation.

Noticing how market cycles impact Best Dividend Stocks allows investors to adjust their plans accordingly. When you manage your investments according to peak, expanding, contracting, and trough cycles, you may earn more, save your capital, and capture valuable opportunities. Using a disciplined and cyclical method helps build strength for lasting results. Being able to understand cycle dynamics is crucial to optimizing a dividend-focused portfolio as market conditions change.