Alumina prices have soared to record highs this week, compressing margins at the world’s aluminium smelters which convert the intermediate product into metal.

The alumina-aluminium ratio was just 15% at the start of 2024, when alumina was priced at $350 per ton.

A series of supply disruptions have driven the alumina price higher this year. The trigger for the latest price jump was news of export problems in Guinea, the major import source of bauxite for China’s alumina refineries.

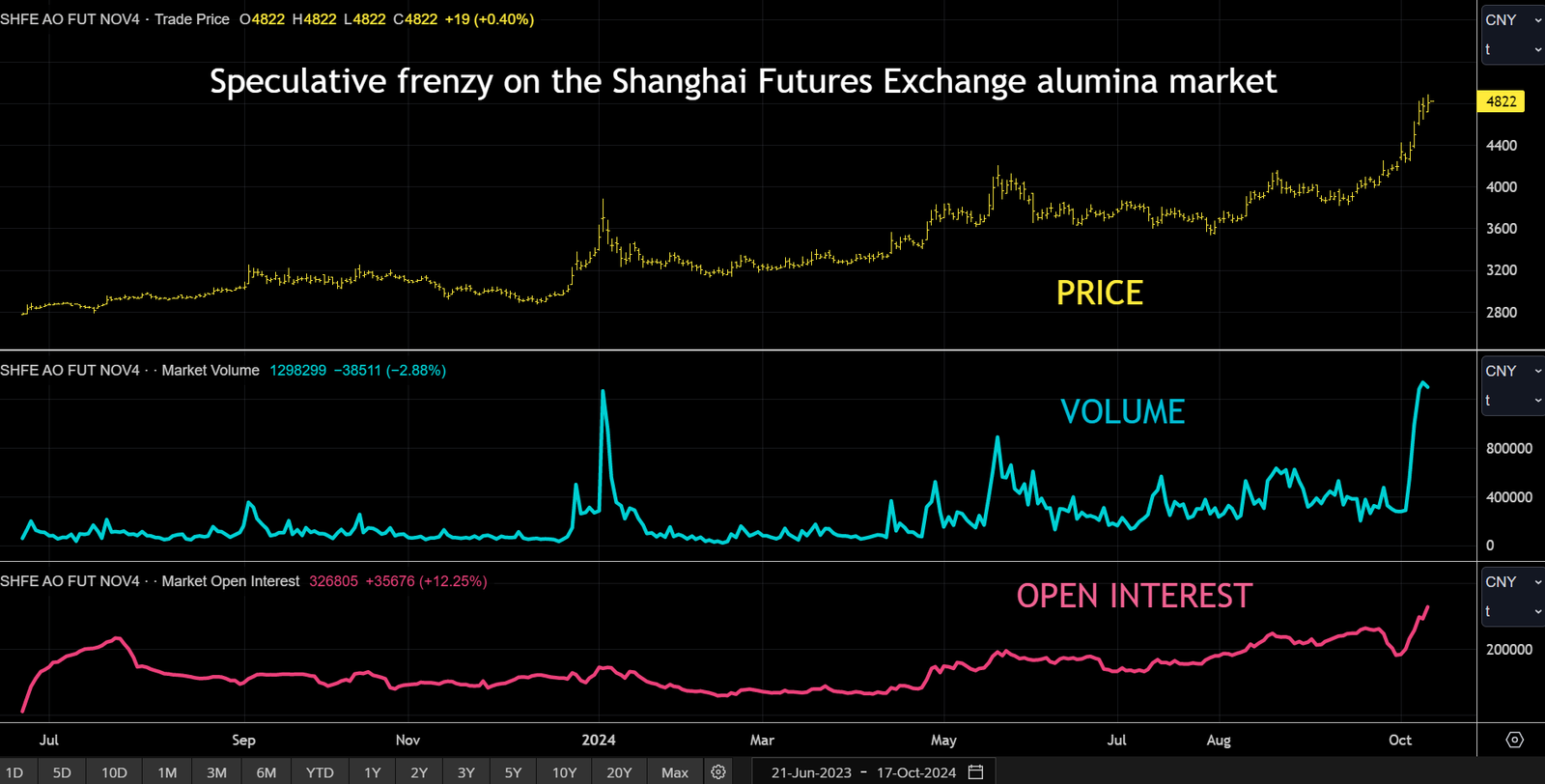

The physical alumina market is undeniably tight but the explosive nature of the price action also signals a speculative frenzy on the Shanghai Futures Exchange (ShFE).

SHANGHAI BOOM

Nearly 25 million tons were transacted on the ShFE alumina contract on Wednesday, a record daily high and equivalent to almost a fifth of global annual production.

Open interest has also soared to life-of-contract highs as investors have bought into a steadily rising market.

The exchange adjusted both trading limits and margins on Thursday, imposing a percentage point premium on speculative positions relative to industrial hedge positions.

This is standard operating procedure for China’s exchanges in the face of speculative surges such as that currently washing into the Shanghai alumina market.

This sort of futures price volatility is a new phenomenon for the alumina market.

Both the LME and its U.S. peer CME Group offer alumina contracts but neither is liquid. The explosive growth in the Shanghai contract, by contrast, has changed the dynamic between paper and physical markets since trading began in June last year.

ALL EYES ON GUINEA

The price sensitivity to events in Guinea highlights how dependent China’s alumina refineries have become on West African bauxite.

China’s bauxite mining sector has been hit by multiple waves of environmental inspections, limiting domestic supply and encouraging more alumina refineries to look overseas for their raw material.

Imports of Indonesian bauxite stopped early 2023 after the Indonesian government banned exports in a drive to force its miners downstream into refining and smelting.

Guinea has fast emerged as China’s primary bauxite supplier. Imports doubled between 2000 and 2023 to almost 100 million tons and were up by another 13% in the first eight months of this year.

Although wildly exaggerated, the price reaction in Shanghai is logical, given the lack of alternative bauxite supply and tighter conditions in the alumina market itself.

SUPPLY HITS

Alumina supply has taken multiple hits this year.

Meanwhile, Chinese demand for alumina has been growing strongly as the country’s smelters have benefited from improved power supply, particularly in the hydro-rich province of Yunnan.

National aluminium output rose by 4.4% year-on-year in the first eight months of 2024 with annualised run-rates increasing by almost 1.5 million tons since December.

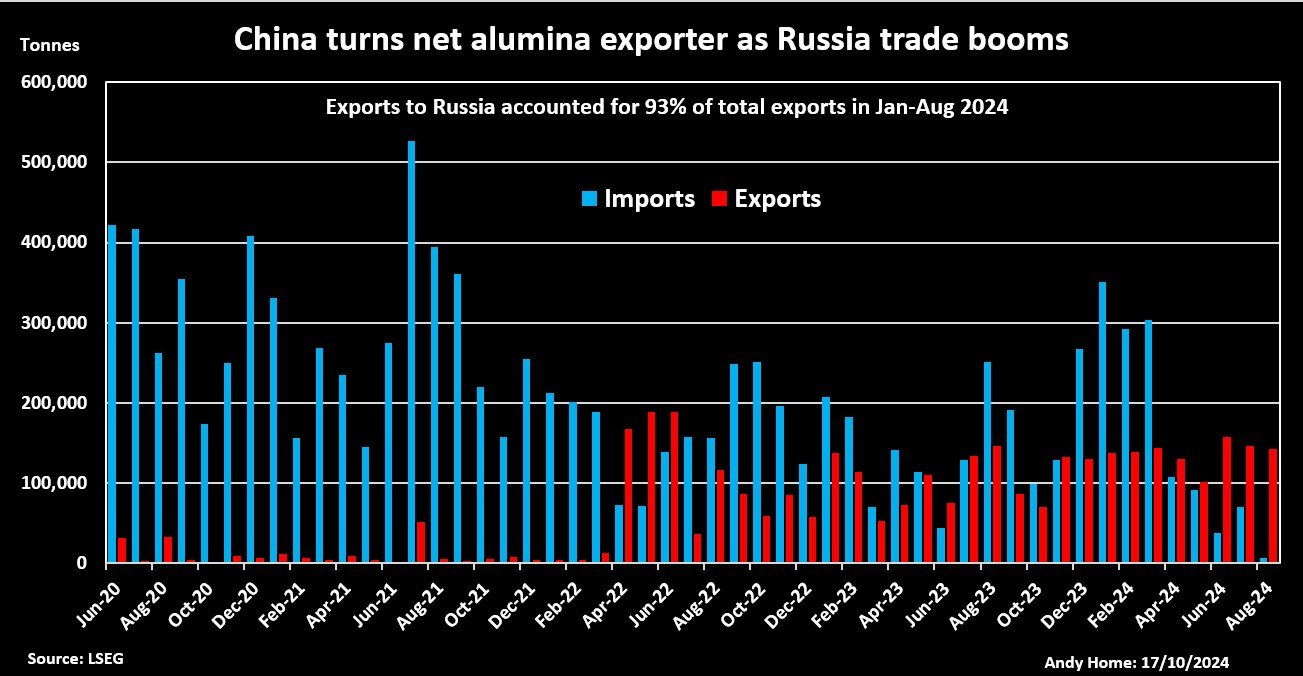

That said, China at a national level doesn’t seem to be physically short of alumina since it continues to export significant quantities to Russia.

Indeed, exports to Russia surged by 41% year-on-year to 1.0 million tons in January-April, turning China from net importer to net exporter of the intermediate product.

FUTURE(S) DISRUPTION

But physical availability is not the same as exchange availability.

ShFE alumina stocks have dropped by more than half since June to 103,416 tons. The result is time-spread tightness with the premium for cash relative to forward contracts flaring wider this week.

Short-position holders’ ability to deliver physical material will depend on how much alumina is located at ShFE’s four delivery points in the provinces of Shandong, Henan, Gansu and Xinjiang.

Much also hangs on how serious the threat of disruption to Guinean bauxite shipments is. The January scare quickly subsided and there’s no indication the latest incident is the harbinger of a national change of policy around exports.

What has changed, however, is the reaction time to such events.

Before the arrival of the Shanghai futures contract, spot alumina was priced by physical cargo transactions, which can be few and far between in a market dominated by yearly supply contracts.

Now a headline from Guinea can move the futures price in seconds, creating a disconnect between paper and physical markets.

This added volatility is going to make the previously tranquil alumina market a much more turbulent place.

It’s also going to make smelter costs much more unpredictable with a potential knock-on impact on the price of aluminium itself.

Our Standards: The Thomson Reuters Trust Principles.