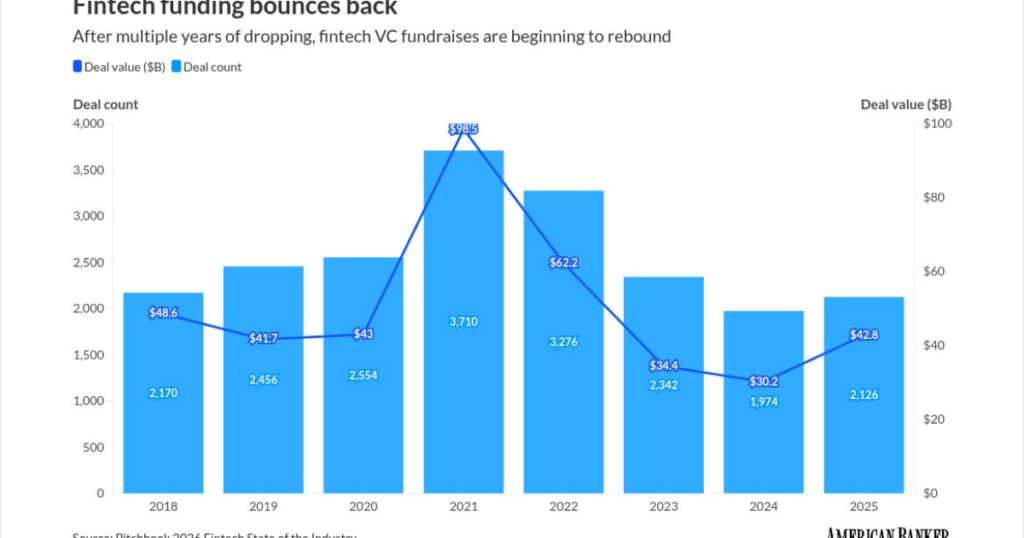

- Key insight: The fintech venture capital market saw more mega-deals in 2025, according to recent data.

- Expert quote: Pitchbook senior analyst Rudy Yang said that “the fintech ecosystem is entering 2026 with momentum.”

- Supporting data: 40% of the total fintech deal value for 2025 originated in Q4.

2025’s fintech funding volume concluded with fewer, but individually larger, deals on average compared to previous years, according to recent data.

Processing Content

Pitchbook’s

Late-year activity drove most of the investment, with $17.3 billion (40%) of the total deal value for the year originating in Q4 alone. For example, according to the Pitchbook report, the U.K.-based fintech Revolut raised $1 billion in a Series K funding round in August and another $3 billion in a

“The fintech ecosystem is entering 2026 with momentum, marked by a return to pre-pandemic funding levels and a revitalized exit market,” Pitchbook senior analyst Rudy Yang said in the report.

Sarah Lamont, a senior associate at global venture capital firm F-Prime, also saw the average deal size go up in fintech over the last year.

“There are a few factors influencing that,” Lamont told American Banker. “One of them is that more fintech funding is going to AI deals, which are going to be bigger and later stage rounds and more highly valued companies.”

2025 was not necessarily the year of AI adoption in financial services, according to Lamont, particularly in comparison to early adoption in other areas such as coding and customer service.

“However, it is coming quickly and we anticipate that future state of fintech reports will show a lot more adoption,” she said.

2025 closed out with a 282.4% increase in exit value year-over year from $17.7 billion in 2024 to $67.6 billion in 2025. Of that, $53.8 billion came from 20 IPOs, $10.8 billion came from 199 M&A deals and $2.4 billion originated from 64 buyouts.

Even with the

“Public fintech performance was generally below that of major indexes in 2025,” he said. “Hyperscalers within neobanks and neobrokers, such as Robinhood, Dave, Nubank and SoFi, were notable bright spots.”

Lamont wrote in a

“Meanwhile, fintech M&As are showing even greater signs of health, rebounding to pre-2021 levels,” she wrote.

Yang noted that fintech funding has now largely gone back to the figures seen before 2020 after a one-time spike in 2021 and a subsequent drop in funding through 2024.

“However, the post-reset fintech landscape looks fundamentally different from the one that preceded it,” he said. “Scale, profitability and infrastructure depth now matter as much as speed, and only a narrow set of business models are earning sustained investor conviction.”

To Lamont, a bigger average round size for fintech companies indicates more optimism from investors.

“It’s generally a good thing if VCs want to put more dollars into a company,” she said. “It also could indicate that later stage rounds are getting funded, which is good because that means the graduation rate from early stage to mid- or later stage fintech is higher. That is generally a good thing in terms of the state of fintech and the outlook for this year.”