Join Our Telegram channel to stay up to date on breaking news coverage

U.S. cryptocurrency companies are pursuing banking licenses amid the launch of new cryptocurrency listings and the evolution of stablecoin regulatory frameworks. Circle and BitGo lead this integration push, while Congress debates laws governing the management of dollar-pegged digital tokens. The Trump administration’s crypto-friendly approach has created optimistic market conditions for innovative financial products.

Major legislation, including the STABLE Act and GENIUS Act, will reshape stablecoin compliance requirements. These regulations will require issuers to separate reserves, follow anti-money laundering protocols, and meet liquidity standards. Institutional investors demonstrate increased confidence through substantial commitments, such as Cantor Fitzgerald’s $2 billion Bitcoin-backed loan arrangement.

New Cryptocurrency Releases, Listings, & Presales Today

Best Wallet supports 50 chains, with a card, swap engine, and staking rewards for $BEST holders. Presale access, DEX aggregation, and cashback tools make it a go-to non-custodial crypto finance toolkit.

1. MindWaveDAO ($NILA)

MindWaveDAO pioneers decentralized technology, blending economic resilience and cognitive empowerment within Web3, offering a transformative value proposition. Its Bitcoin-based yield infrastructure ensures sustainability via a reinsured Layer 2 blockchain. Consequently, four verticals—AdTech, InsurTech, AI Governance, and ClimateTech—drive scalable value exchange. These interoperable modules foster innovation and strategic clarity. Moreover, the Layer 2 sidechain enables seamless coordination. Additionally, Lloyd’s of London underwriting provides institutional-grade security. Thus, MindWaveDAO redefines decentralized ecosystems.

The AdTech vertical, with The Giant and Wave+, transforms advertising through decentralized ownership and sustainable engagement. The Giant enables transparent ad monetization via real-time auctions. Meanwhile, Wave+ offers tap-to-earn rewards tied to Sustainable Development Goals, promoting sustainability. Additionally, Layer 2 ensures instant, low-cost transactions for scalability. This vertical shift enables passive interactions to transition into economic participation. Moreover, smart contracts enhance transparency. Thus, MindWaveDAO reimagines digital engagement.

MindWaveDAO’s InsurTech merges on-chain smart contracts with off-chain underwriting, delivering asset protection. On-chain mechanisms automate claims, ensuring efficiency during congestion. Conversely, off-chain underwriting offers trusted solutions for crypto risks. Furthermore, Layer 2 syncs with oracles, enhancing claim reliability. This hybrid approach mitigates custody risks for investors. Additionally, smart contracts adjust terms dynamically. Consequently, MindWaveDAO provides robust insurance solutions.

🚨 Important Security Notice – Beware of Fake Tokens! 🚨

It has come to our attention that there are unauthorized tokens falsely using the name NILA. Please be informed:

✅ MindWaveDAO has only one official token.

🔗 Official Token Contract Address (BEP-20):… pic.twitter.com/aopH2ETkom— MindWave (@nilatoken) April 22, 2025

A recent alert warned of unauthorized tokens falsely claiming to be NILA. Please be advised that we are not affiliated with the project. The community was urged to verify official channels. This emphasizes vigilance in decentralized ecosystems.

In advertising, The Giant and Wave+ deliver transparent campaigns settled via Layer 2, enabling scalability. Users earn rewards through Wave+ for engaging in SDG-aligned activities. For insurance, InsurTech automates claims and dynamically adjusts terms. ThinkTact.ai aids decision-making by detecting manipulation, with Layer 2 enhancing governance. AQUAE Impact tokenizes carbon offsets, leveraging Layer 2 for compliance.

2. Coral Protocol ($CORAL)

Coral Protocol provides infrastructure for AI agent collaboration, fostering diversity in Web3 like a digital reef. It focuses on enabling coordination among specialized agents. Consequently, it solves challenges in discovery, composition, scalability, and safety. By enabling secure agent communication, Coral ensures decentralized efficiency. Moreover, its Layer 2 architecture supports scalable interactions. Thus, Coral is pivotal for the digital economy. This approach distinguishes it in decentralization.

Coral enables agents to discover and verify compatibility, ensuring seamless collaboration across systems. Agents register on a messaging layer, coordinating via threads. Furthermore, cross-framework payments allow transactions without human intervention. Scalability is achieved through Layer 2, ensuring availability. Additionally, safety is prioritized via decentralized security mechanisms. Consequently, Coral delivers robust automation infrastructure. This framework supports diverse applications.

In e-commerce, Coral automates product listings, customer responses, and marketplace postings, addressing inefficiencies. Agents on Layer 2 ensure instant, low-cost transactions. Moreover, automated responses enhance user experience and efficiency. By integrating content generation, Coral streamlines operations. Additionally, scalability supports high-demand periods. Thus, Coral transforms e-commerce processes. This highlights its practical utility.

The Coral Server is now open source.

It’s an early-stage implementation of a MCP server—a messaging layer for AI agents to register, communicate, and coordinate via threads and mentions.

Let’s take a closer look at what the Coral Server enables. 🧵👇 https://t.co/8d883BV38t

— Coral Protocol (@Coral_Protocol) April 18, 2025

Coral Protocol recently announced that its server is now open-source, enabling agents to register and coordinate through a messaging layer. This MCP server supports threads for collaboration. It marks progress toward decentralized agent ecosystems.

In education, Coral composes AI tutors that adapt content to learning styles, enhancing engagement. Operating on Layer 2, tutors deliver real-time responses. Furthermore, scalability supports institutional adoption. By enabling collaboration, Coral ensures that educational experiences are tailored. Additionally, safety mechanisms protect data. Consequently, Coral redefines digital learning. This underscores its transformative potential.

3. Best Wallet token ($BEST)

Best Wallet Token powers a non-custodial wallet with a 50% monthly growth rate, targeting 40% of the $11 billion market by 2026. Supporting thousands of cryptocurrencies across 50 chains, it enables seamless buying and swapping. Consequently, its user-friendly interface attracts a diverse range of users. The integration of Best DEX and Best Card enhances utility. Moreover, $BEST unlocks reduced fees and higher staking rewards. Thus, Best Wallet leads in non-custodial solutions. Its presale success reflects market confidence.

$BEST holders gain early access to presales, giving them a competitive edge in the crypto market. Layer 2 ensures instant access to vetted opportunities. Furthermore, holding $BEST reduces transaction fees, enhancing cost-effectiveness. Higher APY staking opportunities incentivize long-term holding. Additionally, Best Card enables real-world spending with cashback for $BEST holders. Best DEX aggregates 50 decentralized exchanges (DEXs) for optimal swap rates. These features create a versatile financial toolkit.

Best Wallet recently announced that its Airdrop is ending soon, offering the final chance to secure $BEST rewards. Users must complete quests and connect their wallets to claim. Failure to link wallets prevents the distribution of rewards.

The Best Wallet Airdrop is ending soon, and this will be the final chance to secure your $BEST rewards. ⏳

✅ Make sure you’ve completed all quests

✅ Double-check that your Best Wallet is connectedIf your wallet isn’t linked, you won’t be able to claim any rewards.

Don’t… pic.twitter.com/jl5ftT8mrO

— Best Wallet (@BestWalletHQ) April 21, 2025

In early access, $BEST holders participate in presales via Layer 2 for secure transactions. Reduced fees benefit traders, processed efficiently on Layer 2. Moreover, staking $BEST yields higher APYs, encouraging passive income. Best Card allows global spending at Mastercard merchants with cashback. Best DEX facilitates cross-chain swaps with minimal fees. These use cases highlight $BEST’s utility in finance. They position it as a market leader.

Visit Best Wallet Token Presale

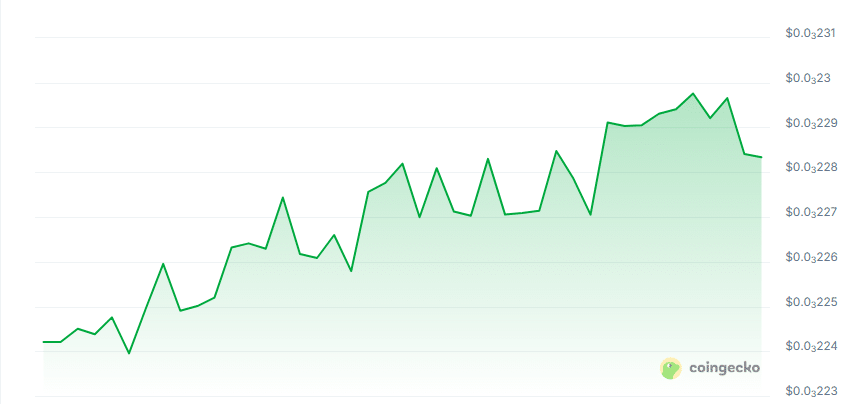

4. Pell Network ($PELL)

Pell Network pioneers the first omnichain BTC Restaking Network, extending Bitcoin’s security to decentralized validated services. Leveraging BTC and liquid staking derivatives enhances capital efficiency. Consequently, it reduces costs for building secure applications. Its trust network eliminates dilutive validator sets. Moreover, Layer 2 ensures scalable validation. Thus, Pell unlocks Bitcoin’s cryptoeconomic potential. This positions it as a leader in BTCFi.

Pell enables stakers to allocate assets to DVSs, securing services like data protocols. Slashing conditions on Layer 2 ensure participant integrity. Furthermore, Pell’s marketplace allows developers to incentivize validators with non-dilutive rewards. This streamlines security bootstrapping. Additionally, universal restaking enhances composability across networks. Consequently, Pell simplifies cryptoeconomic security. This supports scalable infrastructure designs.

In restaking, stakers repurpose BTC for DVSs, securing applications via Layer 2 validation. Developers attract validators through Pell’s marketplace, reducing costs. Moreover, universal restaking enables composability without new trust setups. Layer 2 ensures low-cost coordination. These use cases make Pell scalable in terms of security. Additionally, passive income attracts BTC holders. This drives Pell’s adoption in BTCFi.

Recently, the Pell Testnet launched EGLD Restaking, accompanied by a meme contest, to engage the community. This highlights Pell’s focus on innovation. It advances its restaking ecosystem.

Pell has partnered with ArkStream Capital, a venture firm focused on Web3 investments; Contribution Capital, a decentralized venture capital fund; and D11-Labs, a venture studio with a $100 million fund. These collaborations bolster Pell’s development of its omnichain DVS network. Additionally, partnerships with Lorenzo Protocol and Solv Finance enhance its BTCFi ecosystem. These alliances provide financial and technical support for growth. Moreover, the $3M pre-seed round, co-led by Paper Ventures, Halo Capital, and Mirana Ventures, strengthens its foundation.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage