What Made Fintech Stand Out In 2025?

It was business as usual for fintech startups in 2025. The sector once again topped funding charts, raising $2.5 Bn across 120 deals last year. Median ticket size soared, and two of the year’s largest fundraises came from the sector. So, what kept investors writing big cheques?

Decoding The Surge: The sector’s capital pull in 2025 stemmed from multiple factors. Investors made a beeline for platforms embedding lending at consumption, which offer clear monetisation paths.

Simultaneously, payments infrastructure – contactless tech and payout systems – attracted hefty capital as digital payments surged, while Groww’s IPO validated exit readiness. Simply put, investors followed structural demand and tangible exits, not hype.

Capital Concentration: While the funding stayed flat YoY, fintech deal count fell from 162 in 2024 to 120 in 2025. However, median ticket sizes jumped 75% YoY to $20.8 Mn, reinforcing fintech as the sector where investors still wrote large cheques despite a risk-off environment in 2025.

What’s In Store For 2026? The easy wins are over. Execution depth in underwriting, distribution, compliance and capital efficiency will define the fintech sector’s next phase. Regulatory scrutiny is expected to remain tight, with the zero-MDR regime likely forcing payments players to monetise through lending, wealth and insurance.

Competitive intensity is slated to rise as Jio Financial Services will further scale up its fintech ambitions later this year, intensifying pressure on PhonePe, Groww and CRED. Going forward, all eyes will be on whether fintechs can sustain their capital pull or will 2026 expose cracks in their growth model.

For now, here is how the fintech ecosystem fared on the funding front in 2025.

From The Editor’s Desk

💰 Nitro Commerce Nets $5 Mn

- The AI-led marketing service provider has raised fresh capital in its Series A round led by Cornerstone Ventures to boost growth, strengthen agentic AI capabilities, scale global operations, and expand hiring.

- Founded in 2023, Nitro Commerce offers a suite of AI-enabled marketing platforms that enable brands to own customer data, measure cross-channel performance, and reach audiences beyond social and search with full visibility.

- The startup claims to have generated INR 20 Cr in GMV so far. It claims to cater to 2,500+ brands and is targeting an ARR of $10 Mn.

👚 Koskii Eyes The Ethnic Wear Big League

- With its genesis in a family Saree store run by its cofounders, Koskii has emerged as an omnichannel D2C ethnic wear brand with 30 stores across seven cities, attracting over 50 Lakh visitors and generating INR 150 Cr in revenue in FY25.

- The startup sources products from small manufacturers, instead of large in-house design teams. It also uses a proprietary platform that combines demand analytics and trend detection to flag bestselling designs in real-time and push them into production.

- Koskii is targeting INR 200-240 Cr in FY26 revenue, growing store count to 50-60, scaling marketing, preparing for a bigger round and an eventual IPO.

🎾 PadelPark Merges With 7Padel

- The turf sporting startup has merged with the MS Dhoni-owned rival to create a holistic padel ecosystem and build 400-500 courts through the franchise model over the next few years.

- Founded in 2020, PadelPark manages 40+ courts, turned EBITDA positive in FY24, and has so far built 200 courts. It also offers padel coaching classes across player levels and organises events.

- India currently has 300 padel courts, up from 70 in 2023. The merger aims to capture a significant share of India’s fast-growing padel ecosystem before market saturation.

🔲 UP Rolls Out Red Carpet For Semicon Giants

- The Uttar Pradesh cabinet has approved incentives and sops for companies investing INR 3,000 Cr+ in the local semiconductor ecosystem. Thirteen proposals were approved to attract large-scale semiconductor investments in the state.

- Under this, the state government will offer interest and electricity bill subsidies, appliance cost reimbursement, 10-year net SGST relief and 100% EPF reimbursement for UP-native professionals.

- This comes as the Union government is mulling a broader $20 Bn package for India Semiconductor Mission (ISM) 2.0 to build a sophisticated chip manufacturing ecosystem in the country.

💵 AntiNorm Bags INR 28 Cr

- The beauty and personal care startup has raised $3.1 Mn in a seed round led by Fireside Ventures to strengthen multi-channel presence, accelerate R&D, increase workforce and introduce new product lines.

- Founded in 2024, the Delhi NCR-based startup manufactures beauty and skincare products that blend multiple functionalities in a single SKU, moving away from multi-step regimens marketed by competitors.

- The funding comes as the homegrown BPC segment is projected to become a $35.9 Bn opportunity by 2032, driven by rising disposable incomes, deeper internet penetration, and consumer shift toward specialised wellness offerings.

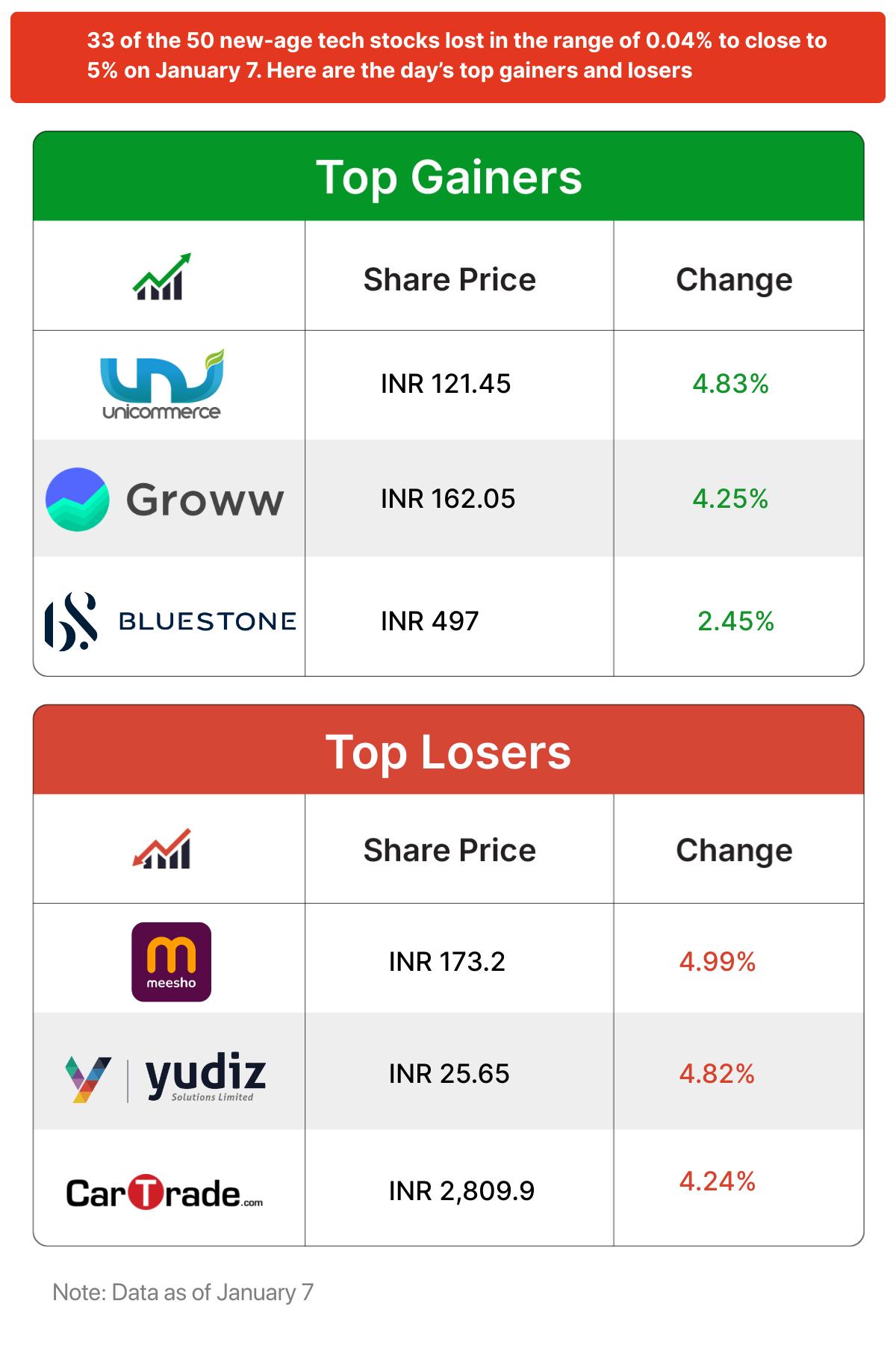

Inc42 Markets

Inc42 Startup Spotlight

Can Green Aero Propulsion Decarbonise Aviation?

The aviation and shipping sectors together produce nearly 10% of global carbon emissions. Reducing these emissions is tough because both industries rely heavily on fossil fuels and outdated engine technology. Trying to change this is Green Aero Propulsion.

A Dragon Is Born: Founded in 2023, the IIT Delhi-incubated startup is developing hydrogen-powered propulsion systems and advanced gas turbines that can replace traditional engines with cleaner and more efficient alternatives. In May 2025, the startup successfully tested The Blue Dragon, its first hydrogen-powered jet engine.

Flight Trials On Deck: Green Aero is expanding R&D capabilities with a 25,000 sq ft facility and a larger team to accelerate flight trials and next-generation propulsion development. It aims to leverage green hydrogen technology for strategic defence and energy applications to transform aviation while addressing national security and global climate imperatives.

So, can Green Aero spark a revolution to decarbonise the world’s toughest sectors?

Infographic Of The Day

Unicorn creation in India has been driven by conviction capital, repeat founders and investors who back winners more than once. Here are the VCs backing India’s billion-dollar club…