Foreign investors are flooding into South Africa’s government bond market to take advantage of one of the best emerging-market trades of recent years.

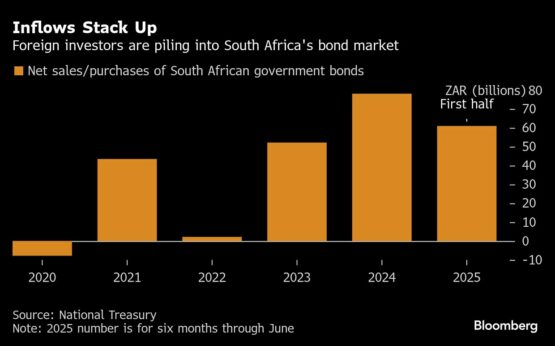

The bonds have drawn net inflows of R139 billion ($7.9 billion) in the 18 months through June, more than the previous four years combined, according to National Treasury data. The coalition government established after elections in 2024 has proved key to sentiment, winning over investors with plans to reform the economy and improve the state’s finances.

ADVERTISEMENT

CONTINUE READING BELOW

Inflows have continued this year, the Treasury data shows, despite bouts of selling sparked by wrangling over the budget in the first quarter and President Donald Trump’s tariff threat in April.

The increased demand helped the debt return 29% in dollar terms over the year and a half through June, the most among major emerging markets after Argentina, according to data compiled by Bloomberg. The average for developing-nation local-currency debt was 9.2%, while the benchmark index for EM equities rose 14%.

Van Eck Associates and LGT Capital Partners are among firms betting that South Africa’s bonds will continue to outperform as low inflation, a stable currency and an improving fiscal outlook increase their appeal.

“The full potential of South Africa’s real yields has only begun to emerge,” said Sebastian Kistner, a portfolio manager at LGT Capital. “With credible monetary policy, fair currency valuation and high real yields South Africa now stands out as a compelling opportunity for EM investors.”

Already in the second half, the debt has returned 4.4% for dollar investors, compared with an 0.2% average loss for EM peers, underscoring enduring appetite for the bonds.

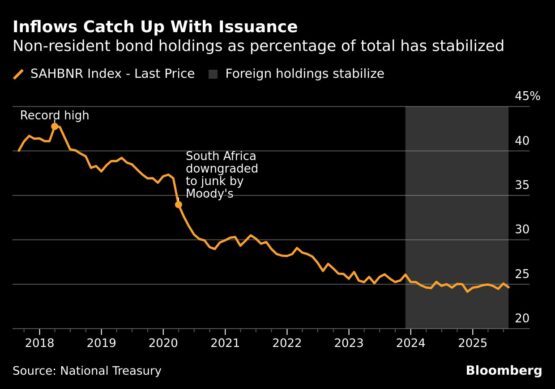

South Africa’s debt was ejected in April 2020 from the FTSE World Government Bond Index — which tracks investment-grade debt — after the country received a full deck of junk ratings following a downgrade by Moody’s Ratings. That forced index-tracker funds to sell the bonds, leading to net outflows that year.

The market has attracted inflows each year since, helping to chip away at the decline in non-resident holdings as a proportion of outstanding debt. This figure dropped to 24.2% in November from a high of 44% in 2018 because purchases failed to keep pace with issuance as government debt soared. But it has started to stabilise, rising to 24.7% at the end of July, according to Treasury data.

Even with inflation seemingly anchored near the bottom of the South African Reserve Bank’s target range, the country’s real yields remain among the highest in emerging markets, according to Van Eck Associates. The central bank’s plan to lower the inflation target would support further bond gains, according to David Austerweil, a deputy portfolio manager at the New York-based firm.

The yield on benchmark 2035 notes has dropped more than a percentage point in the past year to 9.6%, a five-year low. With annual inflation running at 3%, that still gives investors a real yield well in excess of 6%.

“With real yields still above 6.5% at the long end, bonds remain cheap in our investment process,” Austerweil said. “The entry point remains attractive. Additionally, the prospects of Sarb lowering the inflation target can serve as a catalyst for structurally lower yields in South Africa.”

Africa’s largest economy has expanded by less than 1% a year for more than a decade, constrained by graft, underinvestment in infrastructure, logistics snarl ups and insufficient energy supply. The so-called Government of National Unity that came into power when the African National Congress lost its outright majority in May last year has pledged reforms to bolster growth and cut state debt.

‘Good news story’

The country has met about 10% of its reform targets over the past 18 months, according to Business Leadership South Africa. The lobby group has developed a tracker to monitor implementation of promised reforms, and said the story so far is “good news.”

ADVERTISEMENT:

CONTINUE READING BELOW

The GNU is also making headway on the fiscal front, while state-owned electricity company Eskom is being restructured with the help of a government bailout. The country has been largely free this year of rolling power outages that have crippled the economy in the past.

“South Africa is one of the few emerging markets where you see a turnaround in terms of economic prospects just because there’s a momentum for better reforms, and the fiscal policy is doing a lot better,” said Thierry Larose, a portfolio manager at Vontobel Asset Management AG. “That’s something that the market appreciated a lot.”

The rand’s newfound stability has also bolstered the bonds’ appeal. The South African currency has gained more than 7% this year and three-month realised volatility is hovering near a 16-year low, giving foreign investors more confidence to take on the exchange-rate risk.

Six-month implied volatility, meanwhile, is at an 11-year low, suggesting traders are anticipating price swings to moderate further. Positioning in the options markets is likewise becoming less bearish, with six-month risk reversals — the premium for contracts to sell the rand over those to buy them — at the lowest since March.

A more reliable electricity supply, the stability of the coalition government and rising infrastructure investments will continue to support the currency, said Matthew Ryan, head of market strategy at Ebury Partners.

“High global uncertainty and the possibility of further bouts of risk aversion brought about by Donald Trump’s erratic policies could weigh on the rand, but elevated gold prices and a weaker dollar mitigate these risks,” Ryan said. “We maintain our call for a gradual strengthening of the rand against the dollar.”

Where many investors in the past tended to look to Latin America for speculative exposure to emerging markets, much of that attention is now turning to South Africa, Vontobel’s Larose said.

“The market has been perceiving South Africa as a safe beta to play emerging markets,” he said. “It’s safer than people thought before, and it’s very liquid.”

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.