By Marc Jones

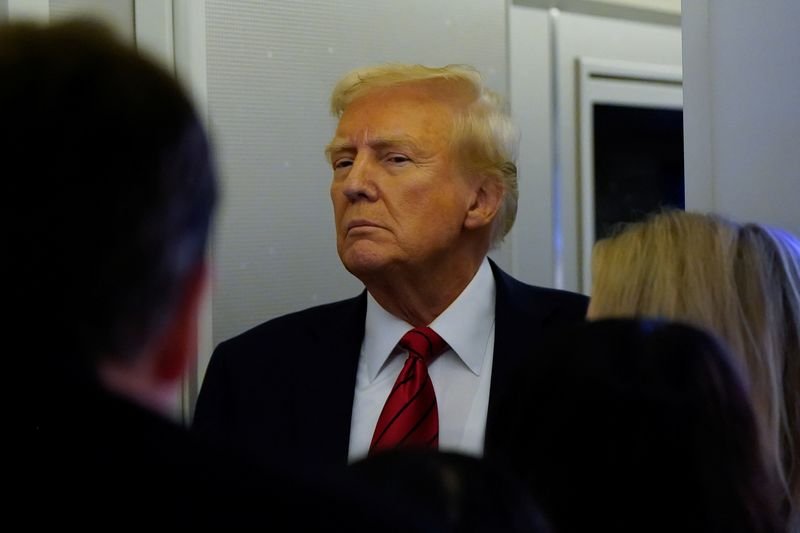

LONDON (Reuters) – Donald Trump’s rapid move to ban a “digital dollar” has left the field wide open, observers say, for China and Europe to make their already-advanced central bank digital currency (CBDC) prototypes into global standard-setters.

While the United States has long seemed reluctant to turn the world’s number one reserve currency digital, the fact that it is now the only country to impose a presidential ban on such an asset is hard to ignore.

Until last week the U.S. was one of the more than 130 countries, representing 98% of the global economy, exploring a CBDC to try to take advantage of – or at least keep up with – the rapid pace of technological change.

Supporters say digital currencies could make 24/7, real-time, cross-currency payments a reality and are a natural alternative to physical cash, which seems in terminal decline.

Opponents argue the touted advances can be achieved with existing systems, and protests around the world have focused on one of Trump’s main criticisms – denied by central bankers – that CBDCs could become a tool for government snooping.

Clear leaders in the CBDC drive have been emerging. Pioneers like China, the Bahamas and Nigeria are seeing usage of their e-currencies pick up, while later this year, despite some growing resistance in Brussels, the European Central Bank will lay out the key features of a future digital euro.

Josh Lipsky, who runs international affairs think-tank the Atlantic Council’s global CBDC tracker, says that though Trump’s ban will have little impact domestically given the Federal Reserve has never shown real appetite for a “retail” digital dollar, it is still a blow.

“The most significant impact from the executive order is the signal it sends to the rest of the world,” Lipsky said.

“It tells Europe that they have the playing field to themselves to set privacy and cybersecurity standards through the digital euro.”

Dollar-backed “stablecoins” will probably now become de facto digital dollars for the foreseeable future, he added.

Meanwhile, “China can go to other countries and say the U.S. is not involved in this technology you’re interested in, but we are and we are leading”.

DIVIDE OPENS

The anti-digital dollar signal from Trump, who instead favours cryptocurrencies and wants a national crypto stockpile, comes at the exact time that a geopolitical divide appears to be opening up over CBDCs.

There was shock in October when the Bank for International Settlements (BIS), the central bank body overseeing much of their global development work, suddenly quit the flagship “mBridge” project it had been collaborating on with China, Hong Kong and a number of other developing economies.

As well as the privacy issue, Trump’s new executive order cites threats a digital dollar could pose to U.S. sovereignty and financial system stability. It now prohibits U.S. agencies from “undertaking any action to establish, issue, or promote central bank digital currencies”.

Lewis McLellan at the London-based Official Monetary and Financial Institutions Forum (OMFIF) said it effectively “hammers a final nail into the coffin of a U.S. central bank digital currency”.

It also feeds into the narrative of “de-dollarization”.

Marcos Viriato, whose Parfin firm is helping develop Brazil’s DREX CBDC, thinks the U.S. move won’t stop others pushing ahead with their own plans. But it will add to long-standing questions about how freely CBDCs will interact.

Many are now waiting to see what happens with another BIS project called Agora. Unlike mBridge, it is dominated by Western G7 central banks, including the New York Fed.

Neither the NY Fed, the BIS or top U.S. commercial banks involved in Agora like JPMorgan and Citi have commented on their plans. But given Trump’s fierce stance, OMFIF’s McLellan wondered how things would play out.

“This risks seriously devaluing these projects since the dollar holds such an enormously important role in financial markets,” he said.

The only way for Agora and its ilk to proceed without a Fed presence would be to heavily incorporate “stablecoins”, which are pegged one-to-one to the dollar.

That, however, McLellan said “would require a major pivot”.

(Additional reporting by Michael Derby in New York)