On August 5, 2024, Jason Cole, CFO & Treasurer of Desktop Metal Inc (NYSE:DM), executed a sale of 24,064 shares of the company at a price of $4.23 per share. This transaction was documented in an SEC Filing. Following this sale, the insider now owns 69,352 shares of Desktop Metal Inc.

Desktop Metal Inc specializes in the manufacturing of 3D metal printing systems designed for both prototyping and mass production. The company’s innovative technologies aim to make 3D printing accessible across a wide range of industries including automotive, aerospace, and healthcare.

Over the past year, the insider has sold a total of 384,064 shares and has not made any purchases. This recent transaction is part of a broader trend observed over the last year, where there have been four insider sells and no insider buys.

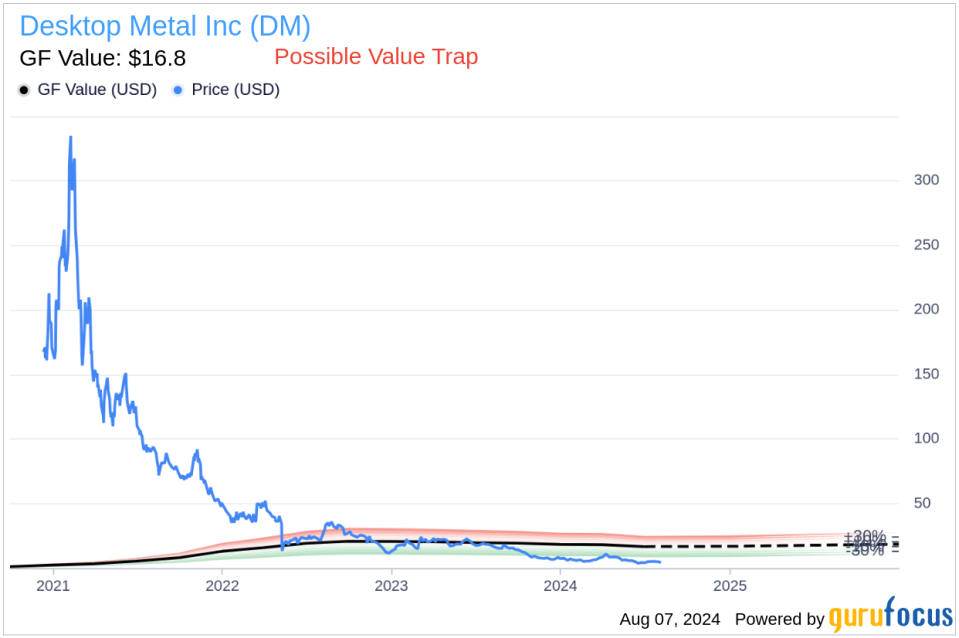

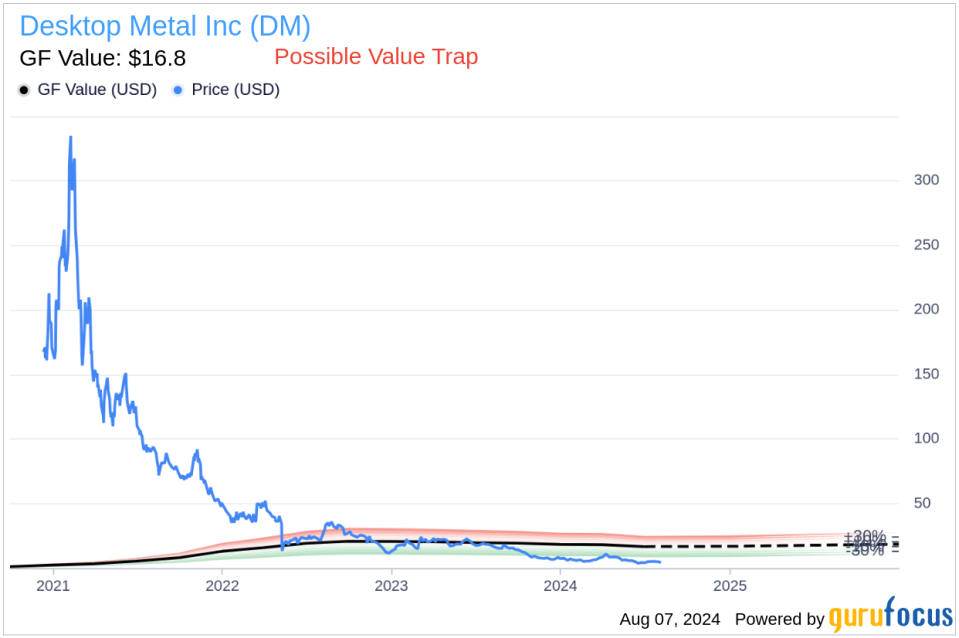

Shares of Desktop Metal Inc were trading at $4.23 on the day of the transaction, giving the company a market cap of $144.899 million. According to the GF Value, the intrinsic value estimate for the stock is $16.80, which suggests that the stock is currently undervalued, with a price-to-GF-Value ratio of 0.25. This valuation indicates that the stock might be a Possible Value Trap, and investors should think twice before making an investment.

The GF Value is calculated based on historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

This insider sale might provide valuable insights for current and potential investors, particularly in the context of the company’s current valuation and stock performance trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.