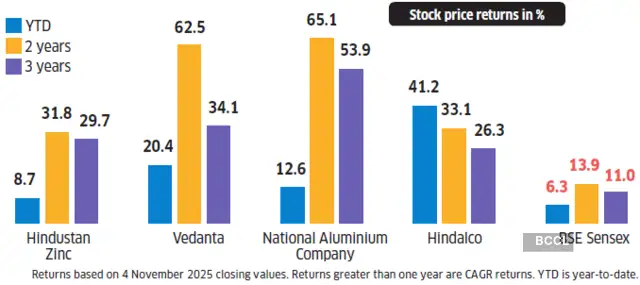

This price momentum, combined with the depreciation of the USD-INR exchange rate, is expected to enhance the performance of non-ferrous metal companies for the September quarter. Investor optimism is evident in the stock market, with year-to-date returns for leading players outpacing the broader BSE Sensex’s 6.3% gain.

Base metal prices remained firm through October, with LME prices rising another 5-8%. This is expected to support the financial performance of non-ferrous companies in the December 2025 quarter as well.

Gleaming gains

According to a September 2025 note by credit rating agency ICRA, domestic primary non-ferrous entities are likely to demonstrate earnings resilience through 2025-26. In 2024-25, India’s nonferrous metal demand grew by 9% yearon-year, driven by robust offtake in infrastructure, electrical, and renewable energy sectors. ICRA projects demand growth to remain healthy at 7-9.5% in 2025–26, outpacing global growth rates.

Copper outlook

Experts foresee a structural supply tightness in copper, which is expected to sustain price strength. A recent Emkay report highlights that demand is being propelled by megatrends such as data centre expansion and electrification. The current copper project pipeline is estimated to meet only half of mediumterm requirements, suggesting a prolonged supply deficit. Additionally, critical minerals like lithium, nickel, and rare earth elements are facing even sharper supply bottlenecks.

Aluminium outlook

Aluminium prices are also expected to remain elevated, supported by a supply deficit stemming from capacity constraints in China and a gradual recovery in global demand. According to a Motilal Oswal report, while demand is improving due to clean energy initiatives and infrastructure development, supply responsiveness is being hindered by energy constraints, environmental regulations, and geopolitical factors. Although new alumina and smelter projects in Indonesia and India are expected to add capacity, they are unlikely to fully meet the pace of global demand growth. Here is how the key four listed nonferrous players are placed:

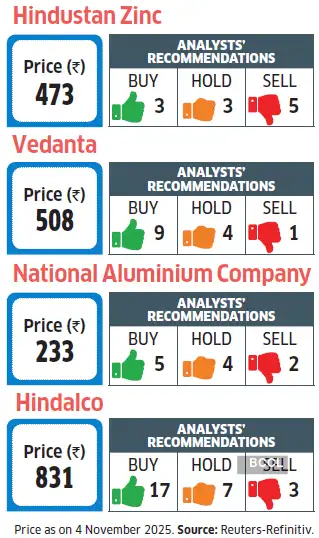

Hindustan Zinc, a major producer of zinc, lead, and silver, delivered a strong performance in the September 2025 quarter, with sequential revenue and EBITDA (Earnings before interest, taxes and depreciation) growth of 10% and 15%, respectively. This was supported by favourable metal prices.

- Market drivers: Zinc and lead prices benefited from tight inventories and rising demand in infrastructure and battery sectors, while silver prices surged due to increased industrial consumption.

- Outlook: Management anticipates further cost improvements by March 2026, driven by increased renewable energy usage.

- Capex plans: Capital expenditure of $350-400 million for 2025–26 will fund ongoing projects, smelter debottlenecking, and new expansion initiatives.

- Analysts view: Key positives include favourable pricing, cost optimisation, capacity expansion, and potential margin enhancement. However, the management’s downward revision of silver output guidance is viewed as a limiting factor.

Strong showing

Vedanta, a diversified natural resources and technology company, posted robust operating results in the September quarter, buoyed by strong LME prices and forex gains.

- Financial highlights: EBITDA rose 15% quarter-on-quarter, with a margin expansion of 237 basis points. The aluminium segment benefited from stable production costs, while copper saw gains from higher realizations.

- Strategic focus: The company is investing in backward integration across the bauxite– alumina–coal value chain to reduce production costs.

- Capex guidance: Full-year capital expenditure is projected at $1.7-1.9 billion for 2025–26.

- Debt position: Strong cash flow generation is expected to keep debt levels comfortable.

- Analyst view: Strengths include promising prospects in aluminium, power, and zinc, along with a focus on deleveraging and raw material security.

NALCO, a public sector enterprise with integrated operations in mining, metals, and power, stands to benefit from rising global aluminium demand.

- Cost advantage: Captive high-quality bauxite mines help maintain low alumina production costs, enhancing profitability.

- Operational levers: Full benefits from captive coal are expected in the second half of the current financial year. The renewed Fuel Supply Agreement with Mahanadi Coalfields and employee cost rationalisation will support margin expansion.

- Financial strength: A robust cash reserve of Rs.5,760 crore (as of 2024-25) will fund upcoming capex initiatives.

- Growth plans: These include aluminium smelter expansion and a new aluminium foil plant.

Hindalco reported 13% and 6% year-on-year growth in consolidated revenue and EBITDA in the September quarter.

- Demand drivers: Growth in electric vehicles, electrification, packaging, and transportation is fuelling metal demand.

- Efficiency focus: The company is leveraging renewable energy and backward integration in coal to drive cost synergies and margin improvements.

- Capex strategy: A significant investment programme is underway for both India and Novelis operations, aimed at expanding aluminium and copper capacities.

- Concerns: The recent crash in the stock price of over 7% reflects investors’ concerns emanating from the September quarter results of Novelis (subsidiary company) that reported a 9% year-on-year decline in EBITDA and the impact of $500-650 million on free cash flows in 2025-26 due to a fire at its New York plant.