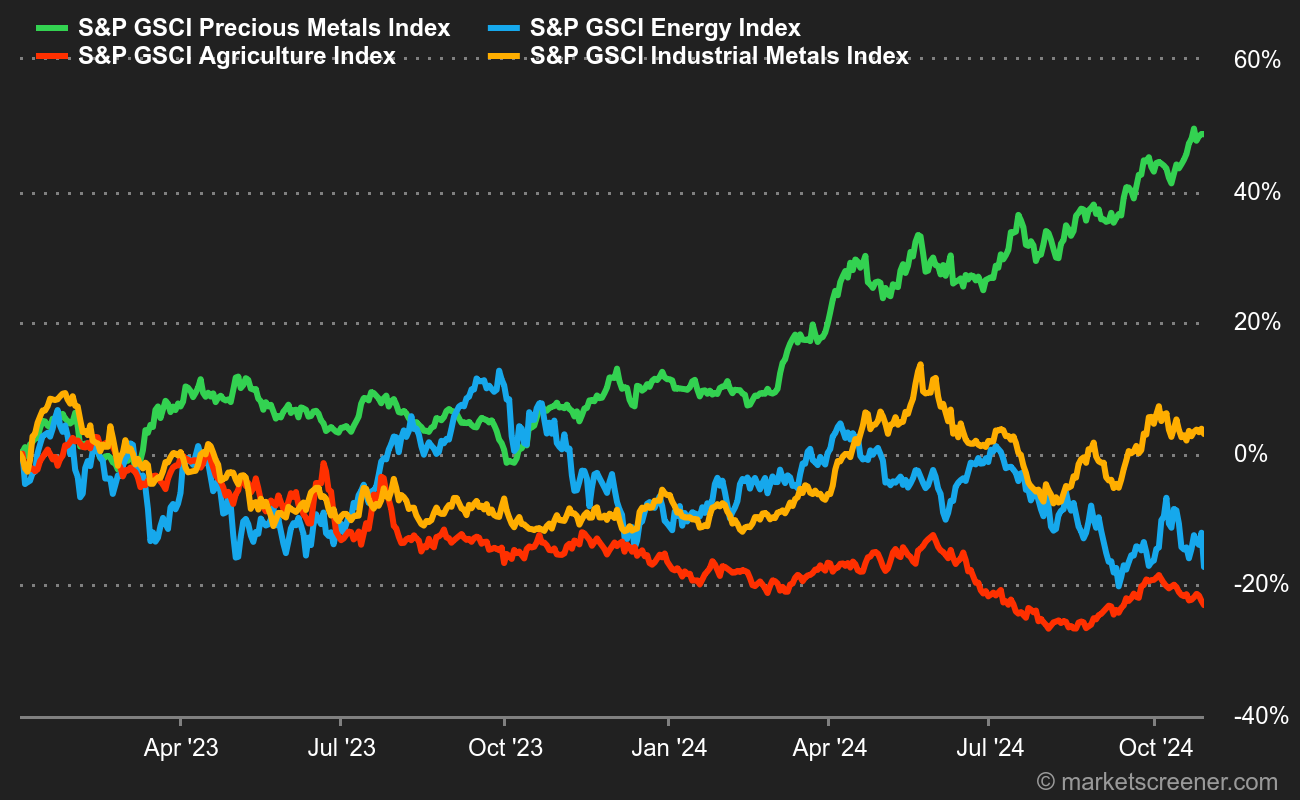

Every week, our commodities overview reviews the latest developments on the commodities markets, to gain a better understanding of the price movements in energy, metals and agricultural commodities. Oil is still down: the market is well supplied, and Israel’s measured response to Teheran is raising hopes of a de-escalation of geopolitical tensions. Elsewhere, gold remains in Olympic form, despite some headwinds. I’m referring to the sharp rise in bond yields, which should logically weigh on the barbarian relic.

Energy: One week follows another in the oil markets, which remain torn between concerns over fundamentals and geopolitical tensions, particularly in the Middle East. The market feared Israeli reprisals against Teheran, which finally came to pass over the weekend. However, Israel spared Iran’s oil interests, as well as Tehran’s nuclear program, suggesting that the response remains measured and that the worst has been avoided in terms of escalating tensions between the two regional powers. It is against this uncertain backdrop that OPEC+ must decide on the phasing out of its voluntary production cuts, due to start in December. Weak oil prices could prompt a postponement of this strategic decision.

Metals: It’s still time for a pause in the base metals segment, as copper and lead continue their lateralization sequence in London, at USD 9541 and USD 2030 (cash prices) respectively. Aluminum and zinc are showing a little more strength, rising to 2645 and 3139 USD respectively. There’s not much more to say, as traders are opting for a pause while awaiting the next catalyst, which will be the Chinese manufacturing PMI, to be unveiled this week on October 31. Gold continues to perform well despite rising bond yields. The precious metal is trading at around USD 2,765, up around 35% since January 1.

Agricultural products: Corn prices recovered in Chicago, buoyed by a rise in US exports. A bushel of corn is trading at around 418 cents (December 2024 contract). Wheat, on the other hand, lost ground to 573 cents. Elsewhere, the price of cocoa fell by around 8%, a backlash caused by improved supply, as Côte d’Ivoire revised its harvest forecast upwards.