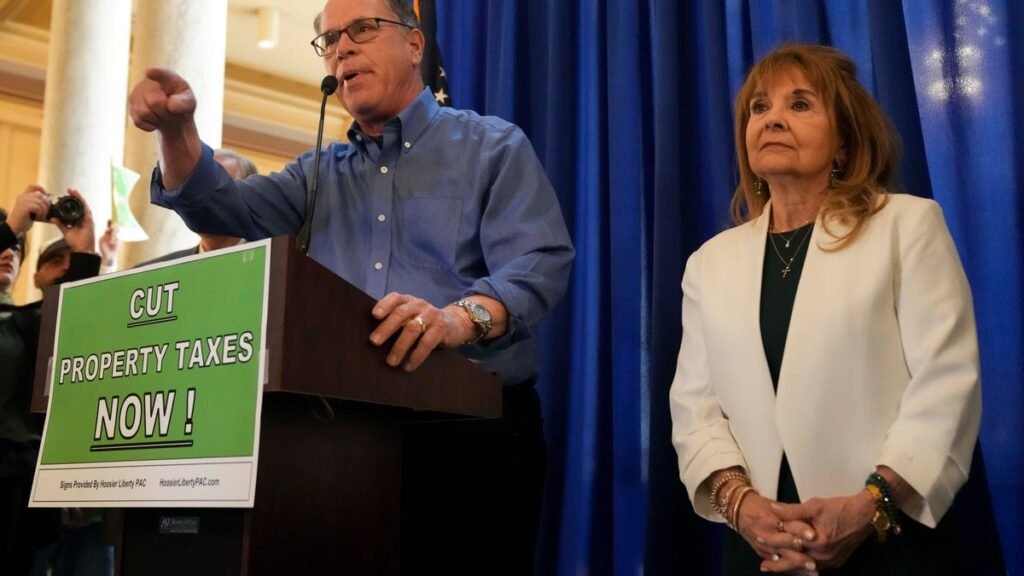

Indiana Gov. Mike Braun speaks during rally for property tax reform at Indiana Statehouse

Indiana Gov. Mike Braun speaks during a rally for property tax reform Monday, March 17, 2025, at the Indiana Statehouse.

(Correction: This story has been updated to reflect that the 10% property tax credit is off of a homeowner’s bill, not their assessed value.)

Gov. Mike Braun and Republicans in the Indiana House have reached an agreement on property tax relief for Hoosiers, which lawmakers say will have two thirds of property owners paying less on their tax bills in 2026 than this year.

Republican leaders in the House on Wednesday said the new version of Senate Bill 1 will boost the maximum property tax credit Hoosier homeowners owners can claim next year to $300, a $100 increase from the amount a House committee approved earlier this week. The tax credit would be worth 10% of a Hoosier homeowner’s property tax bill, up to $300, meaning Hoosiers that see property tax bills of $3,000 or more would receive the full $300 discount.

Both Braun and House Republican leaders praised the latest version of the bill for the amount of relief it provides taxpayers, even though the savings appear to be less than Braun’s original proposal. The governor’s original plan included $4.1 billion in savings over the next three years, nearly three times more than the savings House Republican predicted the current proposal would generate.

“I am proud to announce that with Amendment 36 to Senate Bill 1, we have agreed upon a plan to bring historic property tax relief to Hoosiers,” Braun said in a statement.

The Senate will still have to give its stamp of approval on the changes in the House. But a spokesperson for Senate President Pro Tem Rodric Bray, who leads Senate Republicans, said Wednesday that Bray was “happy with the progress on the bill.”

Democrats this week, though, have criticized how quickly lawmakers have had to vote on major changes to Senate Bill 1 without further details on the future fiscal impacts to local governments and school corporations. An updated fiscal analysis of the latest version of the bill was not immediately available early Wednesday evening, but GOP leaders estimated homeowners would save $1.4 billion over the next three years, which would mean a hit to local governments’ coffers.

“I just can’t continue to stomach and vote for something that has so many uncertainties,” said state Rep. Greg Porter, D-Indianapolis. “I just hope we can continue to work on it, but my spirit tells me this is probably it right now.”

Democrats and local government leaders this week have specifically expressed concerns about tax cuts to business owners that were added to SB 1 on Monday, and later adjusted on Wednesday, and how that might impact local revenues.

But House Speaker Todd Huston, in a speech on the House floor, said it’s about answering the call to help Hoosiers as local entities have seen the benefits of growth in recent years.

“It’s time for all of us, just as the state’s doing, to tighten our belt and to do more with less,” said Huston, who rarely speaks about amendments to bills on the floor. “This is that balance.”

What’s in Senate Bill 1

The current version of Senate Bill 1 also includes provisions:

- Removing a requirement for businesses to pay taxes on new business equipment, such as computers, if their value is less than $1 million in 2025 and $2 million in 2026. (Under current law, businesses have to pay those taxes on new equipment worth $80,000 or more.) Republicans said that change will likely benefit small businesses across the state.

- Phasing in increases of certain deductions for property owners, while transitioning other existing deductions to property tax credits.

- Allowing cities and towns with more than 3,500 residents to raise their own local income taxes.

- Changing requirements to make more Hoosiers age 65 and older able to qualify for special property tax credits

- Requiring referendums to be held during general elections

- Requiring school corporations, starting in 2028, to share property tax revenue with certain charter schools

Contact IndyStar state government and politics reporter Brittany Carloni at brittany.carloni@indystar.com. Follow her on Twitter/X @CarloniBrittany.

Sign up for our free weekly politics newsletter, Checks & Balances, curated by IndyStar political and government reporters.