The world’s rarest precious metal, Osmium has become an investment proposition of great interest. Find out why it’s about to become rarer still, and why it has garnered such significant attention in recent days.

We’re all aware that Earth’s resources of minerals are finite, and that at some time we’ll start running out of one or another of them. Reassuringly we tell ourselves this is unlikely to happen in our own lifetimes, yet according to Ingo Wolf, scientific director of the Osmium Institute in Germany, it’s already happening now. In what the Americans term “the Osmium Bigbang”, the global supply of this precious metal, which is increasingly in demand by the high-end jewellery and watchmaking industries, as well by those holding it as a tangible asset, will very soon dry up completely. And Wolf believes this simple fact, buttressed by other considerations that include its extreme rarity and the impossibility of counterfeiting, as well as its brilliance and beauty, means that osmium’s time has come as an investment proposition.

“It was only possible to buy osmium after 2013, when it was first introduced to the market in its crystalline form, which is the only state in which it can be traded on a significant scale,” says Wolf of the noble metal, one of only eight known to be highly resistant to corrosion and oxidisation, as well as the last precious metal to be made available for trade to individuals. “Since then, it’s been going through three market phases. First there’s the raw osmium. That’s followed by the second phase, when it goes to crystallisation and into the hands of tangible-asset owners. And then there’s the third phase, where the osmium goes to the jewellery market.

“These three phases have been separated by two particular moments in time,” he explains. “The first one has been the Osmium Bigbang, in which raw osmium from ethical sources is running out and all the osmium goes to crystallisation, and then to people who hold it as a tangible asset. The second moment is the osmium thin-out, because osmium will increasingly be going from crystallisation to the jewellery market via the same tangible-asset owners, who’ve either bought it already or are buying now, as well as from the Osmium Institute. And the osmium will stay in the jewellery market, because the moment you try to melt it you destroy its surface, which serves as the unique ‘fingerprint’ of each crystal and is used for identification. That’s why some Americans are calling it ‘the tangible bitcoin’ – and it’s also why jewellery makers are so hot on osmium right now. Because if you put it into a piece of jewellery, not only is the osmium itself absolutely unique, but also the entire piece. It can’t be counterfeited.”

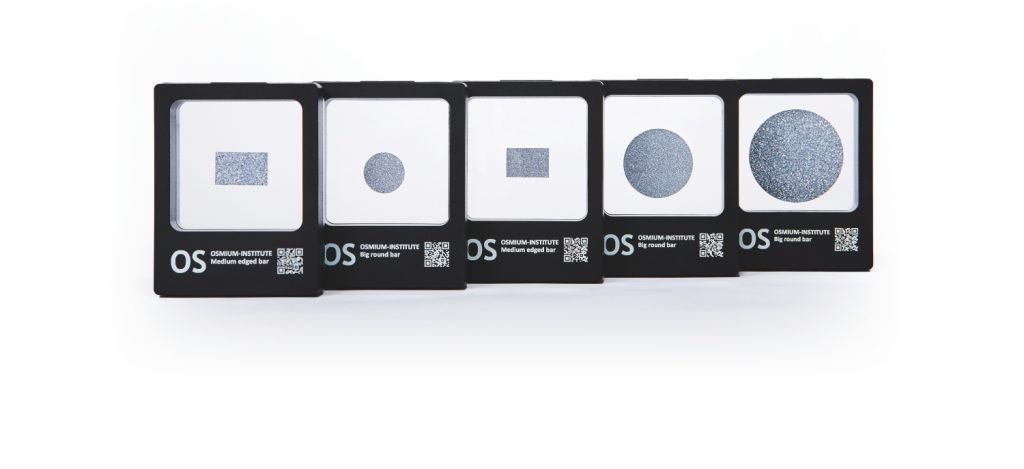

A member of the platinum group, which also includes platinum, iridium, palladium, rhodium and ruthenium, osmium carries the number 76 in the periodic table and, in its crystalline form, has the highest density of all non-radioactive elements. Although first identified around 200 years ago, raw osmium was known as being toxic, so no market existed for its sale to investors or private individuals. That only became possible within the last 15 decades when, after some 40 years of research, a highly sophisticated process was developed in which the raw material was exposed to very specific conditions that transformed it into flat crystalline osmium. In this state it’s not only safe to handle, but each piece also retains its unique form and sparkle forever. The pieces are then cut into the disks, flat bars and other shapes in which they’re traded on the market. The procedure is so precise that it permits the resulting metal to be standardised and controlled to a degree of purity of at least 99.9995 percent.

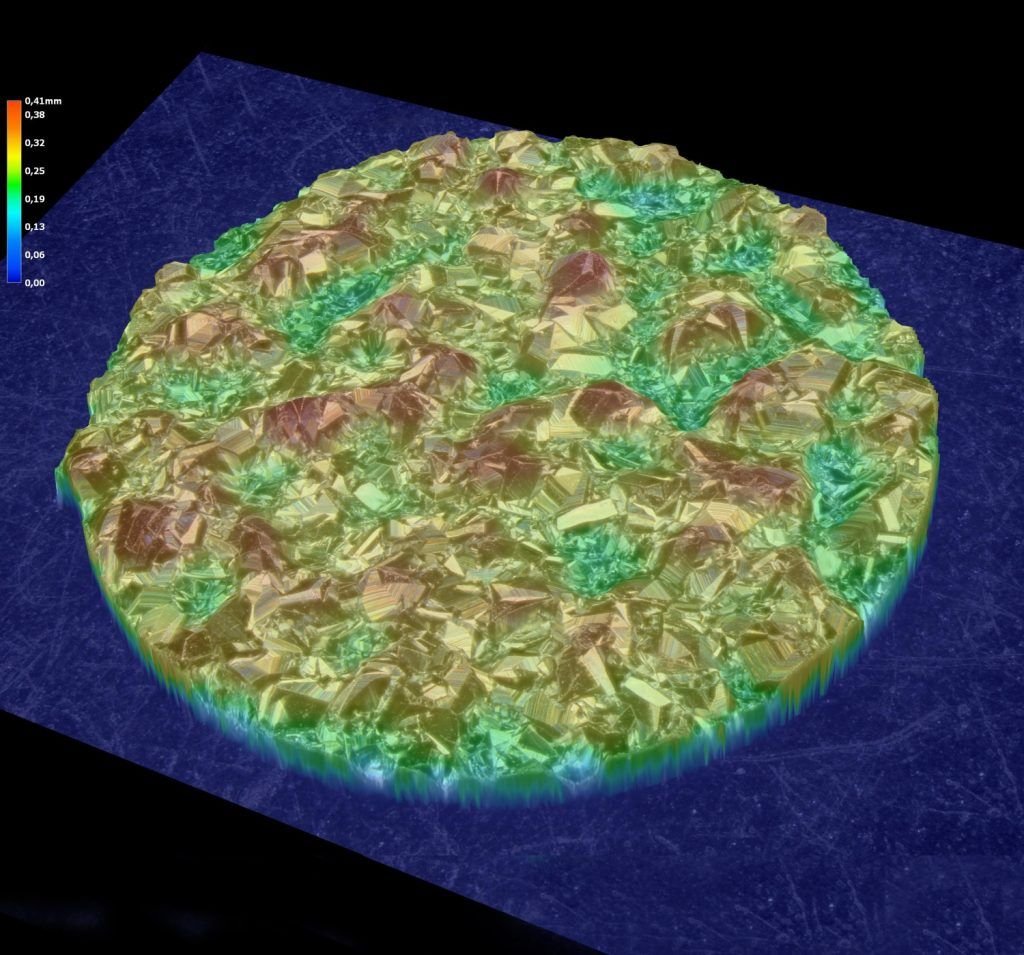

As well as making its marketing feasible for the very first time, the process also revealed several remarkable characteristics about the metal, not least the unique fingerprint of every crystalline surface, which in combination with certification by the Osmium Institute provides a guarantee that it cannot be counterfeited. Because unlike other easily malleable metals, such as gold, crystalline osmium is dimensionally absolutely stable, with a form that cannot be structurally reversed – and nor is it sensitive to corrosion, radiation or discolouration.

Moreover, osmium is the rarest metal found on Earth, says Scarlett Clauss, vice-director of the Osmium Institute. “Along with the other platinum-group metals, it was most likely created in a kilonova, which is like a supernova but even more intense, and was caused by the collision of two neutron stars. When Earth was young and still rather liquid, it was hit by parts of the explosion, which is also why the platinum-group metals aren’t finely distributed around the world, like gold, but rather they follow lines into the Earth.

“In every 10,000 tonnes of platinum ore you find only around 30 grams of osmium,” Clauss explains. She adds that as it’s only produced as a by-product of extracting the other mineral and no one goes looking for it on its own, the amount of osmium mined will depend on the future mining of platinum – “and as demand for platinum is decreasing,” she says, “the sourcing of osmium will also decrease.” Platinum is a key component for the catalytic converters used in internal combustion engines, so the current transition to electric power for motor vehicles means there’s simply less of the metal being mined. A further factor restricting supply are the current embargoes on trading with Russia, another potential supplier of raw osmium.

Currently, the Osmium World Council estimates that minable quantities of the mineral are vanishingly small. But, says Clauss, there’s another reason why the amount of newly crystallised metal entering the market will soon dry up completely, causing an Osmium BigBang to occur – and that’s because “there’s only one company that can do the crystallisation. It’s in Switzerland, and the man behind it is going to retire and isn’t planning to pass on the knowledge. That means the entire crystallisation process will cease on December 31, 2026, at which point the osmium market will really start to ‘heat up’. Although everything that’s been crystallised until then will still have to be sold into the market, no more newly crystallised osmium will come onstream. Aside from the reduction in supply of raw material from the ethical sources we support and the fact that the crystallisation company is ceasing production, we’ve also told tangible-asset investors that the market will end at a given point.”

“If you buy osmium now, you can put it into your wallet and wait,” says Wolf, “because this is a long-term tangible investment. You wait – and in the future the jewellery market has to come back to you, because there’s no other source.”

As osmium is best regarded as an alternative investment, a portfolio diversifier and a potential hedge against inflation, the suggested timeframe in which investors should hold on to their stock is at least 10 years – and possibly up to 15 – by which time all the metal previously available in the market should have been snapped up. But whenever that latter point is actually reached, says Wolf, “the jewellery industry will have to come back to investors, because there is no other market”. And that’s when sizeable movements in the price of osmium are likely to be seen.

Such a scenario, however, is likely to unfold against the current trend of consistent growth in the gram price of crystalline osmium, which has almost doubled since 2017, independent of any global fluctuations in the stock market. It also attracts investors who see it as an early buy-in to a new metal market. And as the supply of newly crystallised osmium will cease completely within the next two-and-half-years, and demand from the luxury sector is increasing, it’s not unreasonable to expect that the price is likely to rise exponentially in the future.

Although now priced in grams, the unit of weight for osmium is likely to change, possibly by the beginning of 2025. “In the near future,” says Wolf, “we see the need to reflect the constant convergence with the diamond market in the units [in which osmium is sold]. In agreement with the Osmium World Council, it will presumably change the sale of osmium to carats as a unit of measurement as early as next year.”

by Swiss luxury brand OSLUX

The attractiveness of osmium to jewellers and watchmakers requires little explanation, as in the past few years the two industries have been taking increasing notice of this incredibly rare and beautiful metal. Just as with existing staples such as gold and platinum, diamonds and other precious stones, that’s partly because of the glamour and mystique associated with their rarity, but it’s also because of the qualities unique to each material, such as the fact that platinum has such stiffness and strength that it can hold a stone without any additional setting.

In the case of osmium, however, there’s also the fact that it simply wasn’t available in its current form until very recently, as well as the crystalline metal’s remarkable silver-blue colour, which is utterly distinct from other materials, and also its incredible reflectiveness. “Rarity plays emotionally into the jewellery aspect, and also its beauty,” explains Clauss, who was an early pioneer in the use of osmium inlays in rings, bracelets and necklaces with her own company, Oslery. “Whereas the sparkle of diamonds with perfect cut and clarity can be seen from up to 6 metres, the sparkle of osmium can be observed from up to 30 or 40 metres. But probably most important, in the luxury industry there are huge problems with forgery, and as the crystalline structure of a square millimetre of osmium is 10,000 times as precise as a human fingerprint, every piece can be identified without any doubt. It’s so precise that when you call up the surface scan on the internet and compare it to a high-resolution photo you took yourself, you’d be able to identify it with the naked eye. That’s the main reason it resonates so strongly, because as soon as you integrate a piece of osmium into your jewellery or watch, it’s 100-percent authentic.

“And that leads to another reason why it’s so interesting right now, as it’s increasingly seen as an alternative to diamonds,” Clauss adds. That’s partly because diamonds can now be grown in the lab and even high-end laboratories are struggling to identify the difference between them and natural stones – but even before that the origin of diamonds was always in doubt. People never really knew where they came from and whether they’d been used for certain purposes in the past. You can laser small codes into them, but even those can still be forged, whereas with osmium the crystalline structure in itself is absolutely unique.”

Indeed, osmium not only increasingly features in rings, bracelets and pendants, but it’s also been used for dials in high-end watchmaking. Among several luxury brands that have done so is the Swiss watch manufacturer Hublot, part of the French-owned luxury conglomerate LVMH, which employed osmium in the dial of its Classic Fusion Tourbillon Firmament timepiece of 2014, as well as the tourbillon mechanism. Other watch brands working with the metal include Ulysse Nardin, Czapek and UNE, while new on the market are recently launched high-quality watch brands such as Epitome.

The sparkling metal was also used in a recent collaboration between renowned Cremona-based luthier Edgar Russ and the Austrian brand Osmium-Art. Unveiled last year in a recital by the famed violinist Elena Denisova, the Osmium Violin incorporates 541 individual osmium inlays in its construction, making it the most expensive new musical instrument of its kind in the world.

As for acquiring osmium to serve as an alternative tangible asset within a diversified portfolio of investments, the process is simple. The Osmium Institute is the world’s leading authority for the certification and distribution of crystallised osmium, tasks that are carried out by a team of specialists who perform authentication and supply identification codes for pieces that make their way into the market, all of which are entered into the Osmium World Database. The institute also trains and works alongside dealers, and provides information to various interested parties, as well as setting up an international network of 20 regional institutes on five continents and a further 1,300 partners in 40 countries around the world, all of whom provide a local customer-friendly point of contact.

“Crystallised osmium can be bought through any of those partners, or direct from the Osmium Institute in Germany, or online,” says Clauss. “There are what we call country partners who act as local representatives, so if someone in China, for example, were to purchase online from the Osmium.com website, they’d automatically get an invoice from the Osmium Institute China in their own currency, including the local tax – and if a country doesn’t have an Osmium Institute, then the German institute takes care of everything.

“Unless you prefer storage by the Osmium World Council in Germany, or want it shipped to a bank or a storage facility, when you buy osmium you get a physical delivery of the piece. And as to how much you actually buy, that obviously depends on how big your investment portfolio is. The smallest investment pieces start from around USD 1,000 – USD 1,500 – those are the smaller so-called osmium bars – and the biggest single pieces go up to about USD 150,000. Those are what we call “investment disks”, which are a little bigger than the palm of your hand, so with six or seven of these you can be holding EUR 1 million in one hand. And that’s yet another reason why osmium is so interesting, because it’s so value-dense.” Add to that the fact that every piece of osmium purchased has its own authentication and certification, and it would seem to be the perfect addition to any investment portfolio.

While it’s rare indeed that any precious metal enters the market for the first time, it’s almost unheard of that production of new quantities of that same substance would cease within a few years. The Osmium Bigbang marks a unique opportunity for long-term investors seeking an alternative tangible asset, one that’s unlikely ever to be replicated for the simple reason that no other precious metal is known to exist on this planet.

The information in this article is accurate as of the date of publication.