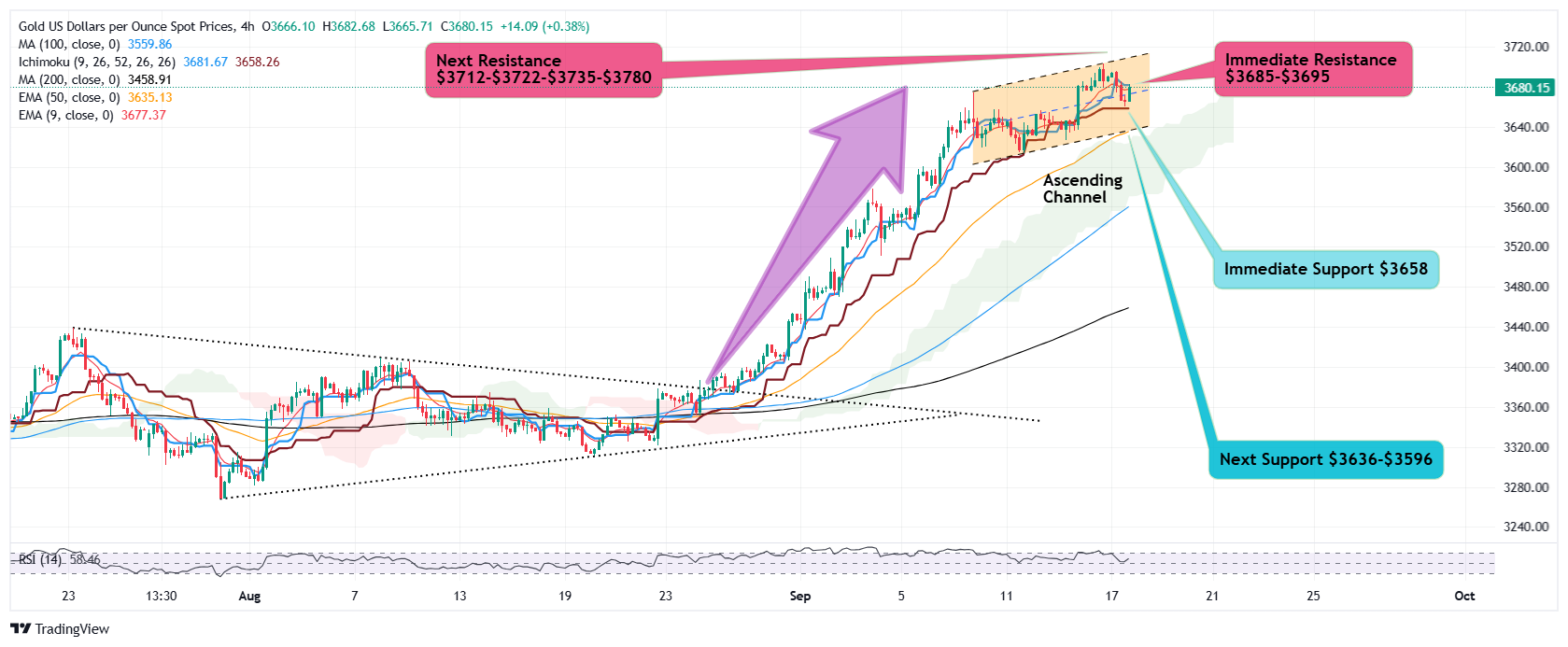

As all eyes are fixed on upcoming interest rate decision by Federal Reserve, Gold trades sideways around $3682 with bullish bias after some mild retracement towards immediate support $3660 during London session as New York prepares to come to desks.

Gains remain capped by immediate hurdle $3682-$3685 which if cleared, opens the way to next resistance $3695 followed by retest of $3703 high above which the metal enters unchartered territories for next potential resistance levels $3712 and $3722 followed by $3735 while bullish wave main target may come for $3780

$3760 acts as horizontal demand zone attracting buyers though the zone is vulnerable to break below the belt as next downside support sits at $3645-$3635

If traders decide to book profit and selling intensifies below $3630, downside momentum shift may put Gold under extended selling pressure looking for $3600-$3580

Fundamental drivers

Federal Reserve Rate Cut: A 25 BPS rate cut is widely speculated and well priced in. Markets will give a knee jerk reaction initially and closely monitor Fed commentary shortly after for Powell’s forward guidance.

Dovish signals will result in lower yields and weaker Dollar adding tail winds to Gold extending run towards $3712-$3722-$3735 and even $3780

Hawkish or less dovish stance will see a stronger dollar, higher yields and Gold dropping sharply.

Retail traders may resort to collect profits on the table and start winding up longs triggering short term sell off towards major support areas and a retracement towards $3550-$3500 may be witnessed this week.

Geo Political Crisis: Global geo political situation is getting worse with recent Israeli air strikes on Hamas leadership in Qatar and ongoing offensive in Gaza while Ukrainian drone attacks continue to raise heat in Russia with no clear signs of any peace deal in sight.

Dollar Index Melt Down: Dollar Index continues to drop as economic data and labour market keeps disappointing and safe haven demand attracts investors towards Gold shaking confidence in Dollar as global reserve currency.

Central Banks Buying and ETF Flow: Most Central Banks have stepped up Gold purchases during this year as proportion of Gold in Forex reserve is witnessing a gradual rise while Gold ETFs are recording unprecedented inflow causing elevated demand for the yellow metal.

Sticky inflation

US inflation is yet to come under targeted range, causing investors switching to Gold as hedge against any further spike in inflation.

Overall Outlook: Primary trend for Gold is extremely bullish and mid term bullish targets are estimated to reach $4000 levels and beyond.

Nonetheless, short term price correction is natural and essential for a healthy resumption of bullish extension.

Major catalyst for a substantial price correctional rebalancing is extremely overbought RSI on monthly time frame.