Yesterday, in “What’s Behind The Recent Surge In Platinum, And Will It Continue“, we not only explained in detail what is going on both at the technical and fundamental level, but also answered in the affirmative and why – yes, it the surge will continue. One day later, the surge has indeed continued, and having decisively broken $1200 earlier this week, platinum spiked another $100, touching a session high of $1285, and is now just dollars away from the post-covid high above $1300.

For some perspective on what comes next, we go to Goldman materials specialist James McGeoch who writes today that having cut through $1200 like a hot knife through butter, Platinum is now clearly targeting $1300, and even though the precious metal is overbought here, it is going to test some resolve to go against the flow.

As McGeoch adds, “I’d say look at the chart, but it will make you cry, as it starts the move comes from Asian hours and we know they cannot get enough precious” and furthermore, it “feels like someone loading up on a flat price position.”

Ultimately, to the Goldman trader, it feels like the price of platinum is determined by fundamentals vs momo, but that is markets in a nutshell. To James, his mind “always says has to be a long duration hand, tactical guy cannot buy that shape, but have been wrong before, ask these guys what they think – “Gold, Platinum and Why Everyone Has it Wrong.”

In a nutshell, “the issue for most is how does it move the needle, small wins yes, bigger ones harder to capture.”

Unless, of course, the Chinese buyers – who have historicall been very price discriminate no longer are – and this time the melt up momentum only brings with it even more momentum, blasting the metal to parity with gold, if not higher.

A more sketpical view was published today by Goldman’s precious metal analyst Lina Thomas, who notes that the platinum breakout began on May 20, coinciding with the start of Platinum Week (May 20-21) and a bullish World Platinum Investment Council (WPIC) report published on the day prior. However, as we subsequently reported and as Goldman also writes today, it was speculative and ETF demand that fueled the rally to $1,280/toz.

We agree with Goldman on this, where we disagree with the bank is its claim that “a sustained breakout is unlikely for three reasons.” Goldman’s three reasons to be bearish are the following:

#1 Price-Sensitive Chinese Demand

Chinese buying, which corresponds to about 60% of new annual platinum production, appears highly price sensitive, with increased buying when prices are low but reduced buying when prices are high.

Goldman believes that this strategic buying has likely contributed to platinum’s range-bound trading over the past decade. Nearly 50% of China’s imports are driven by price-sensitive jewelry and investment demand. For instance, lower prices post-the ‘Liberation Day’ US tariff announcement contributed to higher platinum withdrawals from the Shanghai Gold Exchange (SGE), a proxy for Chinese jewelry and, to a lesser extent, investment demand, in April and consequently high Chinese platinum imports that month. But – the bank argues – the rally that started in mid-May appears to have already curtailed Chinese jewelry (and investment) demand for platinum. Which however is irrelevant if speculators have enough firepower to keep pushing the ascent higher, in which case Chinese jewelers will eventually be forced to chase the price again, only this time much higher.

#2 Downside Pressures on Auto Sector’s Demand for Platinum

Here, Goldman repeats the trite and familiar “fundamental” case why platinum demand is evaporating because very soon nobody will be driving ICE cars, and yada, yada. To wit: China’s rapid shift towards EVs is eroding long-term autocatalyst demand for platinum (which depends on ICE and hybrid car sales) while simultaneously increasing scrap availability as ICE vehicles are retired. Which is a lovely, if categorically false thesis, because China is already facing a resistance threshold in its power grid, beyond which it will no longer be able to support all the EVs on the road. What happens then? And what happens when Chinese EV subsidies finally run out.

Meanwhile, in the West, Goldman’s autos equity analysts expect the ICE and hybrid vehicle fleet to remain relatively stable, with no large impact on the platinum balance

#3 Stable-to-Moderately Higher Global Supply

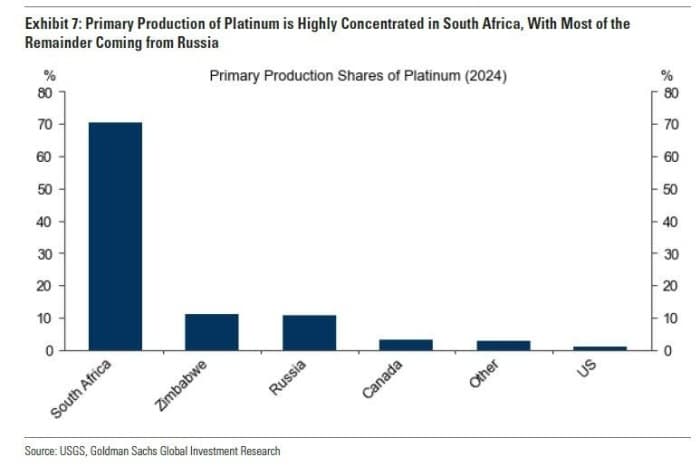

In an attempt to re-engage at the fundamental level, Goldman expects stable-to-moderately higher global platinum supply… unless South African power constraints re-emerge, which they will. Platinum production is highly geographically concentrated, with South Africa accounting for 70% of primary platinum production, with most of the remainder coming from Russia.

In South Africa, which is a country that has rolling blackouts for half the day, guidance from the major PGM miners points to moderate increases in PGM supply (12% year-over-year in 2025). The supply resilience is most likely fabricated as it defies the impact of years of low platinum prices and compressed margins, and so expect declining South African production in the coming years.

Platinum production is primarily a byproduct of other metals, such as copper, and is co-mined with other Platinum Group Metals (PGMs) such as palladium and rhodium. Consequently, the PGM basket price (denominated in ZAR) and revenue derived from associated metals — rather than just the platinum price — heavily influence the overall profitability of these mining operations. Periods of high prices for byproduct metals, such as the near-record chrome prices in 2024, can provide financial relief and offset downward profit pressure from lower platinum prices

Here Goldman admits that PGM production cannot be easily increased due to capacity constraints, which is bullish for the price; alternatively, significant curtailments are also rare due to a high proportion of fixed costs inherent in these operations, particularly energy and labor. The heavily unionized nature of South Africa’s mining sector makes layoffs “politically sensitive” and doing so could increase the risk of strikes, social unrest and reputational damage. These socialist factors support a strategy in which mines operate at a high capacity utilization without materially increasing output; in other words just churning. Lower capex guidance – similar to the US shale patch – suggests producers are focused on extracting more from existing assets

Goldman’s optimistic view notwithstanding, the main risk to production remains operational disruptions and thus South African power outages and labor strikes represent the most significant threats to supply. Such events can halt production entirely and lead to substantial, albeit often temporary, supply deficits.

By Zerohedge.com

More Top Reads From Oilprice.com