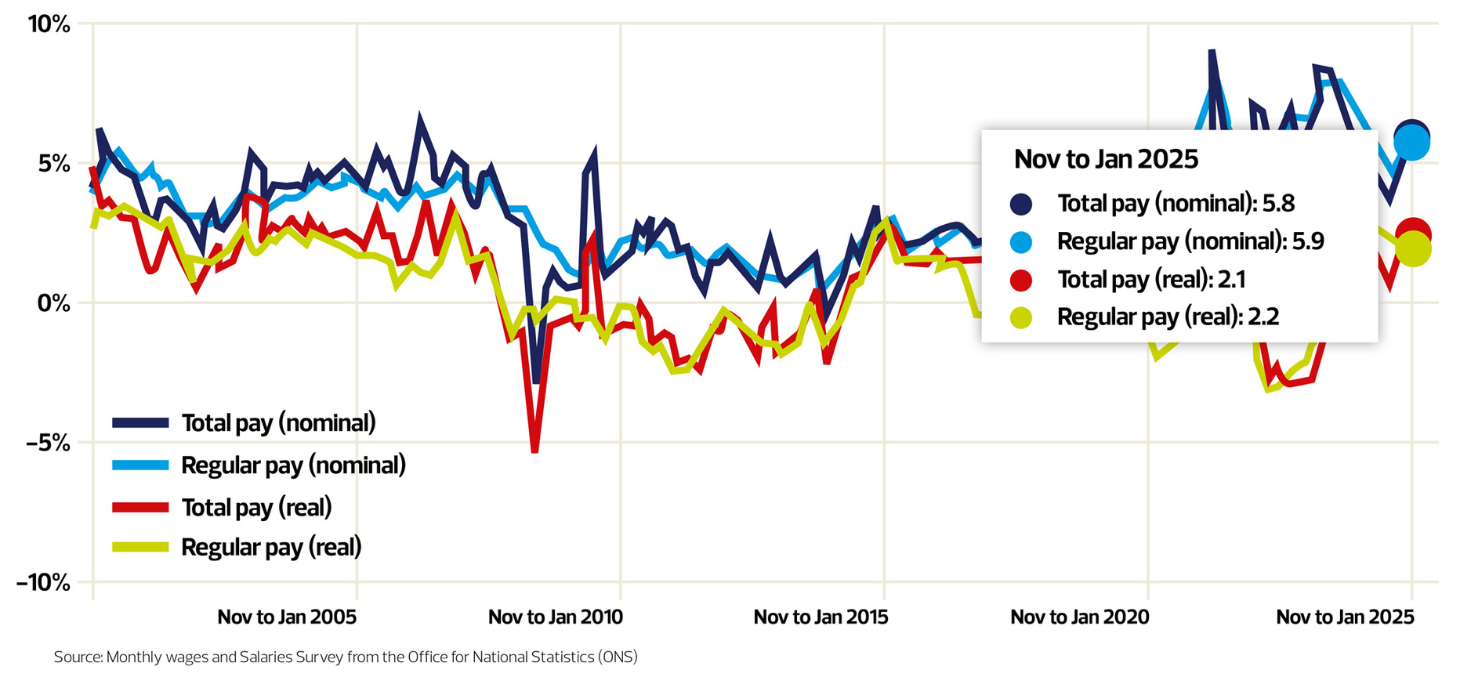

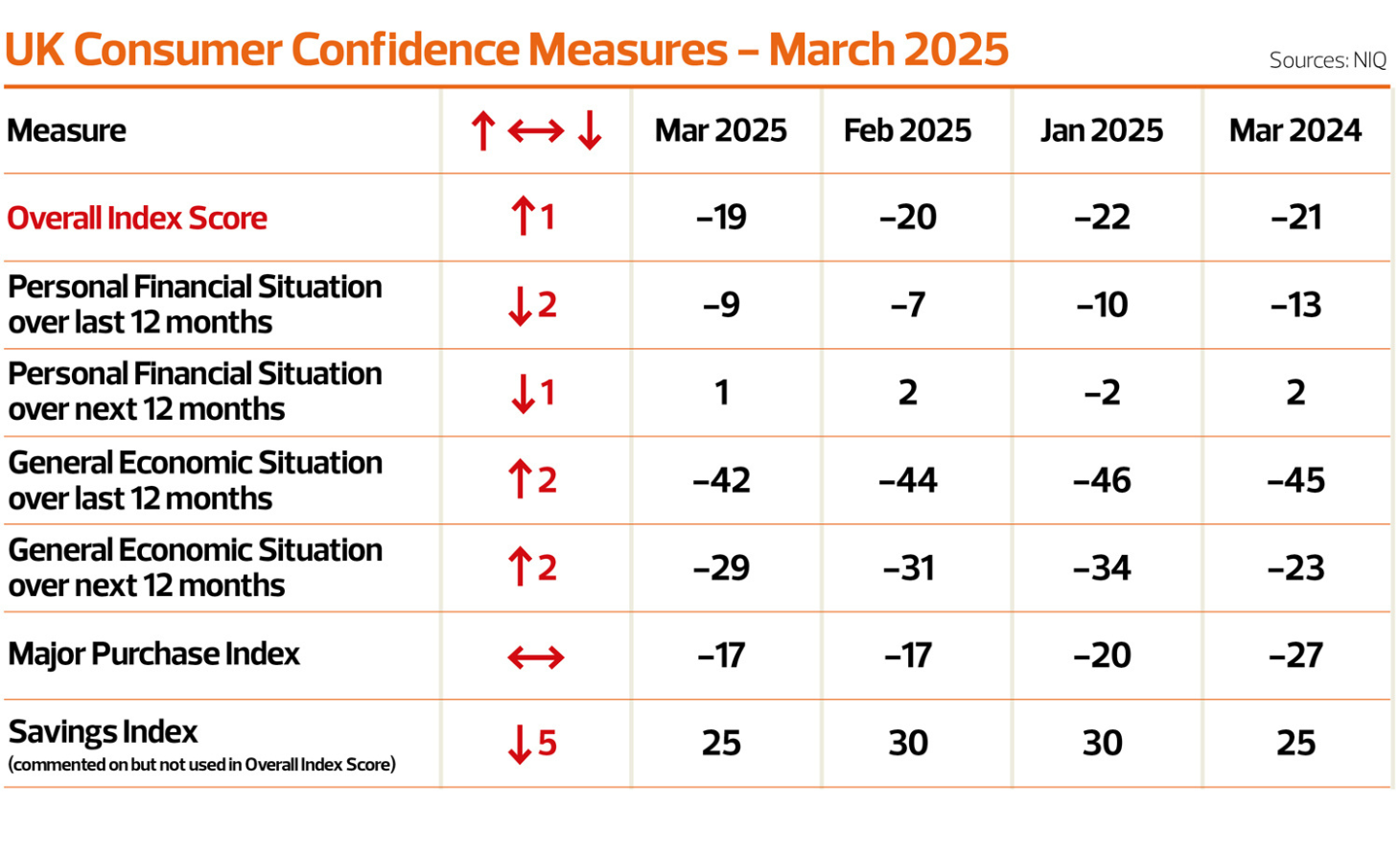

Prior to ‘Storm Donald’s’ trade wars, the economic situation and property market was looking pretty good. Inflation was calming down, wages were reducing, but still ahead of inflation, and consumer confidence for making major purchases was improving.

Prior to ‘Storm Donald’s’ trade wars, the economic situation and property market was looking pretty good. Inflation was calming down, wages were reducing, but still ahead of inflation, and consumer confidence for making major purchases was improving.

Then Mr Trump decided to throw a wobbler and threaten the global, American and even economies driven by….Penguins. And if you think I’m joking read this.

Although we haven’t got definitive stats yet on the impact of the tariffs, it’s definitely going to affect the UK one way or another.

However, hopefully, the impact will be muted and even positive, especially if it helps drive down interest rates and reduce mortgages, boosting demand in the property market.

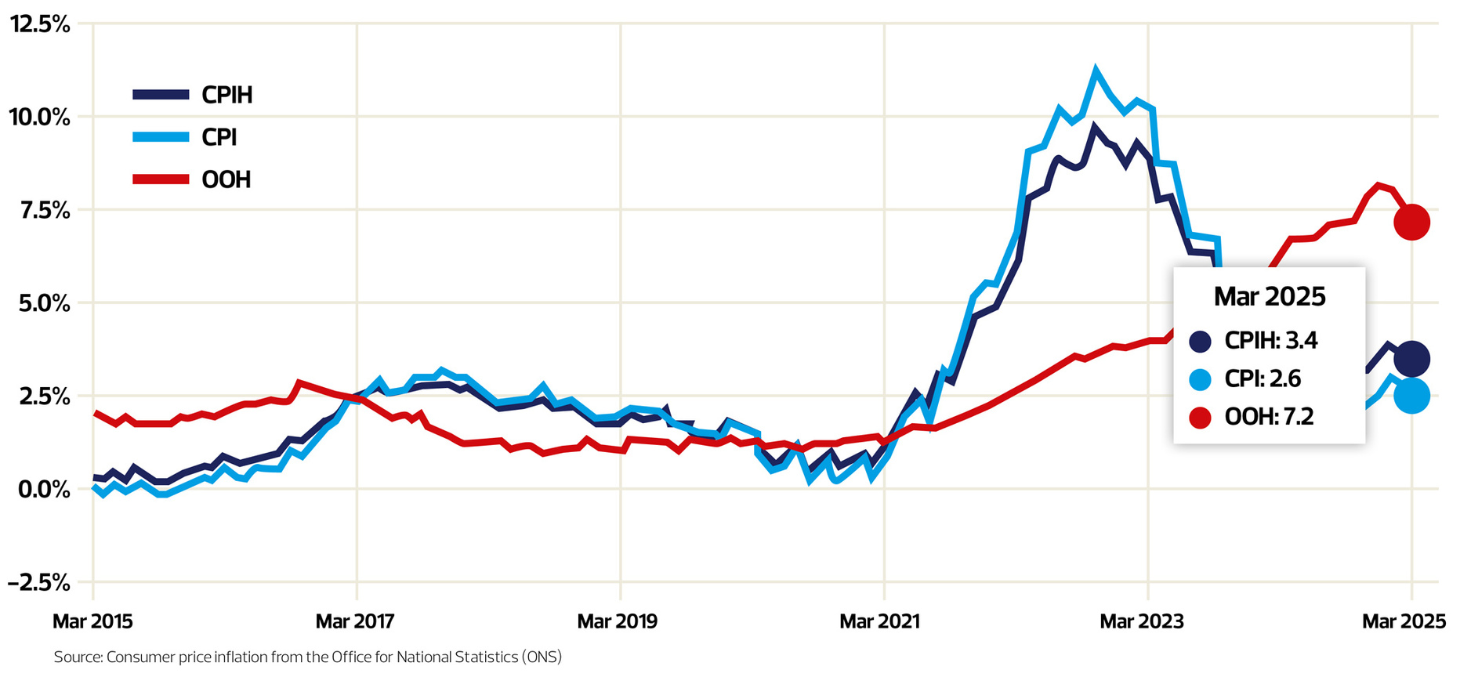

Inflation and annual wage growth

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.7% in the 12 months to February 2025, down from 3.9% in the 12 months to January. The current official Bank Rate is 4.5%.

Property market report

Apart from the economy impacting on the property market, the other issue everyone is watching out for is how the market will react now that SDLT has returned to normal levels. In theory, for many areas this shouldn’t have much of an impact, but areas where average prices are over £300,000, the extra money could end up being a drag on the market.

However, with the recent announcement of some mortgage rates falling below 4%, albeit for those with a hefty deposit and typically a large fixed fee, hopefully this will raise demand enough to counter balance any buyers struggling to find the cash to pay the SDLT upfront.

Looking at the data from the indices this month, probably one of the best quotes to sum up the market is from Home.co.uk:

“Despite negative economic news regarding the wider UK economy, the UK property market retains significant optimism. The flow rate of properties moving through the sales market is relatively high, thanks to substantial demand. Rising asking prices during the last month were supported by seasonal optimism and a moderation in supply following the surge in new instructions seen in January.”

However, Douglas Shepherd from Home.co.uk does express a word of caution that with current high levels of property for sale and demand still restricted due to current mortgage rates, with increased taxes yet to hit both companies and people, the property market has the potential to stall quite quickly.

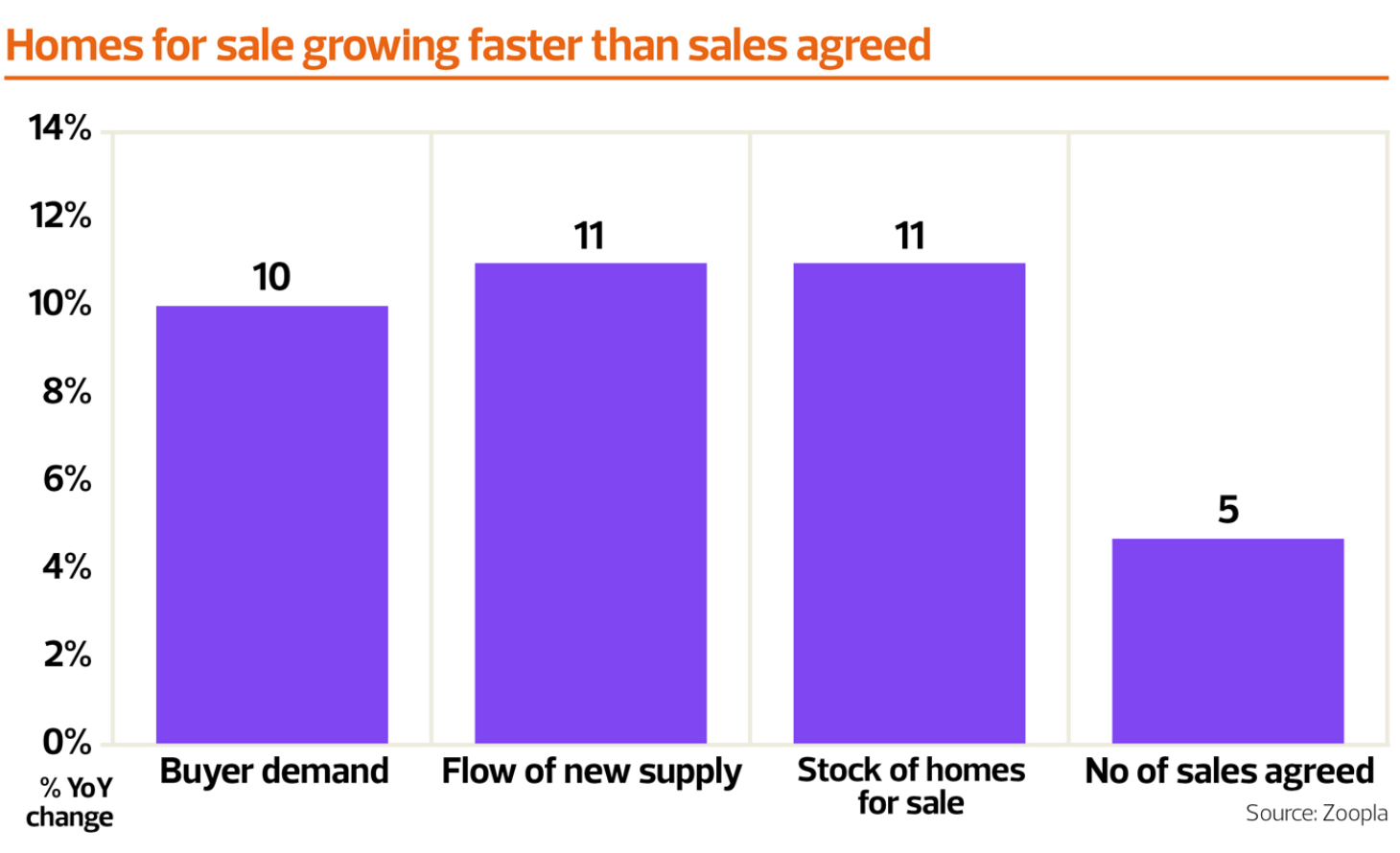

Richard Donnell, Executive Director from Zoopla is less worried though. He suggests this could be a great time for buyers to get on the ladder or trade up: “The housing market is resilient, supported by faster growth in average earnings. There are the most homes for sale in 7 years, which will keep price inflation in check.”

Are canny buyers missing opportunities in the flats market?”

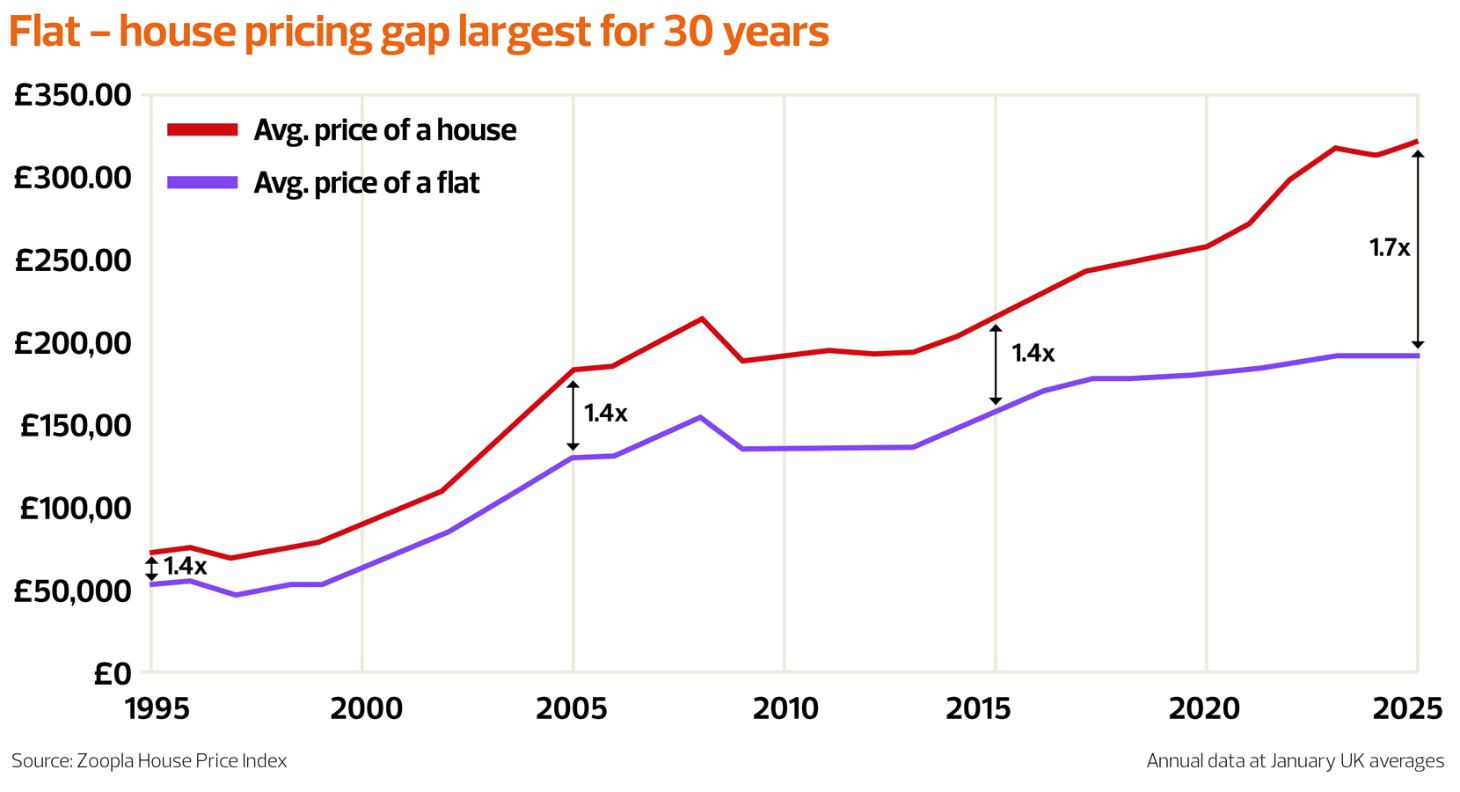

And he asks the question: “Are canny buyers missing opportunities in the flats market?”

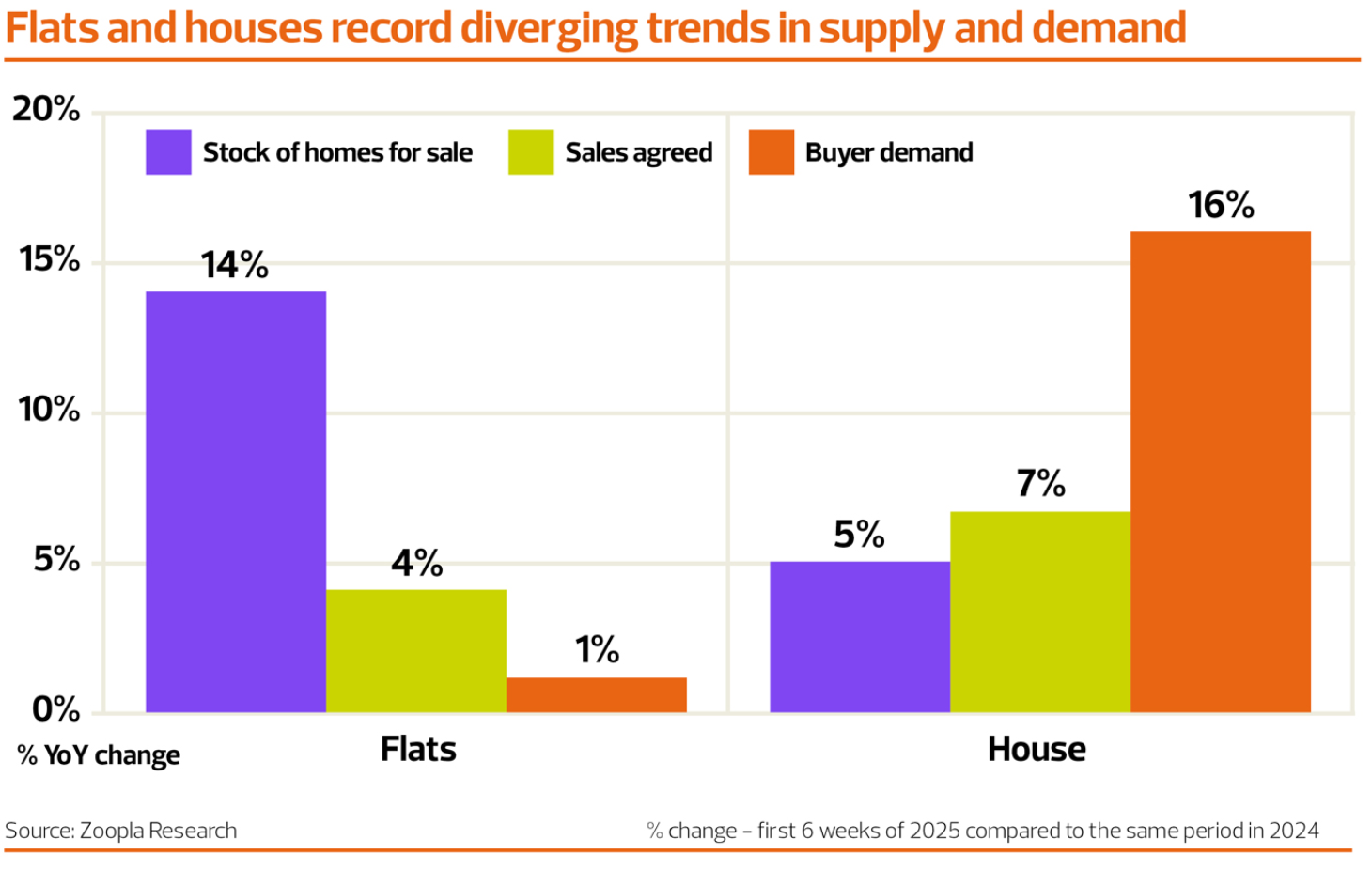

Although this trend has been going on for a while, according to Zoopla, demand for flats is lower than houses again and this is impacting on price inflation in London in particular, which has a higher proportion of flats versus most other areas:

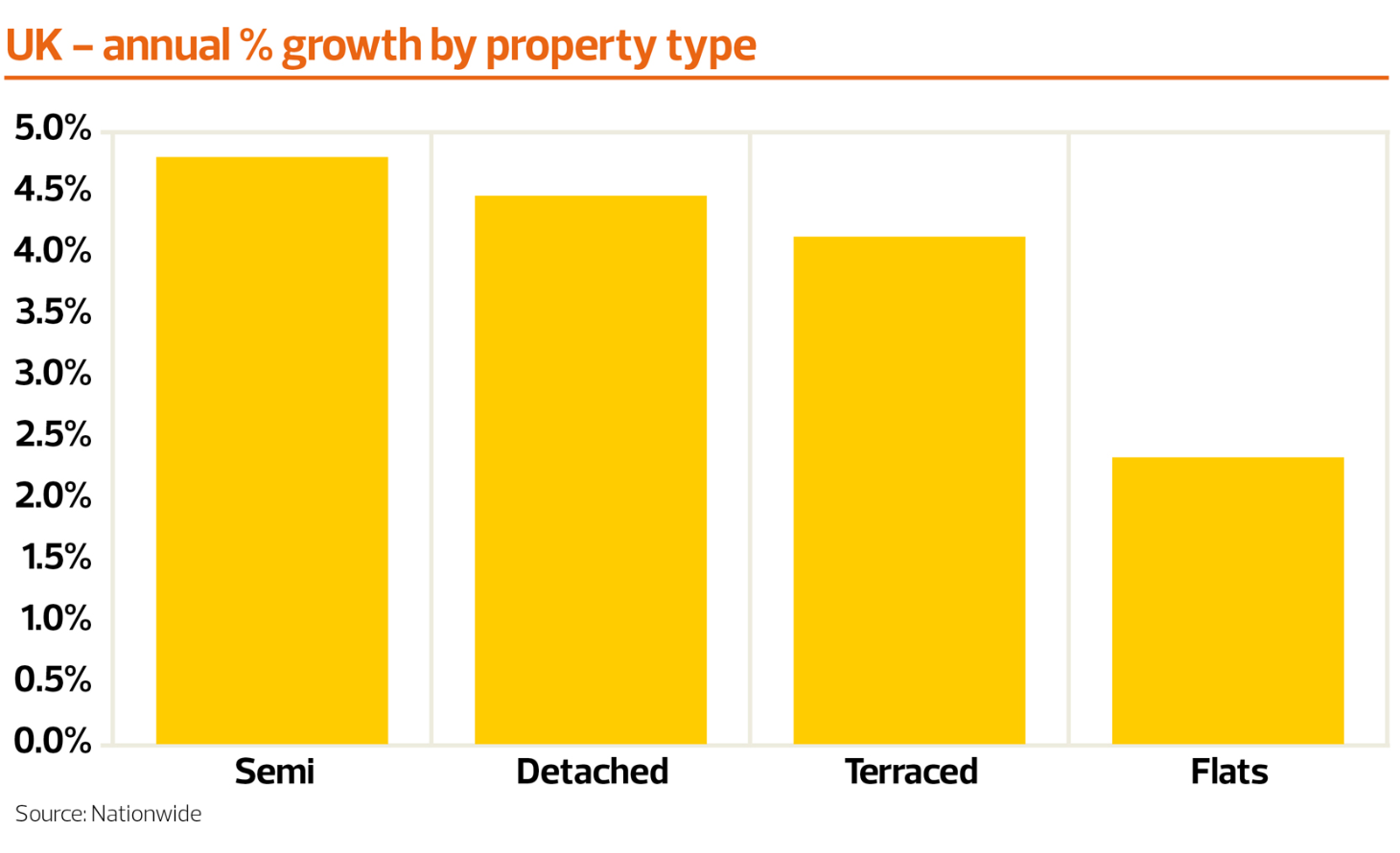

Nationwide also has some interesting figures to back up Richard’s suggestion that flats could be a good purchase (as long as an experienced leasehold conveyancing lawyer is engaged), not just because of good value prices, but also because of the upcoming changes to leasehold the government is implementing to improve leaseholders’ rights.

In summary, the current picture for the property market is ‘steady as she goes’. However, the head winds are: Trump; impact of the SDLT changes; high levels of stock on the market.

But as long as interest and mortgage rates fall at least once if not twice this year, that should help support demand enough to make sure the property market continues to perform well.

Property price and market indices headlines:

Decade-high choice to benefit Spring buyers who miss stamp duty deadline

“The average price of property coming to market for sale rises by 1.1% (+£3,876) this month to £371,870, in line with the long-term March average increase, as many new sellers price sensibly amid decade-high competition to sell.”

Sales market activity softens slightly over the month

“House prices still rising at the national level, but momentum appears to be moderating.”

Prices Leap Ahead in the North and West Midlands

“Asking prices rose in every English region, Scotland and Wales during February, making the national average rise by 0.5%.”

Annual house price growth steady in March

“Annual rate of house price growth remained stable in March at 3.9%, unchanged from February.”

Average UK house price falls in March

“House prices fall by -0.5% in March (vs -0.2% in February).”

Market overall is starting to turn

“Market may strengthen as we move into summer.”

Sales agreed continue to rise, up 5% year-on-year

“House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed.”

Summary of the insights from this month’s indices

- While new Spring buyers will not beat this month’s stamp duty deadline, they will benefit from the highest property choice at this time of year since 2015.

- Massive log-jam of 575,000 moves in the legal completion process, with many trying to beat March’s stamp duty deadline.

- The number of sales being agreed is 9% higher than at this time in 2024, a positive sign for the market post-stamp duty increase, and the number of new sellers is now 8% ahead of this time last year.

- The average five-year fixed mortgage rate is now 4.74%, down from the peak of 6.11% in July 2023, but only marginally lower than the 4.84% at this time last year.

- Annualised home price growth across England and Wales remains below the level of inflation at just 1.8% overall.

- The huge surge in new instructions that occurred in January seems to have been transient. Supply of new sales properties entering the market during February 2025 was no more than during February 2024 overall, although there is regional variation, with minor increases still visible in London, the South East and the South West.

- Sales market momentum shows a slight increase over March 2024. Property turnover is currently higher than any of the previous ten years of March readings.

- Typical Time on Market remains the same as in March last year.

- Northern Ireland remained the top performing area, with annual price growth accelerating to 13.5%.

- London weakest performing region, with 1.9% year-on-year rise.

- Average property price now £298,602 (compared to £298,815 in previous month).

- Annual growth remains at +2.9%, unchanged from January.

- Scotland sees house prices rise at fastest pace in 13 months (+3.8%).

- Rising wages and reduced housing costs give ground for positivity despite challenging external environment

- London and South East still bearing down on the overall situation.

- The average sale price of homes in England and Wales has seen a modest increase of 0.1% in March, reaching just over £359,000. This marks the third consecutive month of positive growth, reflecting a gradual recovery in the housing market.

- House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed.

- Price inflation above average in northern regions and Scotland, where demand is growing faster than supply.

- Supply/demand mismatch keeping price inflation 1% or lower in southern regions of England and London.

- London facing a stamp duty deadline hangover, with demand for homes 3% lower than a year ago.

- We expect agreed sales to continue increasing but rising supply and static mortgage rates will temper the rate of price inflation.