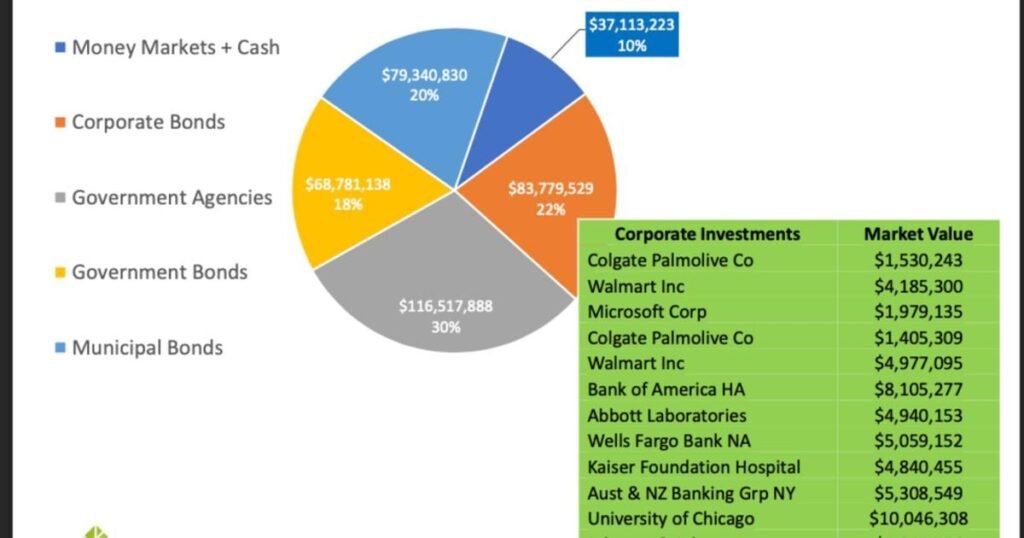

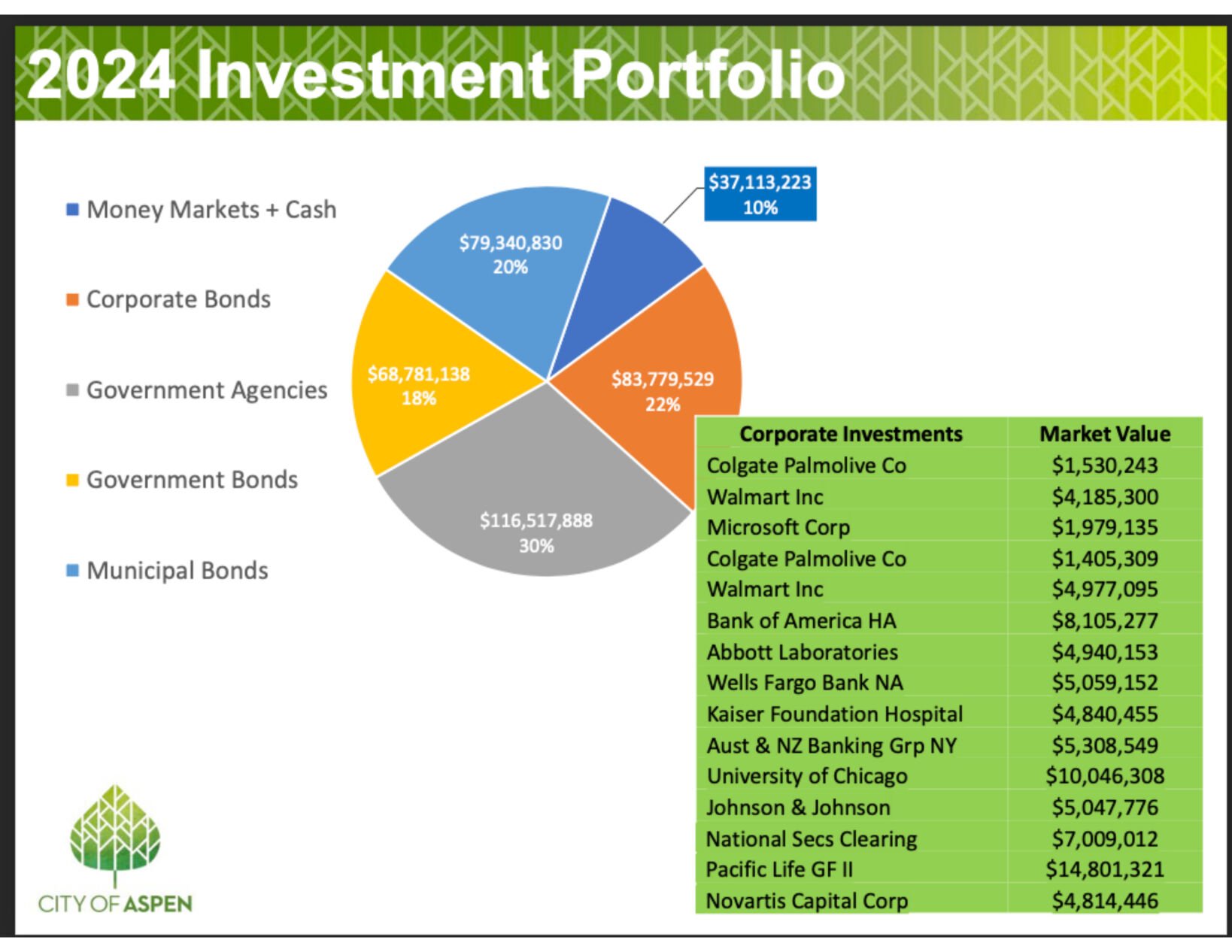

This chart breaks down the city of Aspen’s $385 million investment portfolio in 2024, which resulted in a return of $14.25 million that goes into municipal coffers.

Gordon Gekko the city of Aspen is not, but its low-risk investment strategy realized more than $14.25 million in income in 2024.

That return is allocated to city coffers, including 31% of the haul to the housing-development fund, 13% to the general fund, 9% to the asset management plan fund and 15% to arts and culture, Tyler Sexton, city deputy finance director, told Aspen City Council at a March 10 work session.

“So what just does the city do with this investment income?” he said. “The money floats back into the funds that hold those assets, and it brings additional resources for the community or any needs they may need.”

Last year’s roughly 4% return on the city’s $385 million investment portfolio was consistent with city finance managers’ expectations.

The city is a home-rule charter and as fiduciaries for Aspen taxpayers, it avoids speculative investments by taking a low-risk approach modeled after guidelines set by the State of Colorado Department of the Treasury, Finance Director Pete Strecker and Sexton said.

“Despite being a home-rule municipality, the city has adopted an investment policy that mirrors the state,” Sexton explained to the council. “That requires us looking at investments that must be A1 or A+ (bond credit ratings) or greater, so kind of that upper-medium grade. It does limit our investment options but ensures we are getting the best return with the least amount of risk.”

The city’s investments are limited to five years “so that starts to limit your potential yield, because the longer duration, a lot of times you will get paid for accepting that risk but we can only go a five-year maximum,” Strecker told the council, noting the city manages its various investments under different structures and terms.

“As we reinvest money, we are re-investing things that were put in at 1% and now we’re putting them in at 4%,” Strecker said.

The city’s investments include $83.8 million in corporate bonds, $116.5 million in government agencies, $68.1 million in government bonds, $79.3 million in municipal bonds and $37.1 million in money markets.

The city spreads its investments from corporate concerns like Walmart and Microsoft to corporate bonds managed through the University of Chicago.

“It gives us some diversity,” Strecker said. “You can stick some money in the federal government under treasuries or some of the different agencies. As you invest, you want to invest in a broad range of options — all of these have to have this high grade (credit rating) … so it’s just giving us another avenue to pick up something that will give us another high-yield return with low risk.

“Muni bonds, the University of Chicago — it doesn’t matter in those regards as long as you feel like they are going to be stable and if they are issuing debt for their own building and development, and I have little concern that a university is going to go bankrupt any time soon.”

The city is budgeting for nearly $270 million in expenditures this year, which is roughly $105 million less than the amount in its investment portfolio last year. Councilman Ward Hauenstein asked Strecker if the invested money is being managed smartly given the city’s current financial demands.

“What is the reserve that is accepted as safe? Because that’s a lot of money sitting there that could be put to some good use,” he asked Strecker.

The city has a 12.5% reserve on most of its funds and it is as high as 25% on arts and culture, Strecker noted, adding that banking the investment dollars “well above a reserve threshold makes sense if you’re going to try to cash flow a lot of your projects.”

Councilman Sam Rose asked about the city’s approach toward “green investing” in “companies that are more environmentally friendly.”

Strecker noted that in 2020-21, the city divested its money in funds associated with fossil fuels, but shifting its strategy exclusively toward green funds might not be feasible because the number of investment options would shrink considerably.

“We can do that, and our investment policies have a little bit of a stipulation that we won’t go after certain investments that are like oil and gas or something of that nature,” he said. “We haven’t sought out solely green options. This restriction is already at the state-statute level, which we currently mirror but don’t have to, that currently shrinks the list of options for us — so we if we layer on a really hard ‘only-looking-at-green-options,’ that will really diminish the amount of things you can actually put money into. It’s something council can consider but it won’t give you a lot of flexibility.”

Last year’s investment returns were greater than both the $12 million the city collected in property taxes and the $13 million through tax revenue from short-term rentals. Sexton noted that to council.

“To put that into context,” he said, “that’s more than the property tax we bring in for the city and more than the lodging STR taxes.”