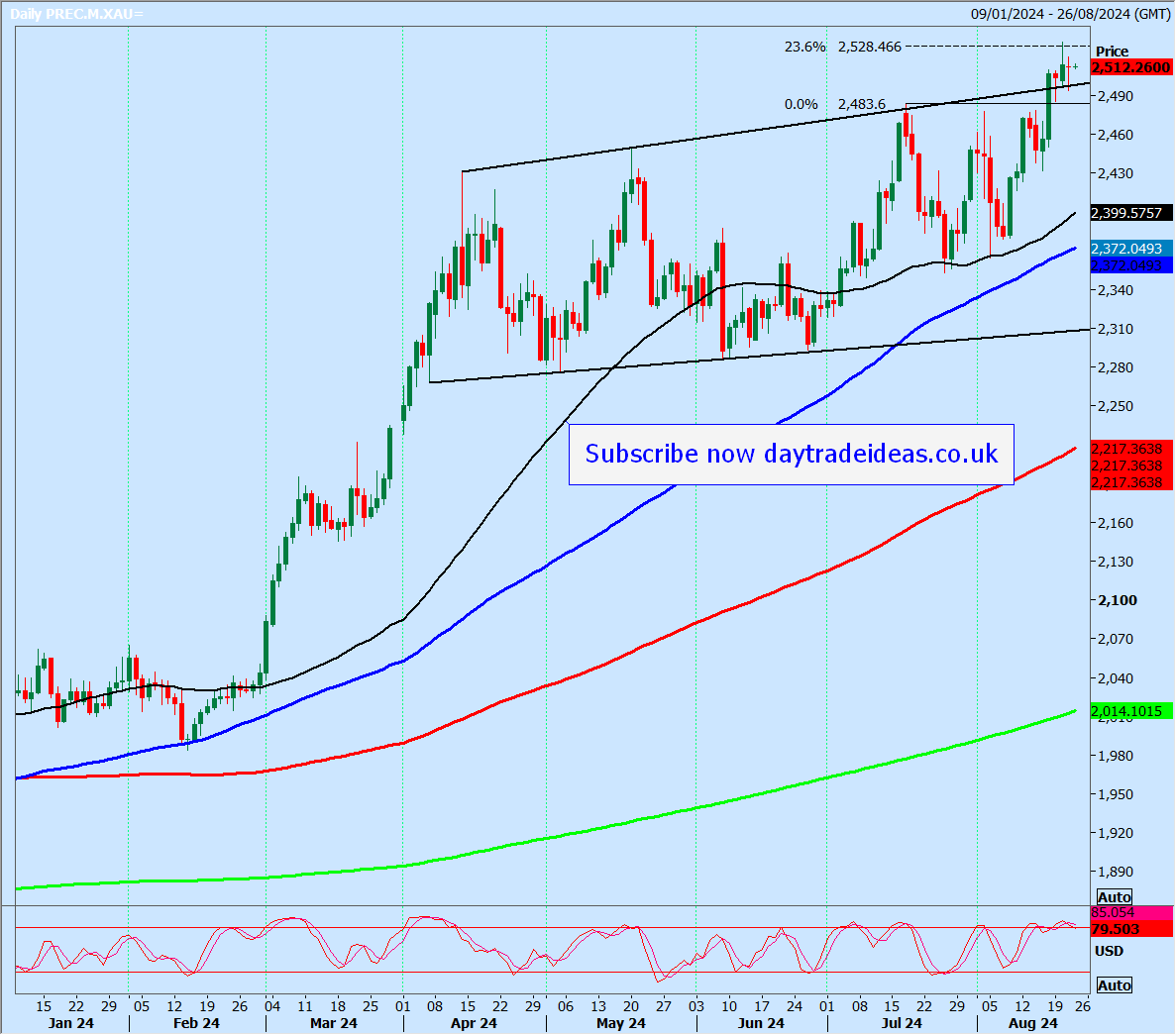

Gold

() has a potential new leg higher in the longer-term 20-year bull trend just starting.

However, yesterday we traded sideways and closed unchanged as we consolidated after recent gains.

We made a low for the day exactly at the buying opportunity at 2494/91.

The same levels apply for today and again, holding above 2509/05 (a low for the day morning here yesterday) allows a recovery to 2525/28.

On a break above 2533 look for 2539/43, perhaps as far as 2554/56.

We could eventually reach 2565 and 2578/82. Even 2599/2602 is possible.

A buying opportunity again at 2494/91. Longs need stops below 2485.

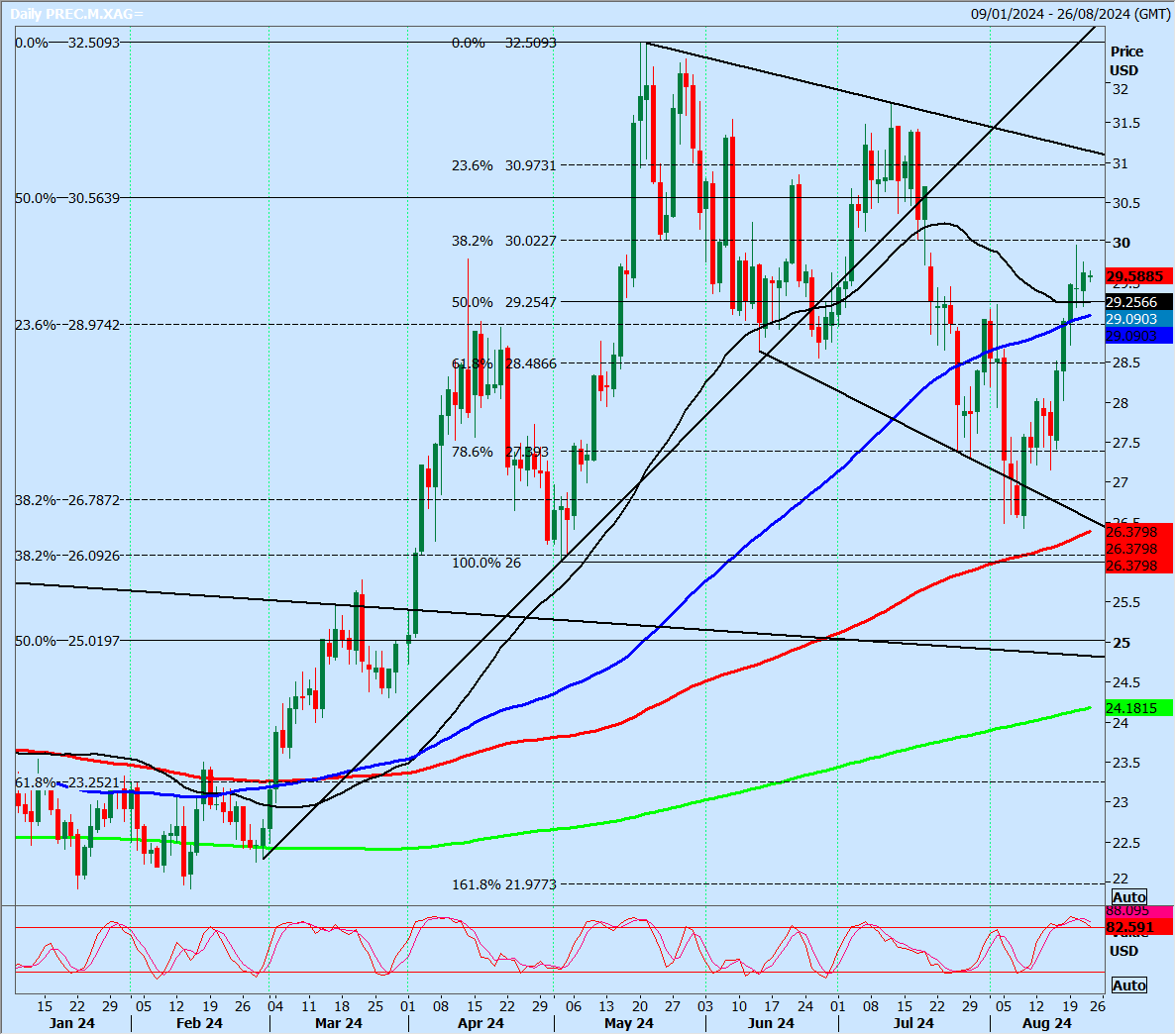

Silver

() break above 2920 was another buy signal for this week targeting 2940/45 and 2970/75

My first buy level is at 2920/2900 again and yesterday we made a low for the day at 2920 – again longs need stops below 2875.

Targets: 2940, 2960, 2980

A break above 3000 is a buy signal targeting 3035 and 3060.

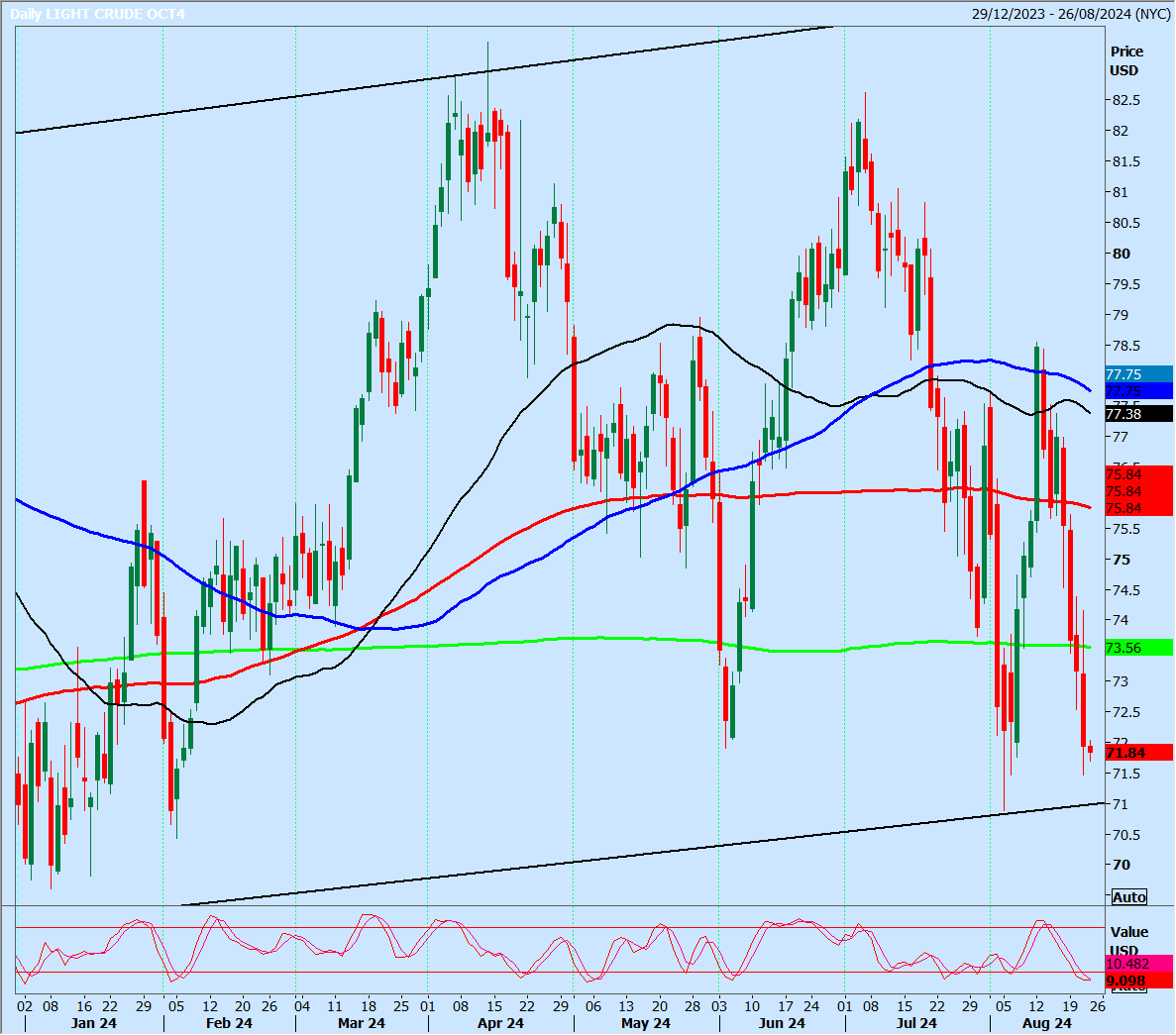

WTI Crude October Futures

Last session low and high for the October contract: 7146 – 7416.

remains caught in a longer-term sideways channel, around 2 years old with moving averages flatlining and converging for 6 months.

For the last 11 months, WTI Crude has been consolidating in a narrowing triangle pattern as the monthly ranges decrease.

WTI Crude made a high for the day at 7416, just 16 ticks above the sell level and hit the 7170/40 target for a potential 200 ticks profit

Once again holding first resistance at 7360/7400 can target 7220/7200, perhaps as far as 7170/40. Further losses today retest the August low at 7100/7088.

A break below 7075 is a sell signal targeting 6990/6970 and 6910/6890.

Even as far as the December 2023 low at 6800/6770 is possible eventually.

Bulls need a push higher through 7490 to target resistance at 7560/90 and shorts need stops above 7640.