(Bloomberg) — Investors are protecting against a potential spike in crude prices. Palm oil futures are surging, and traders are warming up to exchange-traded funds for gold against a backdrop of geopolitical uncertainty and interest-rate cuts.

Here are five notable charts to consider in global commodity markets as the week gets underway.

Oil Options

While the rally in oil futures has cooled a bit, buying of call options to protect against a price spike has continued apace. The aggregate open interest for Brent call options — which benefit when prices rise — rose to a record 2.19 million contracts as of Thursday. Investors continue to be on edge amid uncertainty about the conflict in the Middle East.

Renewables Spending

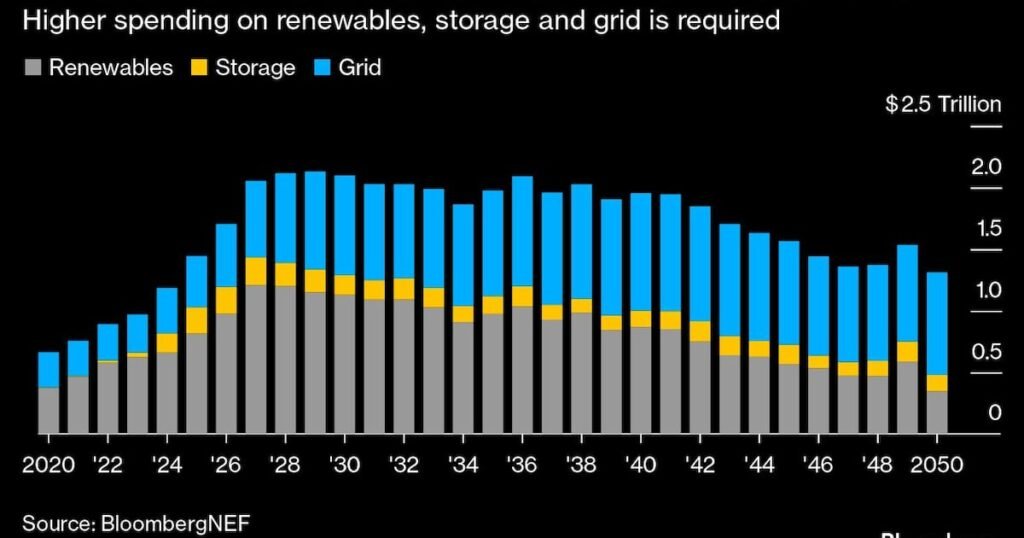

Global spending on renewable energy, battery storage and grid upgrades need to accelerate beyond the record level seen in 2023 to zero out greenhouse gas emissions by 2050, according to BloombergNEF. Renewables require an average investment of $1 trillion per year between 2024 and 2030 to reach that target, according to BNEF estimates. Over the same time frame, average investments in battery storage will need to be $193 billion a year, while $607 billion will need to be spent annually in grid upgrades. Governments need to end fossil fuel subsidies, remove regulations and ease supply chains to enable clean-power developers to build projects, BNEF said.

Palm Oil

Tight supply in top producers Indonesia and Malaysia has driven futures of palm oil — the world’s most widely consumed vegetable oil — to highs last seen in April. The trees that grow the commodity are aging, and the rally has put the crop at an unusual premium to its main alternative, soybean oil, where global harvests have been more bountiful. Should an escalation of hostilities in the Middle East disrupt commodities and energy trade, that could stand to further boost the tropical oil, which is also used as a feedstock for biofuels.

Gold ETFs

Investors are warming up to gold ETFs amid the metal’s more than 25% surge this year, thanks to its appeal as a haven asset in times of geopolitical and economic uncertainty and its role as diversification play to safeguard wealth. Global holdings of physically backed gold funds have registered five straight months of gains, reaching 3,200 tons by September, according to data from the World Gold Council. While investors remained net sellers of about 25 tons in gold ETFs year-to-date, strong inflows over the past few months turned the year-to-date value of the ETFs to positive to $389 million, according to John Reade, market strategist at WGC. The precious metal surpassed $2,600 an ounce to an all-time high last month, bolstered by the Federal Reserve’s shift to interest rate cuts. Non-yielding gold tends to perform better in a low-rate environment.

Milton & Gas

Natural gas futures slid in the lead-up to Hurricane Milton and in its aftermath as millions lost electricity. Gas is used to power the plants that create electricity for homes and businesses, and when the lights go out, demand for gas typically plummets. Futures were down nearly 8% week-over-week.

–With assistance from Megan Durisin.

©2024 Bloomberg L.P.