Rise of the safe havens

Both gold and silver have shown great resilience amid global turmoil. But the precious metals are riding on distinct strengths. Gold’s rise is being driven by a combination of weaker US dollar, expectations of interest rate cuts, tariff wars and heightened geopolitical uncertainties that reinforce its position as a safe haven. Continuous central bank purchases of gold have added a sheen to the yellow metal’s lustre. Central banks bought more gold in the last four years than in the previous 21 years. Gold’s share in sovereign reserves has now overtaken the US dollar, for the first time since 1996. DSP Mutual Fund explains this phenomenon as the ‘Gold Put’—the consistent, less price sensitive, gold hoarding by central banks of various countries as an alternative to US Treasuries. Besides, inflows into gold ETFs have surged in tandem with the rise in gold prices. Juzer Gabajiwala, Director, Ventura Securities, observes, “Clearly, gold is no longer just emotional, it is economic armour. Its relevance has gone beyond lockers and ornaments; it now stands as both a portfolio hedge and a trusted store of value.”

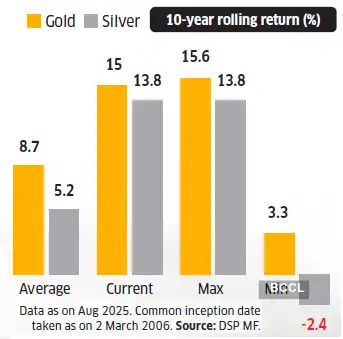

Gold and silver trade at upper end of historical return

Both precious metals are trading at a fat premium to historical averages.

Meanwhile, silver is performing a dual role. It finds favour both as a safe haven asset and a key input for industrial usage. The white metal derives robust industrial demand with applications in fast growing sectors like solar energy, electronics, telecom (5G infrastructure), semiconductors, and electric vehicles. “Silver, being durable and an excellent conductor of electricity has gained prominence in industrial applications,” says Chirag Mehta, CIO, Quantum AMC. Industrial demand accounts for nearly 60% of the total production of silver. It is further suggested that silver’s limited and volatile supply is contributing to its buoyancy. 2025 is expected to be the fifth consecutive year where silver demand outstrips supply, leading to a supply deficit. “Supply remains tight since global silver mine production hasn’t grown much, which is positive for silver prices. Notably, less than 30% of silver comes from exclusive silver mines, while the rest comes as a byproduct of base metal and gold mining,” an Axis MF report mentions.

Investors have been piling into silver ETFs. Lately, silver may also be finding favour in sovereign portfolios, along with gold. Russia became the first nation to announce silver purchases for its state reserves. Saudi Central Bank reportedly took a modest position in silver ETFs, signalling institutional confidence in the metal. The US recently added silver to its critical minerals list, underscoring its strategic importance. Besides, a weak US dollar provides buoyancy to silver as it becomes relatively cheaper for buyers using other currencies, pushing up demand. Lower interest rates are also supportive of silver prices.

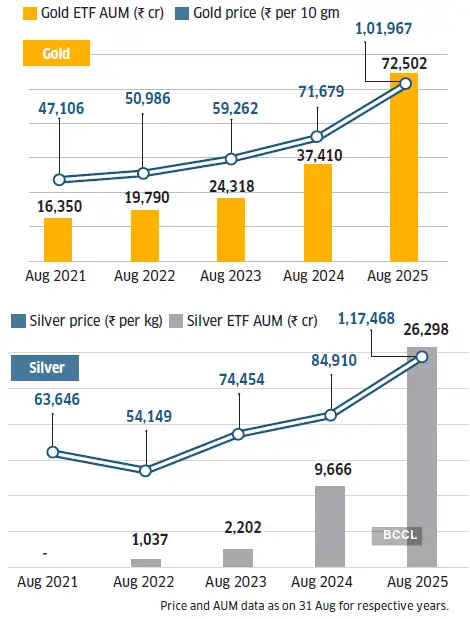

Flows into gold, silver ETFs rise on galloping prices

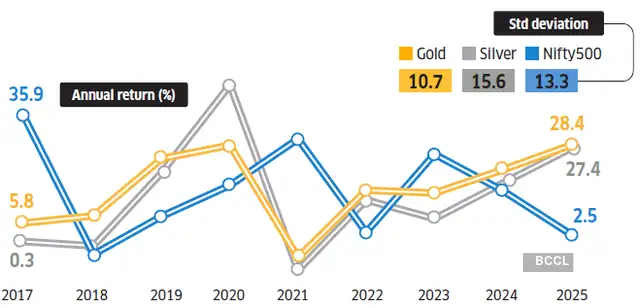

Silver exhibits higher

volatility than equities Gold has proved a better store of value over the years.

Can prices rise further?

The narratives around gold and silver sound compelling for now. Axis MF suggests both metals have relevance in portfolio strategies, especially amid global uncertainties. “Gold remains a preferred safe haven asset, backed by central bank buying and ETF flows. Silver offers dual exposure: safe haven and industrial growth (solar, electronics),” mentions the fund house in its report, suggesting that there is still room for gold and silver prices to rise.

But valuations for both commodities can no longer be ignored, irrespective of demand drivers. Asset prices by nature oscillate between extremes. After the record uptick, both gold and silver have swung visibly to one end. Data from DSP Mutual Fund shows that since March 2006, gold and silver have averaged 8.7% and 5.2% annualised return respectively over 10-year rolling time frames. During this period, the maximum return gold yielded was 15.6%. With gold currently sitting on a 10-year return of 15%, it is perched near the summit of historical return. Meanwhile, silver’s current 10-year return of 13.8% matches its highest return of 13.8% during this period. In the return sweepstakes, the two rank only behind mid cap stocks (16.1% return) over the past 10-year period. Clearly, both precious metals are trading at fat premiums. This warrants that investors temper return expectations. Anil Ghelani, Head-Passive Investments and Products, DSP MF, says, “The fundamental drivers remain intact for now, but nothing lasts forever. If the uncertainty premium associated with safe haven assets goes down, it will particularly affect gold.”

Even as both metals currently find favour, silver’s valuation gap with gold is significant. The gold-to-silver ratio is at around 87, compared to a long-term average of 60. Historically, such extremes have preceded sharp rallies in silver. Ghelani feels silver is better placed than gold as its industrial demand can counter any moderation in safe haven demand. However, some experts are not entirely convinced about silver’s blistering rise. Mehta remains skeptical about the rhetoric around silver’s rising industrial demand. “Time and again, there is a new spin to new demand catalyst emerging for the metal only to find that either it’s not sustainable and is at risk of efficiencies or substitution. Like with all industrial commodities, it will be good to do a deep dive on the sustainability of opportunity rather than falling prey to hyped stories.” He points to a downside risk for demand substitution with inexpensive metals and the evolution of products that minimise the use of silver.

What should you do?

If portfolio diversification is on your mind, avoid painting both gold and silver with the same brush. Silver may not be as uncorrelated to risk assets like equities as many presume. Mehta reckons silver is not a strong risk diversifier, unlike gold. “Given silver’s heavy industrial demand, its fortunes are linked to the level of economic activity. So the underlying driver for silver and equities is the same.” Silver’s claim as a store of value has no historical basis, unlike gold. Take for instance, silver’s 50% crash during the 2008 global financial crisis. Even though a stunning rebound sent silver soaring to its lifetime high of $49.5 per troy ounce in 2011, what followed was a painful, slow descent that the metal is yet to recover from, despite its most recent run of form. On the contrary, gold has proved its worth as a store of value over the years, soaring above its inflationadjusted 1980s high last year. Most experts maintain that portfolio diversification can be achieved purely with gold. Silver can be a tactical bet at best. Ghelani cautions, “Neither gold nor silver should be perceived as return drivers for the portfolio. Restrict allocation to 10% of your portfolio.”

If you are convinced about the near term prospects of gold or silver, there are more efficient routes to invest in them over their physical, ornamental form. “Exposure to gold and silver can be built through ETFs or FoFs. And for those who prefer the indirect route, multi-asset allocation funds offer an easy way in, typically holding 5-10% in precious metals,” points out Gabajiwala. Multiasset allocation funds offer a good alternative to riding the precious metals at current lofty prices. For those who want to take exposure to both, a few fund houses like Edelweiss, Mirae Asset and Motilal Oswal offer goldsilver combo funds in the form of ETFs and FoFs. Tax rules are now in favour of gold and silver ETFs and FoFs. Gains in gold or silver ETF units are taxed at 12.5% if sold after one year. The threshold is two years for FoFs.