Singapore (ANTARA/PRNewswire)- Visa, a world leader in digital payments, today announced results from its annual Money Travels: 2025 Digital Remittances Adoption Report based on responses from 44,000 senders and receivers across 20 countries and territories. The report tracks remittance trends around the world, including Asia Pacific, a key region in the $905 billion[i] global remittance landscape.

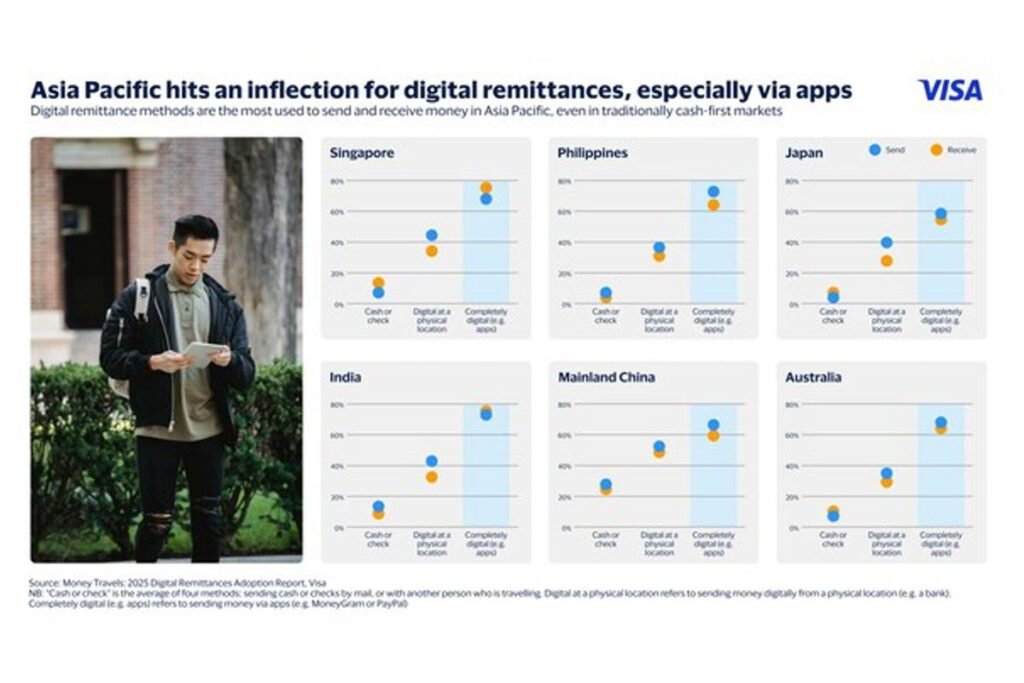

Key findings in this year’s survey show digital applications as the most popular method for sending and receiving remittances, and ease of use, safety, privacy, and security as the top four user experience benefits driving such preference.

“Remittances have long driven growth across Asia Pacific, uplifting many economies in the region,” said Chavi Jafa, Senior Vice President, Head of Commercial and Money Movement Solutions, Asia Pacific, Visa. “The clear shift to app-based remittances reflects the region’s demographics, the growing prominence of digital payment modes, as well as user preferences for easy, safe and quick ways to send and receive money. This shift is an important one for banks, remitters and fintechs to note as it will shape how they engage and serve evolving consumer expectations.”

Key findings for Asia Pacific

Digital apps remain the most popular and are perceived as the fastest option

- Digital apps are the most preferred channel to send/receive remittances in Asia Pacific, with usage rates reaching its highest in India (74%/76%), the Philippines (74%/66%), and Singapore (70%/75%).

- Japan is also seeing steady growth, with digital app usage rising by 10% (58%/56%) in 2025 compared to the previous year.

- Over half of the respondents in the Philippines (73%/73%), Australia (58%/55%), Singapore (67%/66%), and India (55%/53%) perceive digital payments as fastest way to access funds (73%).

- Most Asia Pacific remittance users surveyed report experiencing no issues with sending/receiving digital remittance transfers across all Asian markets, most positively in Australia (48%/53%), Japan (37%/41%), Singapore (36%/37%), and Mainland China (38%/31%, rising significantly since 2024 at +13%/+8%).

Remittance rationale varies across the region

- Contributing to accounts/investments is a primary reason to send/receive remittances across several markets including Mainland China (45%/36%), Singapore (38%/33%), and Japan (27%/23%).

- Sending for general/specific humanitarian need is a key reason for remittances, cited by respondents in Mainland China (45%/33%), India (40%), Singapore (27%), and Australia (25%).

- Sending remittances for an unexpected need was highest in India (44%), the Philippines (41%), and Australia (31%).

- Receiving regular remittances was cited by approximately a third of respondents in the Philippines (39%), Mainland China (34%), and India (30%).

Remitters of all ages opt for digital apps

Security and convenience outweigh pain points such as fees

- Digital apps are viewed as the most secure way to send/receive remittances in Asia Pacific, with top responses from India (50%/53%), Australia (49%/45%), and Singapore (44%/42%).

- Ease of use to send/receive digital remittances was noted most by respondents in Singapore (51%/51%) the Philippines (48%/54%), Japan (47%/42%), and Australia (42%/40%).

- Digital app fees for sending/receiving remittances were highlighted as a top pain point across Asia Pacific, led by the Philippines (43%/30%), India (36%/33%), and Singapore (32%/32%).

- Similarly, high fees were noted as the top pain point for sending physical remittances across all markets, with top responses from the Philippines (45%/29%), India (41%/37%), Singapore (38%/30%), Australia (29%/30%).

- Inconvenience and long travel distances remain key challenges for sending physical remittances, with respondents in India (36%) and Mainland China (27%) citing travel as a barrier. In Australia and Singapore, 29% of respondents each noted the physical remittance process as inconvenient and time-consuming alongside concerns about high fees.

- Across most Asia Pacific countries surveyed, the perceived security of physical remittances was low (3%-6%), with Mainland China reporting slightly higher levels of confidence (10%-12%).

With one billion people relying every year on remittance services and platforms[ii], Visa continues to innovate and build solutions to enable payments businesses to enhance operational efficiency in money movement and broaden financial access for their customers.

“Remittances have long been a lifeline across Asia Pacific, and they will continue to play a vital role in uplifting communities and livelihoods. At the same time, many small businesses are also beneficiary of remittances driving local growth in local economies,” said Rhidoi Krishnakumar, Vice President, Head of Visa Direct, Asia Pacific, Visa. “At Visa, we recognise the enduring purpose of our role in delivering remittances on behalf of our clients and continue to innovate and build solutions to enable more efficient, reliable and secure ways to move money.”

Visa works in collaboration with global remitters, such as MOIN, WireBarley, Money Chain World Remittance and EzRemit, to help enable efficient money movement through digitised remittances.

About Visa

Visa (NYSE: V) is a world leader in digital payments, facilitating transactions between consumers, merchants, financial institutions and government entities across more than 200 countries and territories. Our mission is to connect the world through the most innovative, convenient, reliable and secure payments network, enabling individuals, businesses and economies to thrive. We believe that economies that include everyone everywhere, uplift everyone everywhere and see access as foundational to the future of money movement. Learn more at Visa.com.

Source: Visa Worldwide Pte. Limited

Reporter: PR Wire

Editor: PR Wire

Copyright © ANTARA 2025