Vancouver, British Columbia–(Newsfile Corp. – September 11, 2025) – Pacific Ridge Exploration Ltd. (TSXV: PEX) (OTCQB: PEXZF) (FSE: PQW) (“Pacific Ridge” or the “Company”) is pleased to provide a drilling update for the Company’s 100% owned Kliyul copper-gold project (“Kliyul”) and RDP copper-gold project (“RDP”), both located in B.C.’s Golden Horseshoe at the southern end of the Toodoggone district (see Figure 1).

Drilling Highlights:

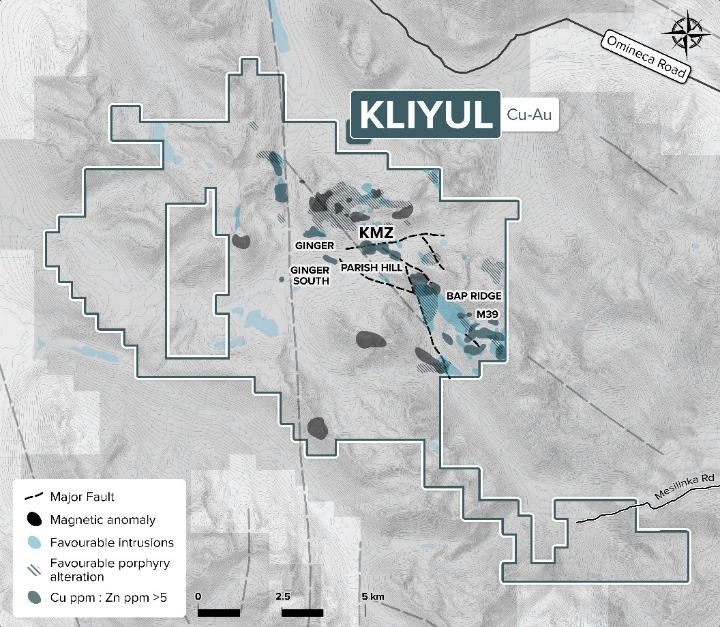

- Two drill holes, totaling 1,287 m, were completed at Kliyul and were focused on infill and resource expansion at the Kliyul Main Zone (“KMZ”), which hosts 334.1 million tonnes (“Mt”) grading 0.33% copper equivalent (“CuEq”)(0.15% copper, 0.26 g/t gold, and 0.95 g/t silver) in the Inferred Mineral Resource category (see news release dated August 6, 2025)(see Figure 2).

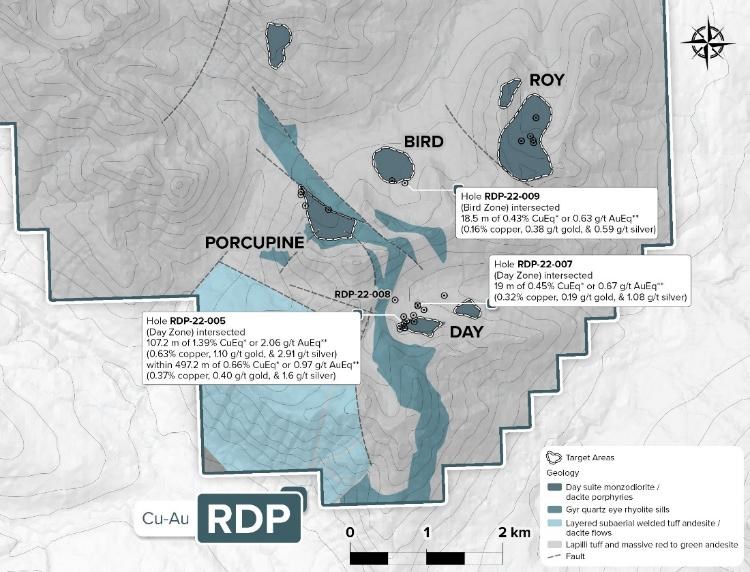

- Five drill holes, totaling 2,156 m, were completed at RDP and were focused on the Day target, which returned one of B.C.’s best porphyry copper-gold intervals in 2022: Drill hole RDP-22-005 intersected 107.2 m of 1.39% CuEq* or 2.06 g/t gold equivalent (“AuEq”)** (0.63% copper, 1.10 g/t gold, and 2.91 g/t silver) (see news release dated October 25, 2022)((see Figure 3).

- Drilling at both Kliyul and RDP intersected strong copper mineralization (see Figures 5, 6, 8, 9, 10, and 11).

Figure 1. Location of Kliyul and RDP

Figure 1. Location of Kliyul and RDP

2025 Kliyul Drill Program

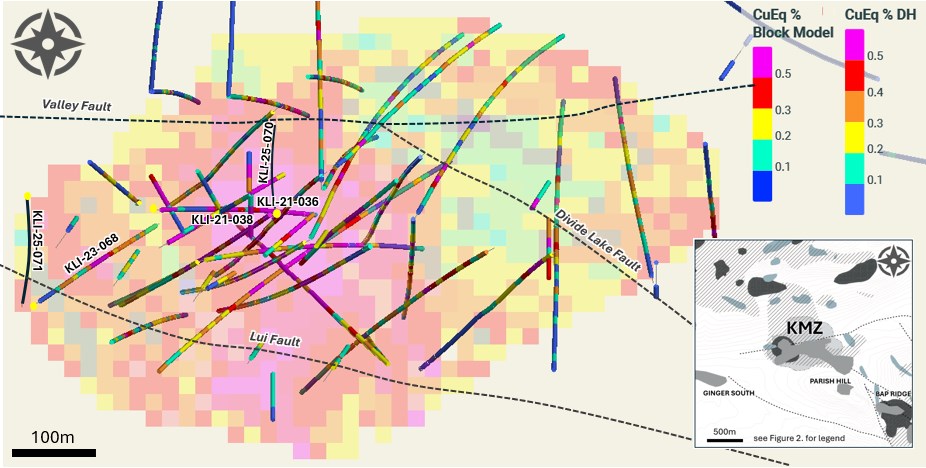

The 2025 drill program at Kliyul was focused on infill and resource expansion at KMZ.

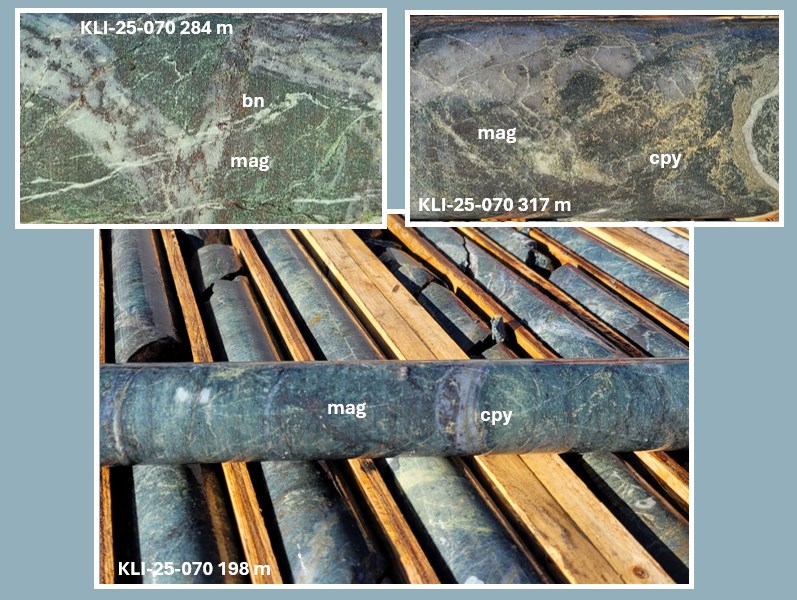

KLI-25-070, the first drill hole of the program, was collared south of the Valley Fault (Figure 4) and was designed to test an approximately 130m gap in drilling north of strong copper-gold mineralization in holes KLI-21-036 and KLI-21-038. KLI-25-070 was collared from the same location as KLI-21-036 and drilled at an azimuth of 354o degrees and dip of 80o from an elevation of 1765m to a depth of 786m. The hole intersected chalcopyrite and bornite mineralization with quartz-magnetite veins and stockworks (Figure 5) and as disseminations, as well as chalcopyrite +/-bornite and pyrite mineralization associated with epidote and anhydrite veins.

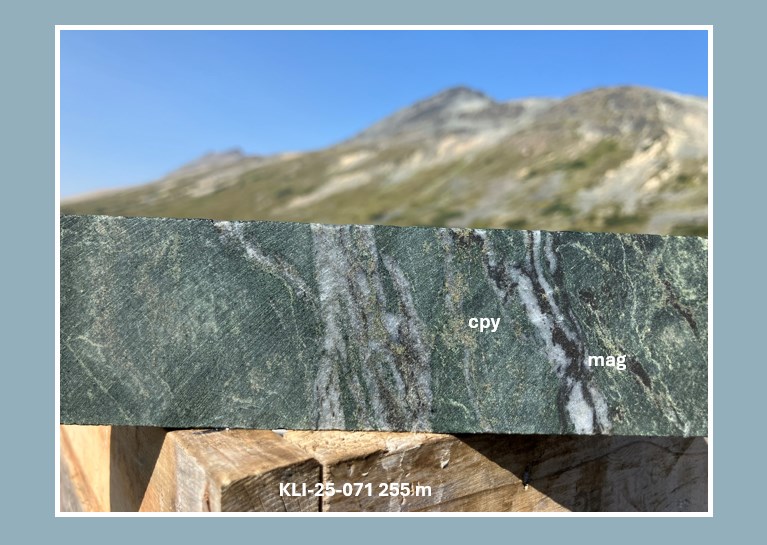

KLI-25-071 was collared west of KLI-23-068 to test for copper-gold mineralization extensions to the west within the mineral resource estimate pit shell. KLI-25-071 was drilled at an azimuth of 180o degrees and dip of 75o from an elevation of 1776m to a depth of 501m. Chalcopyrite-pyrite mineralization occurs as disseminations with epidote-magnetite alteration, with quartz-sericite-chlorite veins, quartz-anhydrite veins and locally, quartz-magnetite veins (Figure 6).

Figure 4. 2025 KMZ Drill Hole Locations With 2025 Pit-Constrained Inferred Resource Block Model at 1470m Elevation

Figure 4. 2025 KMZ Drill Hole Locations With 2025 Pit-Constrained Inferred Resource Block Model at 1470m Elevation

Figure 5. KLI-25-070 Drill Core Photos

Figure 5. KLI-25-070 Drill Core Photos

Figure 6. KLI-25-071 Drill Core Photo

Figure 6. KLI-25-071 Drill Core Photo

2025 RDP Drill Program

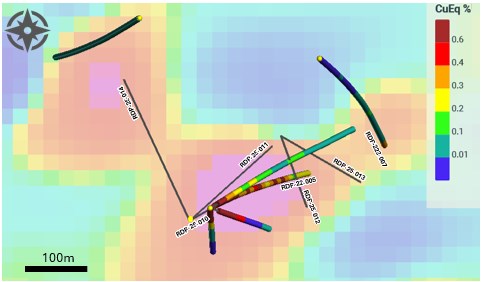

The 2025 drill program at RDP was focused on the Day target (see Figure 7) with the objective of confirming that the porphyry Cu-Au-Ag mineralization intersected in RDP-22-005 is hosted in a westward-striking, steeply northward-dipping tabular body and also to test the western magnetic lobe.

Figure 7. 2025 Day Target Drill Hole Locations on MVI magnetics

Figure 7. 2025 Day Target Drill Hole Locations on MVI magnetics

RDP-25-010, the first drill hole of the 2025 exploration program, was located 40 m southwest of RDP-22-005. RDP-25-010 was drilled at an azimuth of 60o degrees and dip of 72o . A stockwork of quartz-magnetite-sulphide veins was encountered in the first 5m of drilling, however, a late mineral intrusive was intersected from 5m to 175.5m and the hole was terminated.

RDP-25-011 was drilled from the same location at an azimuth of 48o degrees and dip of 65o to a depth of 431 m and cut underneath and to the northwest of RDP-22-005. Patchy potassic alteration (k-feldspar-magnetite) was intersected as well as intervals of strong quartz-magnetite sulphide veining, chalcopyrite+/- bornite mineralization (see Figure 8) hosted in early-mineral monzodiorite and hydrothermal breccia, extending mineralization to the north of RDP-22-005 by a minimum of 50m, with mineralization still being open to the north.

Figure 8. RDP-25-011 Drill Photos

Figure 8. RDP-25-011 Drill Photos

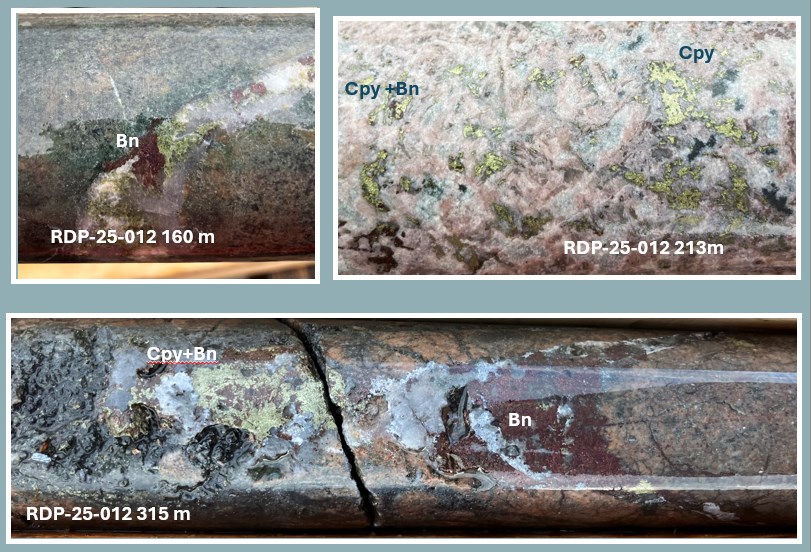

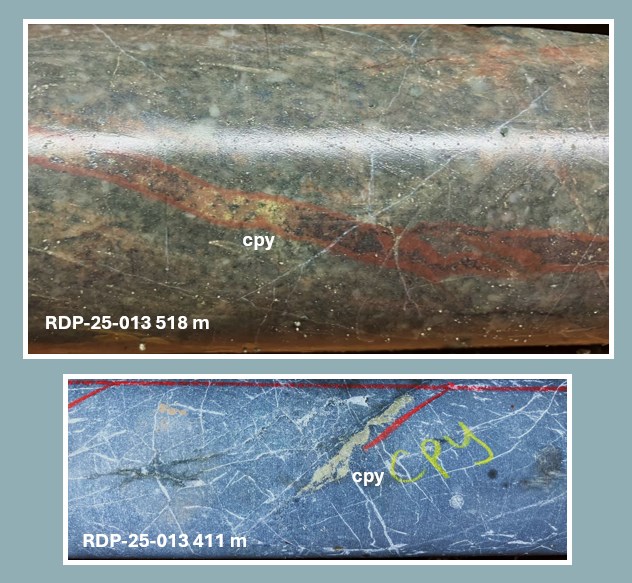

RDP-25-012 (48o /- 65o /363m length) and RDP-25-013 (160o /- 70o /582m length) were drilled from a site 170m northeast of RDP-22-005 to test the interpreted tabular porphyry Cu-Au mineralization geometry between RDP-22-005 and RDP-23-007, which was collared 300m NE of RDP-22-005 and ended in 19.0 m of 0.45% CuEq* or 0.67 g/t AuEq** (0.32% copper, 0.19 g/t gold, and 1.08 g/t silver)(see new release dated November 23, 2023). Chalcopyrite and bornite mineralization hosted in early-mineral, potassically-altered monzodiorite intrusive rocks and hydrothermal breccia were intersected (see Figures 9 and 10), which confirmed the concept of a tabular geometry. Copper-sulphide mineralization was intersected to a vertical depth of 500m in RDP-25-013 and it remains open.

Figure 9. RDP-25-012 Drill Photos

Figure 9. RDP-25-012 Drill Photos

Figure 10. RDP-25-013 Drill Photos

Figure 10. RDP-25-013 Drill Photos

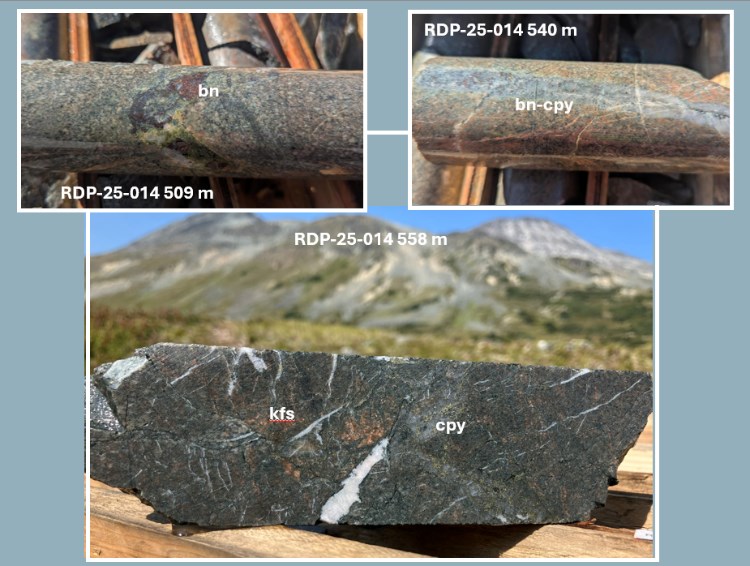

RDP-25-014, the final drill hole of the 2025 RDP drill program, was designed to test the western magnetic lobe for copper-gold mineralization. RDP-25-14 was drilled at an azimuth of 335o degrees and dip of 65o to a depth of 604m. Chalcopyrite-pyrite and chalcopyrite-bornite mineralization occur as disseminations, and with quartz-carbonate and epidote-actinolite veins cross-cutting potassium-feldspar and magnetite-altered monzodioritic intrusions (Figure 11).

Figure 11. RDP-25-014 Drill Core Photos

Figure 11. RDP-25-014 Drill Core Photos

About Pacific Ridge

A Fiore Group company, Pacific Ridge’s goal is to become British Columbia’s leading copper exploration company. The Kliyul copper-gold project, located in the prolific Quesnel terrane close to existing infrastructure, is the Company’s flagship project. In addition to Kliyul, Pacific Ridge’s project portfolio includes the RDP copper-gold project, the Chuchi copper-gold project, the Onjo copper-gold project, and the Redton copper-gold project, all located in B.C. The Company would like to acknowledge that its B.C. projects are in the traditional, ancestral and unceded territories of the Gitxsan Nation, McLeod Lake Indian Band, Nak’azdli Whut’en, Takla Nation, and Tsay Keh Dene Nation.

On behalf of the Board of Directors,

“Blaine Monaghan”

Blaine Monaghan

President & CEO

Pacific Ridge Exploration Ltd.

*CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Cu x 22.0462).

**AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Commodity prices: $Cu = US$3.25/lb, $Au = US$1,800/oz., and Ag = US$20.00/oz.

There has been no metallurgical recovery testing on RDP and Kliyul mineralization.

The Company estimates copper recoveries (CuR) of 84%, gold recoveries (AuR) of 70%, and silver recoveries (AgR) of 65% based on average recoveries from Kemess Underground, Mount Milligan, and Red Chris.

Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne.

The technical information contained within this News Release has been prepared under the supervision of, and reviewed and approved by. Danette Schwab, P.Geo., Vice President Exploration of the Company, and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, which address exploration drilling and other activities and events or developments that Pacific Ridge Exploration Ltd. (“Pacific Ridge”) expects to occur, are forward-looking statements. Although Pacific Ridge believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, that one of the options will be exercised, the ability of Pacific Ridge and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Pacific Ridge’s proposed programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Pacific Ridge does not assume any obligation to update or revise its forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.