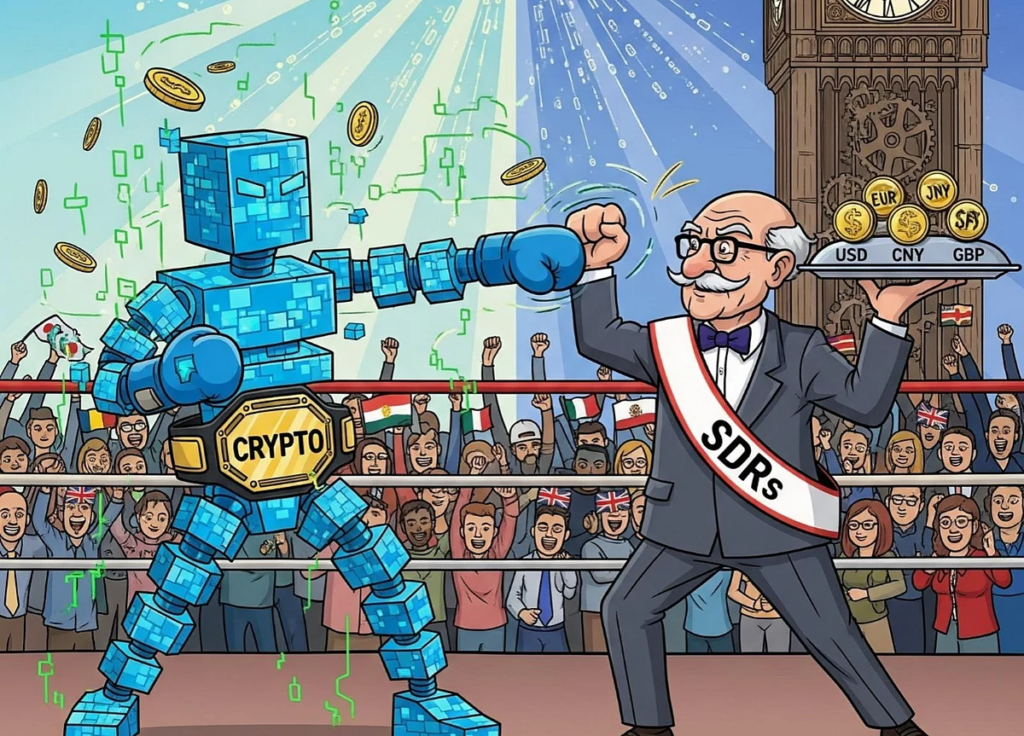

Special Drawing Rights, founded in 1969, act as reserves alongside gold and USD. SDRs stand out as they are valued against a weighted basket of five currencies: USD, Euro, Chinese Yuan, Japanese Yen, and British Pound Sterling. SDRs are most frequently employed by IMF members to stabilize currencies, finance vital imports, and cushion financial crises. For instance, Argentina repaid its IMF loan using its SDRs, which assists its total fiscal load and keeps the reserve level of the country intact. Similarly, Ecuador utilized its SDRs, as guided by its Finance Ministry, to finance government expenses and support reserves. But the availability of SDRs is only to IMF member nations (and a few more), which restricts the extent of availability and usage across nations.