As market leadership shifts and volatility persists, L&G’s Head of Investment Strategy Asia Ben Bennett makes the case for spreading risk across growth stocks, fixed income and developing economies

2025 was another extraordinary year, marked by geopolitical uncertainty and trade tensions, monetary policy moves, and the continued rise of artificial intelligence (AI). These forces have created a complex backdrop for global markets as investors look forward to 2026.

The broad consensus for the global economy in 2026 is relatively positive – the economy should grow at a rate close to its potential, inflation should gradually ease and central banks should consolidate around neutral policy rates.

This consensus forms the central case for the year ahead. From an investment perspective, I would highlight two notable challenges. First, elevated equity markets and tight credit spreads already reflect such a benign backdrop. Second, this consensus view is broadly held, which could lead to significant market moves if it proves incorrect.

What then, should investors consider when facing these dynamics? Below are some key considerations for how portfolios could be positioned to capture potential opportunities on the horizon and mitigate future surprises.

Curve flatteners historically attractive

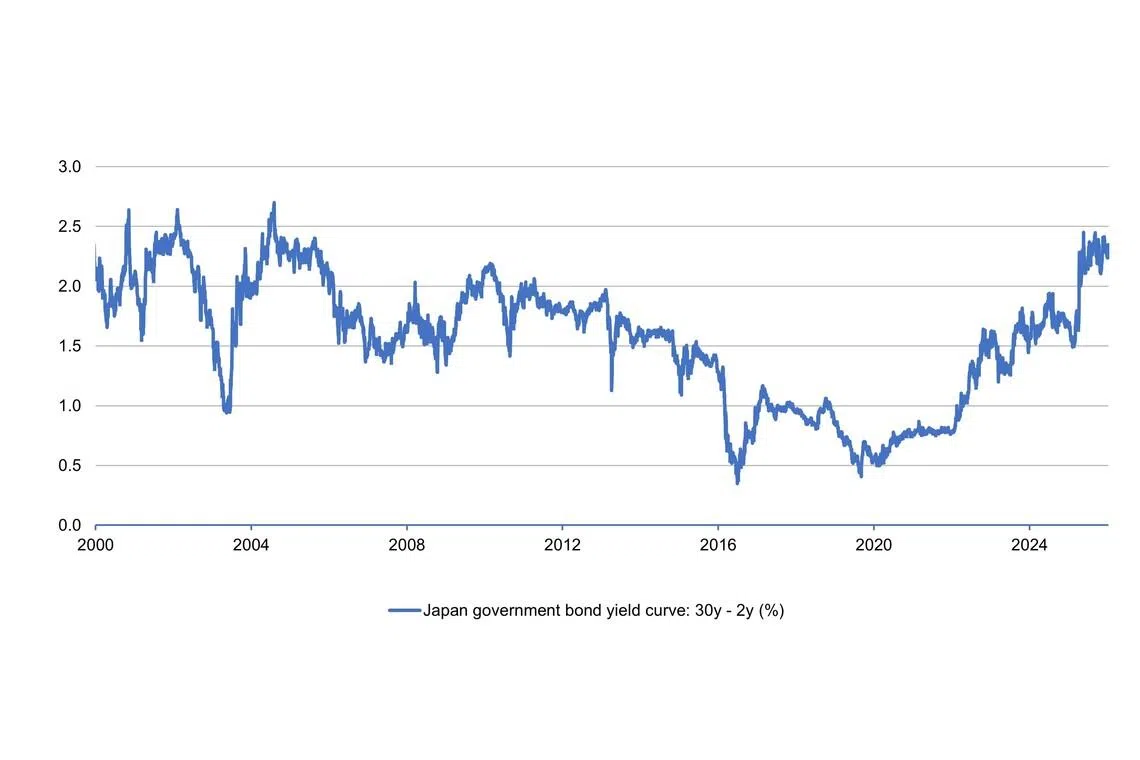

On the first point about markets already reflecting the base case economic outcome, our analysis suggests that government bond markets could react even if the consensus is correct. More precisely, yield curves are unusually steep for a benign economy, particularly in Japan and the UK where the yield differential between 30-year and two-year bonds is unusually large. We believe this gap could get smaller, especially if governments tackle their large budget deficits and look to issue shorter-dated bonds instead of longer-dated ones.

If the economy stumbles in 2026, we believe that owning longer-dated government bonds could also prove to be a useful hedge for equity and credit market weakness. Another potential risk-mitigation strategy could be to explore currencies that traditionally rally when risk assets sell off, such as the US dollar or the yen. The added benefit here is that valuations and positioning appear much cleaner after a weak 2025 for both currencies.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

AI equity: better than bonds?

Shifting the focus to upside risks, it is hard to get away from the technology sector, particularly companies associated with the AI revolution. At L&G, we continue to view this sector favourably from an equity perspective, with future earnings estimates appearing reasonable and valuation multiples remaining attractive.

However, looking back at the final weeks of 2025 – when AI bubble risk dominated headlines – it demonstrated that the AI story may remain a volatile one with relative winners and losers.

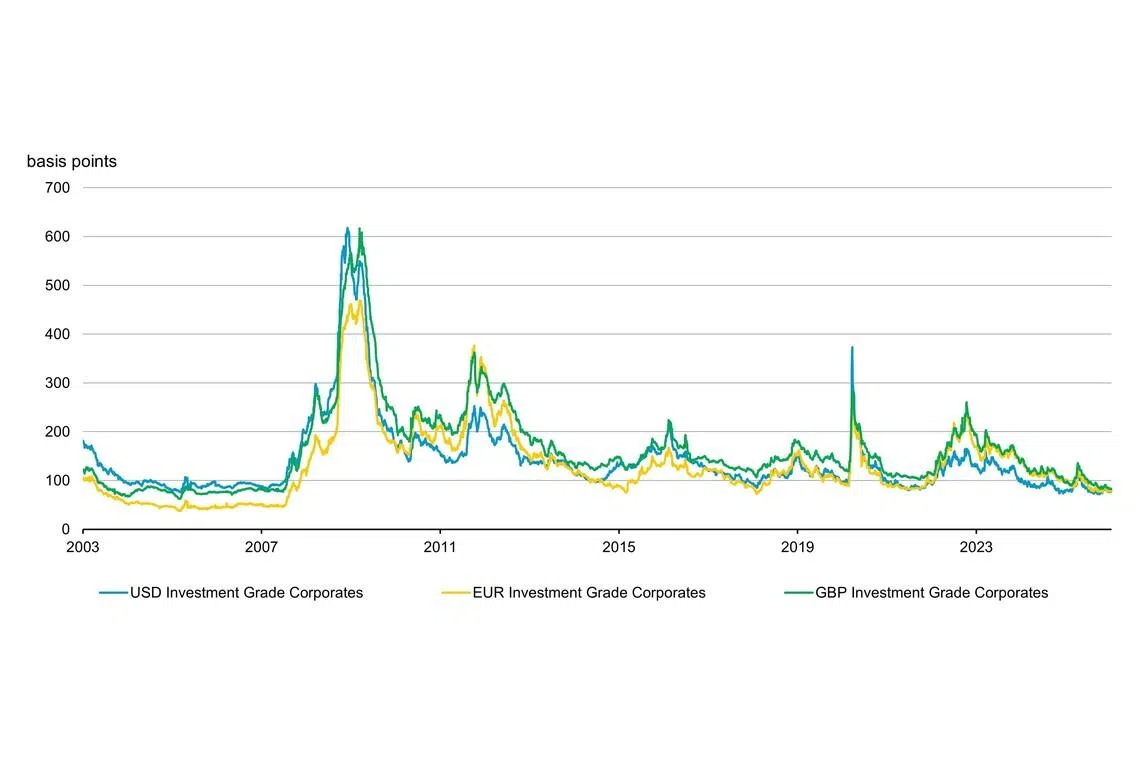

From an asset allocation perspective, we are balancing an overweight in technology equities with a more defensive allocation towards corporate bonds issued by technology companies. Credit spreads are historically tight, but we expect significant new bond issuance in the coming years – potentially US$500 billion to US$800 billion annually over the next three years across public and private bond markets.

Historical patterns also suggest that such heavy supply in a concentrated sector can cause “indigestion” which could lead to weaker demand and lower prices but also higher yields. In our view, this could create some potential opportunities, potentially within investment-grade corporate bonds, where a more defensive stance is maintained and exposure added when valuations improve.

Tight credit spreads, but pockets of opportunity

Despite tight levels, we continue to identify areas of the bond market that remain attractive, particularly given the elevated total yields driven by the steep curves.

For example, we see potential upside in French government bonds, despite the political headlines of recent months. While risks remain, investors are compensated with additional yield. We also see a case for subordinated financial bonds, reflecting the strong profitability of banks.

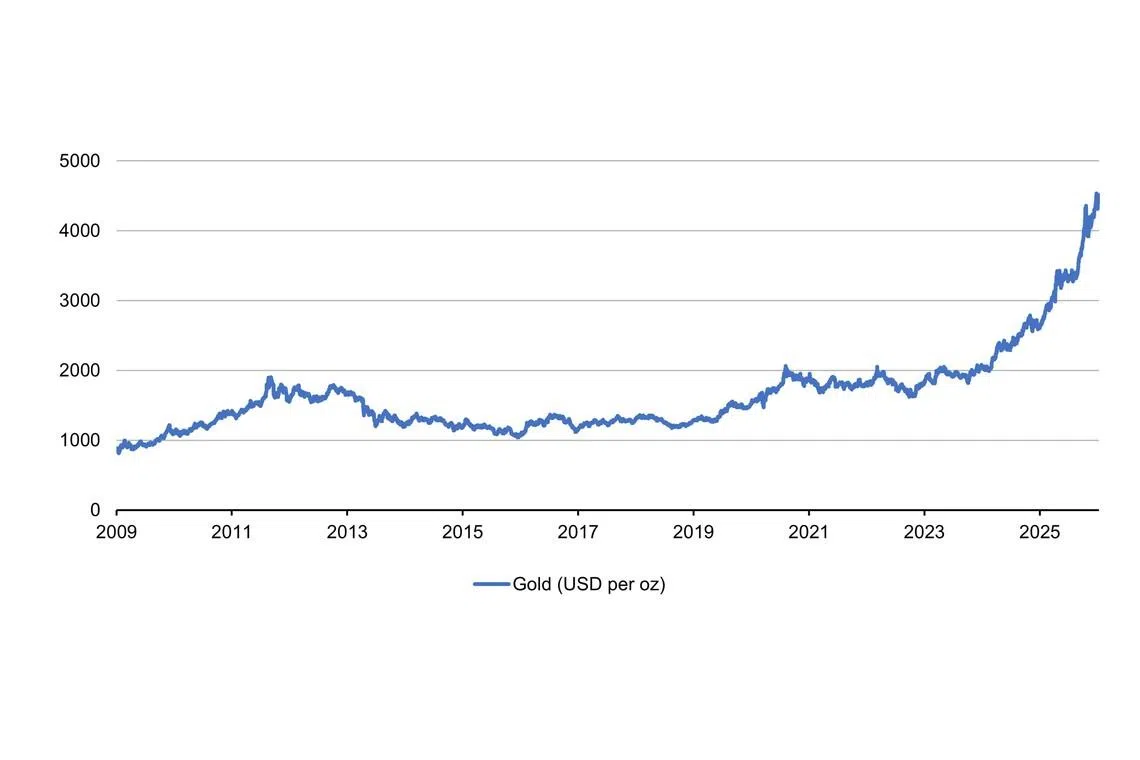

Finally, the erosion of US exceptionalism has led to many investors diversifying away from their exposure to the US. We believe emerging market debt may continue to benefit from this trend in the coming months. While emerging markets cover a vast range of countries and companies, we would highlight examples of improving fundamentals driven by economic growth (such as India), recovery (such as Sri Lanka) and strong commodity exposure (such as Ghana’s link to gold). There are many other similar examples of potential opportunities in emerging markets today, but as always, due diligence is essential.

Uncertainty is the only certainty

If 2025 has taught investors anything, it is to be wary of placing too much confidence in any specific macroeconomic scenario.

In this environment, we believe flexibility and diversification will remain key considerations for investors as they shape their portfolios.

An unconstrained approach which can capture potential opportunities across a diverse global market spectrum while staying focused on mitigating downside risk may leave investors well positioned to navigate the markets in 2026 and the years ahead.

This article is written by Ben Bennett, L&G’s Head of Investment Strategy Asia, and reflects the firm’s analysis. Learn more about L&G’s unconstrained strategies here.

Key risk warnings

The value of investments and the income from them can go down as well as up and you may not get back the amount invested. Past performance is not a guide to future performance. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of L&G as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

Issued by:

Singapore: LGIM Singapore Pte. Ltd (Company Registration No. 202231876W), regulated by the Monetary Authority of Singapore (“MAS”). This material has not been reviewed by the MAS.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.