Since the Brexit referendum, many of the long-established norms that once governed property sales and the market have shifted – particularly how buyers and sellers respond to media-driven speculation around falling prices.

Since the Brexit referendum, many of the long-established norms that once governed property sales and the market have shifted – particularly how buyers and sellers respond to media-driven speculation around falling prices.

In the past, a weekend headline predicting a 5%, 10%, or even 25% property price drop would have been enough to reduce buyer activity, leading to a short-term decline in transactions and in some cases, a temporary dip in prices. But typically, as demand outpaced supply, the market would quickly recover.

Consumers today appear to be much more informed and less reactionary to property market trends. This is partly due to more localised and granular variations in the market. For example, flats at the moment tend to have higher supply versus demand, while detached homes – especially four-bed-plus properties – are in short supply and attract significant interest.

They realise that broad headlines on what’s happening to property prices aren’t necessarily relevant for their personal property market.”

A one-bed flat might sit on the market for months with limited viewings, while a rural family home could be snapped up after 20 viewings in a single weekend. When people experience this at a local level, they realise that broad headlines on what’s happening to property prices aren’t necessarily relevant for their personal property market.

But its also because buyers and owners are less dependent on mortgages than they were in previous downturns. Zoopla reports that 50% of buyers are either purchasing in cash or with a loan-to-value ratio below 50%. First-time buyers are also entering the market with repayment mortgages and are being assessed at much stricter affordability levels than during the post-credit crunch era of 1–2% interest rates. As a result, events like the pandemic or 2022’s failed budget haven’t, to date, caused the steep price drops seen in past crises.

Market resilience

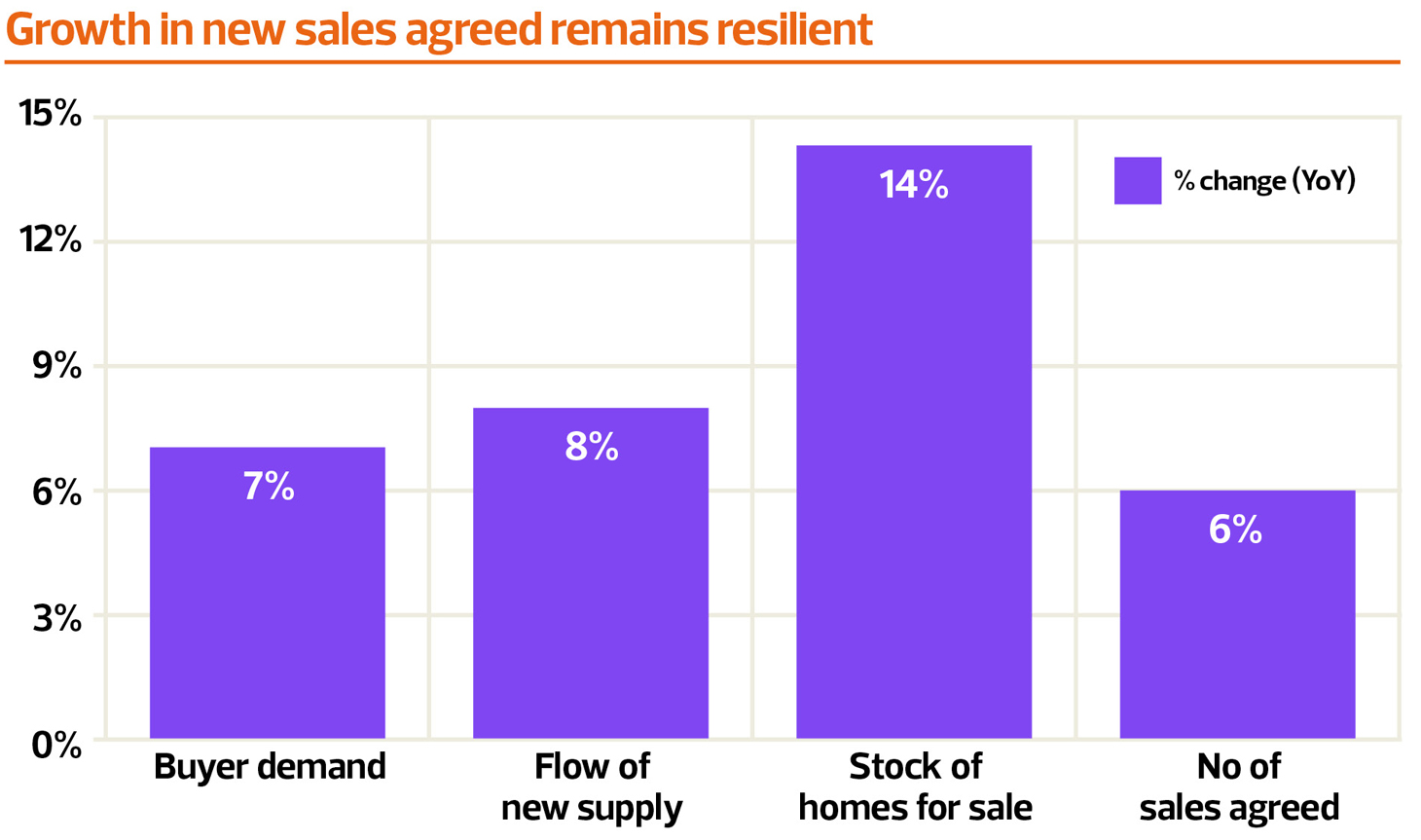

And the resilience of the market is clear in the latest data from Chris Watkin and TwentyEA, which shows a strong rebound in property sales activity despite ongoing economic challenges.

Listings are up 14.5% year on year, and sales are up 6%—rising nearly 11% when compared to the more stable markets of 2017–2019. This underscores the market’s capacity to defy media pessimism and absorb higher borrowing costs.

Zoopla’s latest chart also mirrors the data reported by Chris and TwentyEA, showing every transactional indicator is up year on year.

Yes, the property sales transaction surge in early 2025 was supported by the temporary SDLT reduction. But the fact that seller motivation remains high is now helping to bring more buyers into the fold. If interest rates fall again in August, there’s every chance that by September we’ll see conditions return to a healthier, more balanced market.

Yes, the property sales transaction surge in early 2025 was supported by the temporary SDLT reduction. But the fact that seller motivation remains high is now helping to bring more buyers into the fold. If interest rates fall again in August, there’s every chance that by September we’ll see conditions return to a healthier, more balanced market.

Summary of the latest supply and demand data

“Buyer activity remains resilient, with affordability improving for some. Average wages are rising faster than house prices, and many lenders are loosening their affordability criteria. May was the strongest month for the number of sales being agreed since March 2022, and 6% ahead of the same month last year.

“This suggests that despite the high volume of homes for sale, properties that are priced right and presented well are continuing to attract serious buyers. The number of new buyers entering the market in the month of May was also 3% ahead of the same period last year.

“However, the number of homes coming onto the market for sale is 11% ahead of the same period last year, with the number of new buyers still being outpaced by new sellers. With buyer choice so high, the market is very price sensitive, especially with some mortgage rates slightly rising over the last few weeks.”

Great fact: Homes that receive an enquiry on the first day of marketing are 22% more likely to successfully find a buyer than homes which take more than two weeks to receive their first enquiry.”

“HMRC monthly property transaction data show UK home sales increased in May 2025. UK seasonally adjusted (SA) residential transactions in May 2025 totalled 81,470 – up by +25.1% from April’s figure of 65,110 (up +42.3% on a non-SA basis). Quarterly SA transactions (March 2025 – May 2025) were approximately +7.6% higher than the preceding three months (December 2024 – February 2025). Year-on-year SA transactions were – 11.8% lower than May 2024 (-13.3% lower on a non-SA basis). (Source: HMRC).

“The RICS Residential Market Survey results for May 2025 indicate a persistently soft sales market. New buyer enquiries recorded a net balance of -26%, marking the fifth consecutive month of negative readings, though slightly improved from -32%. Agreed sales remain relatively unchanged at -28% compared to -30% the previous month, continuing a four-month negative trend. Meanwhile, the net balance for new instructions saw a modest increase to +7%.”

“The number of sales being agreed between sellers and buyers continues to run at the fastest rate for 4 years. The pace of sales is slowing, and this will continue over the seasonal summer slowdown. Sales agreed in the last 4 weeks are 6% up on last year, as more homes for sale means more buyers are looking to agree sales. Sales are higher year-on-year across all regions and countries of the UK.

“A greater choice of homes for sale, 14% higher than a year ago is amongst factors holding back house price inflation, which was 1.4% in the 12 months to May 2025. This is higher than the 0.3% increase recorded a year ago, but lower than the 2% recorded in February 2025.

“Demand for homes remains higher than a year ago but buyers remain price-sensitive, which is limiting house price inflation. This is particularly important in housing markets with higher average prices, creating an additional affordability hurdle for home buyers.”

“On average, around 11.5 homes were placed for sale per member branch in May 2025.

“The average number of new prospective buyers registered per member branch fell to 75 in May 2025, likely due to the Stamp Duty threshold changes across England and Northern Ireland at the start of April 2025. However, this figure is expected to resume growth over the summer months.”