By UK Correspondent

UNITED KINGDOM: ALL is set for the inaugural Zimbabwe Property and Business Investment Expo scheduled for Birmingham with hundreds of people expected to attend and explore business opportunities back home.

With Diaspora Insurance among the key partners, organisers said the all-day expo presents a “unique opportunity for Zimbabweans in the diaspora to invest in their homeland’s thriving property market”.

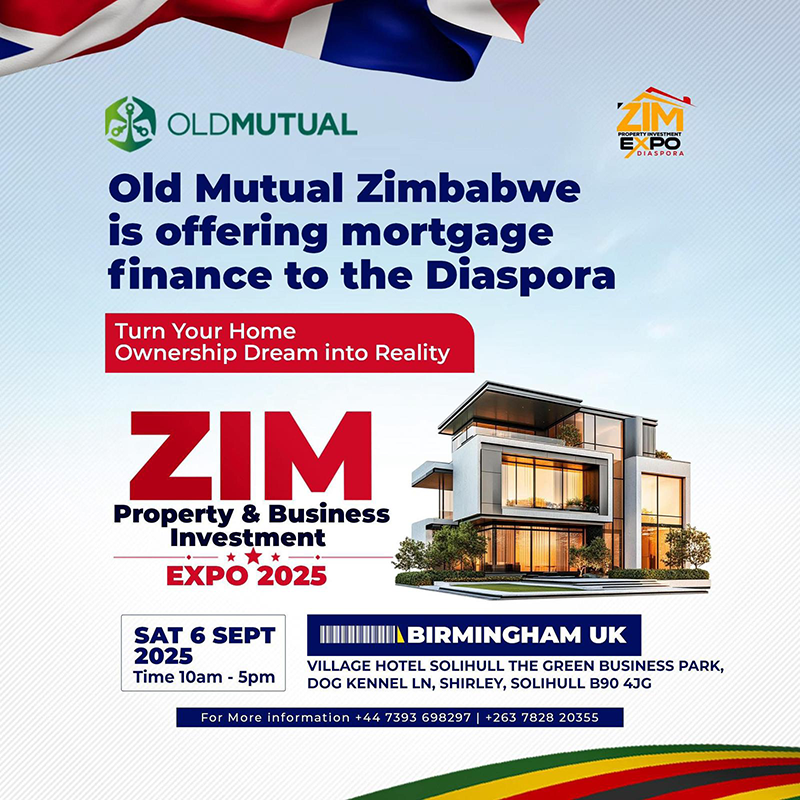

Scheduled for the 6th of September at The Village Hotel in Solihull, the expo will, among other opportunities “showcase exclusive property deals and introduce tailor-made mortgage solutions designed specifically for the diaspora community”.

Nonhlanhla Thuthani who is one of the Expo organisers

“The diaspora market has long been seeking reliable and secure ways to invest in Zimbabwean property,” said a representative of the organisers.

“We’re excited to bring together leading financial institutions, property developers, and industry experts to provide tailored solutions that meet the needs of Zimbabweans in the diaspora.”

The expo comes at a time when CBZ Holdings chief executive Lawrence Nyazema revealed that Zimbabweans in the UK had overtaken compatriots in South Africa as the biggest source of remittances back home.

Annually Zimbabweans living abroad send more than $2 billion back home, representing a key source of foreign exchange for the country.

The remittances, estimated to be about 10 percent of income of diasporans, are used for investments back home and also to support families with basic and regular subsistence needs.

Nyazema said there was need to come up with possibilities for increasing diaspora remittances to more than the current 10 percent by creating and expanding investment opportunities back home.

Organisers of the expo, which will also include diaspora business awards, said attendees would get an opportunity to explore exclusive property deals from reputable developers.

They would also learn “about tailor-made mortgage solutions designed for the diaspora community, network with industry experts and financial institutions and gain insights into Zimbabwe’s property market and investment landscape”.

“By providing a credible, structured, and secure way for diaspora investors to engage with the Zimbabwean property market, the expo aims to unlock new investment opportunities and contribute to the country’s economic growth,” said the organisers.