After an 8% decline in 2024 because of a significant drop in palladium prices, a composite of the four precious metals trading on the CME’s COMEX and NYMEX divisions rose 7.24% in Q2 and were 5.79% higher than the 2023 closing level at the end of June. While gold, platinum, and silver posted gains, palladium prices continued to decline. Rhodium, a platinum group metal that only trades in the physical market, edged lower in Q2 but was still higher since the end of last year.

Silver leads on the upside as the metal breaks above technical resistance

Silver, the volatile precious metal that attracts trend-followers when the price breaks critical technical levels, led the precious metals sector with a 17.34% gain in Q2 and a 21.39% rally over the first half of 2023.

The long-term COMEX silver futures chart dating to the early 1970s shows silver’s bullish price action in Q2. The precious metal broke above the February 2021 $30.16 high, reaching $32.50, the highest price since December 2012. Silver pulled back and settled Q2 at $29.237 per ounce but the price was back around $31 in early July. Silver’s record high was in $50.36 in 1980 and it reached a lower $49.52 peak in 2011.

Gold reaches a new record high

COMEX gold futures rose 5.51% in Q2 and were 12.93% higher over the first six months of 2024. While silver posted the most significant percentage gain, gold rose to a new all-time high in Q2.

The long-term COMEX gold futures chart highlights the rise to a record $2,435.80 high in May 2024. Gold has been in a bullish trend since the 1999 $252.50 low. Gold settled Q2 at the $2,339.60 level. Gold was marginally higher at over the $2,380 level in July 2024, and the bullish path of least resistance remained firmly intact.

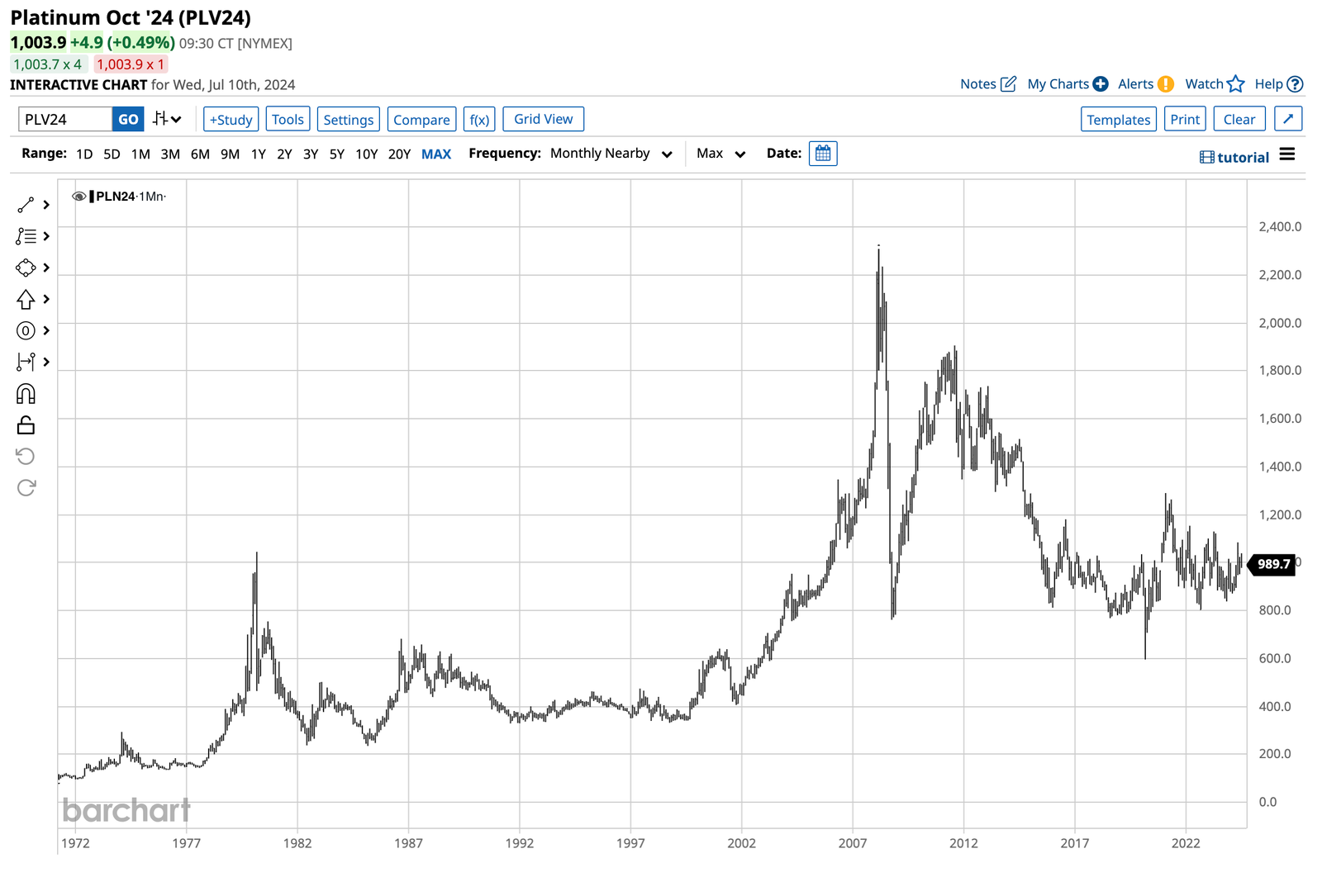

Platinum- Going nowhere fast but posts a double-digit percentage gain

Platinum, the rare precious metal that market participants once called “rich person’s gold,” was the second-best performer in Q2, moving 10.38% higher. Platinum’s price has not posted stellar results, as the metal was only 0.69% higher over the first half of 2024, and platinum remains less than half the price of gold.

The monthly chart shows NYMEX platinum futures settled Q2 at $1,001.90 per ounce. Platinum has traded on either side of $1,000 for nearly a decade as rallies and declines have run out of steam. Platinum’s long-term consolidation continues in 2024, with the price of active month October futures just above the $1,000 per ounce level in July. Platinum’s all-time high was in 2008 at $2,308.80, which is lower than the current gold price.

Palladium and rhodium prices decline

NYMEX palladium futures rose to a record $3,380.50 in March 2022 when Russia invaded Ukraine. Russia and South Africa lead the world in palladium production. Palladium futures plunged from the March 2022 all-time peak, and the selling continues in 2024. In Q2, nearby palladium futures fell 4.27% and were 11.85% lower over the first half of this year.

The long-term palladium chart illustrates the price plunge that took the precious and industrial metal to under one-third of the price at the 2022 high. Nearby palladium futures settled at the $977.90 level at the end of Q2 and were just under $1,000 in July.

Rhodium is the third leading platinum group metal but does not trade on any futures exchange. Rhodium prices fell 1.05% in Q2 but were 3.87% higher over the first six months of 2024, settling at a midpoint of $4,700 per ounce at the end of June.

The outlook for Q3 and the second half of 2024

The precious metals sector is a tale of two groups: gold and silver and PGMs. Gold remains in a quarter-of-a-century bull market, and the odds favor higher highs over the coming months and years. Central banks have been buying gold, further validating its role in the global financial system. The potential for a BRICS currency with gold backing is bullish. Moreover, debt levels make the world’s oldest means of exchange and store of value more attractive. Bank of America analysts believe gold is heading for the $3,000 per ounce level. Gold has no definitive technical resistance as it has made higher record highs for years.

Time will tell if silver’s break above a critical technical resistance level will power the metal significantly higher over the coming months. Silver’s upside target is the 1980 high at over $50 per ounce. The Q2 technical break suggests the bullish price action in silver will continue through the rest of 2024 and beyond.

Platinum has disappointed investors since the 2008 high. The long-term consolidation around the $1,000 level will eventually lead to a technical upside or downside break. The price action in gold and silver, platinum’s rarity and liquidity, production in Russia and South Africa, and its many industrial applications suggest the eventual technical break will be to the upside.

Palladium is searching for a bottom at less than one-third of the price at the March 2022 high. The trend remains bearish in July 2024, but technical resistance levels have declined with the price.

The most direct route for exposure to the four leading precious metals is the physical market for bars and coins. The COMEX gold and silver and NYMEX platinum and palladium futures contracts have physical delivery mechanisms. The Aberdeen Physical Precious Metals Basket (GLTR) owns gold, silver, platinum, and palladium bullish, providing exposure to the precious metals. At $106.19 per share, GLTR had just over one billion dollars in assets under management. GLTR trades an average of 20,424 shares daily and charges a 0.60% management fee.

The monthly chart shows GLTR moved 7.8% higher in Q2 and 13.1% to the upside over the first half of 2024. GLTR outperformed the precious metals sector as the ETF invests most of its assets in gold and silver with small allocations to palladium and platinum.

I remain bullish on precious metals for the second half of 2024.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.