The Hagstrom Report

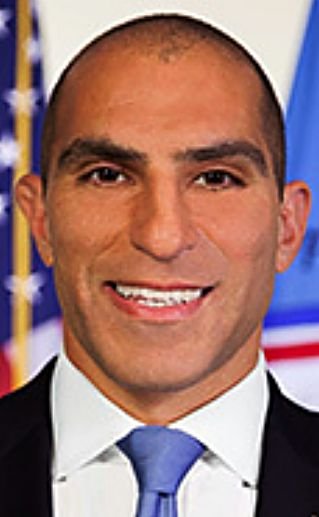

Commodity Futures Trading Commission Chairman Rostin Behnam asked the Senate Agriculture Committee to “act quickly” to give the agency regulatory authority over digital commodities, also known as cryptocurrency.

“What has concerned me most throughout the expansion of this digital asset class is that while everyday Americans fall victim to one digital asset scam after another, there remains no completed legislative response,” Behnam testified. “I have repeatedly been asked by members of Congress what I am doing to protect their constituents. I believe the single most important thing I have done, and continue to do, is advocate to this body to fill the regulatory gap. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

Behnam noted that half the agency’s enforcement efforts are now focused on crypto but said the limited enforcement authority is not adequate to deal with the crypto industry.

Behnam’s testimony was greeted warmly by Senate Agriculture Committee Chairwoman Debbie Stabenow, D-Mich., and Sen. John Boozman, R-Ark., ranking member on the committee. Stabenow noted that she and Boozman “have been steadfast in our effort to advance bipartisan legislation that would give the CFTC regulatory authority over digital commodities.”

Perhaps reacting to criticism that she should be focused on the farm bill, Stabenow added, “We have a lot of important work to do this year in the committee, and I am committed to building bipartisan coalitions both here and on a farm bill so that together, we can make good law that supports and protects our collective constituents.”

During the hearing, Stabenow also noted that she had met with House Agriculture Committee Chairman Glenn “GT” Thompson, R-Pa., and told him that the House bill “shortchanges the commodities in the Midwest.”

Boozman said that Congress needs to get a farm bill “done,” but “we “have a real difference of opinion” on how to get it done.

“Everyone is negotiating in good faith,” he added.

On the digital assets regulation, Stabenow explained that she believes “blockchain technology can help us manage data and move money in more efficient and transparent ways, but those goals cannot be realized without comprehensive federal legislation. Our counterparts around the globe recognize this, and the U.S. must as well. But most importantly, we owe it to the American public to protect them from bad actors exploiting digital assets for personal gain at the expense of their customers.”

Stabenow said the legislation must include “similar rules for similar risks,” protect retail customers and provide adequate, permanent funding for the CFTC to oversee the digital commodities market.

She noted that the House has passed a bill that “takes a somewhat different approach,” but said she is “confident we can come together to pass legislation that brings greater integrity to the crypto market.”

In his opening statement, Boozman said, “The chair has been drafting legislation that would give the CFTC the authority to regulate spot digital commodity trading. We have had many, many conversations, and my staff have been working closely with hers on her proposal for the last several weeks. I am committed to continue to work in good faith on legislation to give the CFTC the authorities it needs.”

Boozman added, “Digital commodities and the regulatory issues they raise are complex and not well understood. I believe as a committee we have a responsibility to help educate our colleagues and the public on these issues, and I would like to see us do more to better understand what policies are needed and why. Hopefully today’s hearing will begin to fill that gap.”

Boozman also explained that he “believes we must have broad support within the community we wish to regulate if we ultimately want to protect consumers and innovation. I and my staff have had numerous meetings with those who would be covered by the proposed legislation. The frank and honest feedback we have received from these discussions does not lead me to believe the necessary level of support for this proposal to be successful currently exists among stakeholders – and people are working very hard to try and rectify that.”

During the hearing, the question of jurisdiction between the CFTC and the Securities and Exchange Commission was broached, and Boozman said, “It is vital that we limit our policy proposals to the agencies that we have jurisdiction over — in this case, the CFTC.”

The CFTC needs additional regulatory authority to be proactive rather than reactive, he said.

In his testimony, Behnam said, “Given the important role the Securities and Exchange Commission plays in the oversight of security-based digital tokens, the committee should consider a disciplined, balanced framework for the determination of tokens as commodities or securities under existing law.”

Behnam also stressed the importance of adequate funding for the CFTC to take on the additional responsibility of regulating crypto. Behnam said, “A permanent fee-for-service model, exclusively assessed on digital asset registrants, and that is commensurate with the responsibilities outlined in a bill, is critical. As with other fee-for-service models, congressional appropriators and the agency should work in tandem to set budget levels and subsequently set fees to meet those budget levels.”

Sen. Ben Ray Lujan, D-N.M., said the bill should address the crypto financiers involved in bringing fentanyl into the United States.

Behnam testified that “it is essential that legislation provide comprehensive authority for anti-money laundering, know-your-customer, and a customer identification program, built off of existing requirements for market participants.”

Sen. Joni Ernst, R-Iowa, asked Behnam how the agency is handing the Supreme Court decision that ended the Chevron doctrine of giving deference to federal agencies on writing regulations for vague laws. Behnam said the CFTC is “looking at the decision” and reviewing the rules to determine if lawsuits are likely to be filed against them. But he added he believes the CFTC needs “a certain amount of discretion” to deal with changing markets.

Sen. Chuck Grassley, R-Iowa, asked Behnam if he supports permanent authority for funding of the CFTC’s whistleblower program, and Behnam said he does.