- The price cap rises on 1 Jan, affecting those on variable tariffs

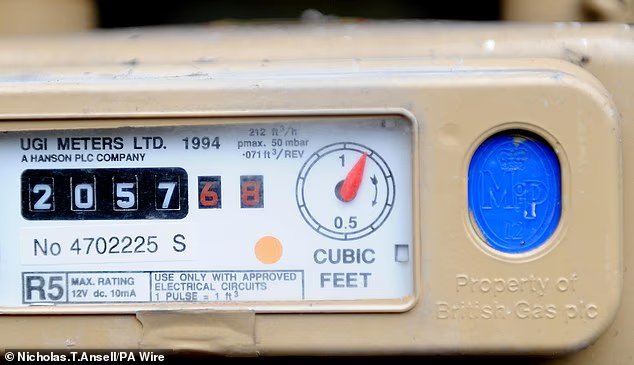

Millions of households risk inaccurate bills in the new year if they don’t submit meter readings by the end of the month.

Most households now have a smart meter, which suppliers say provides more accurate bills because it sends an automatic reading.

And if they are locked into a fixed deal, they will continue to pay the rate agreed per unit of energy and won’t be affected by the price cap.

However, there are more than seven million households who aren’t in a fixed tariff and don’t have a smart meter, according to energy experts at Uswitch – meaning their bills will rise on 1 January.

They are urged to submit a meter reading by the end of the month to make sure they are billed on their actual usage and avoid paying even higher energy bills than they need to.

When a household doesn’t submit readings, they are billed based on estimates which are usually higher.

Households with older meters need to submit readings by 1 January for accurate bills

Why are energy prices going up?

Ofgem will raise the energy price cap by 0.2 per cent, or 28p a month, from £1,755 to £1,758, for a typical dual-fuel household, with electricity prices rising by 5 per cent.

Higher non-wholesale costs have offset the lower price of wholesale energy, which has fallen over the past three months, according to the regulator.

This includes funding Government policies including the Sizewell C nuclear project, which will add around £1 to monthly bills.

The Government announced it would take £150 off bills from April, but it remains unclear how this will feed through to households and how quickly.

Uswitch predicts that the average home is likely to spend £166 on energy in January because of higher usage and rates, compared with £140 in December.

Households that do not submit meter readings on or around 1 January risk having their December usage estimated by suppliers and possibly charged incorrectly.

Ben Gallizzi, energy expert at Uswitch.com, said: ‘Households should take a moment to read their energy meter over the festive period to avoid the possibility of being charged incorrectly at January’s higher energy rates.

‘Customers who don’t have a smart meter should submit their readings before or on Thursday 1 January, so their supplier has an updated – and accurate – view of their account.’

With so much uncertainty about where energy prices might go next year, households are being urged to move to a fixed tariff.

The cheapest fixed deal on the market offers an annual saving of £233 against the January price cap from Fuse Energy and Outfox Energy.

There are 25 other fixed deals available that are cheaper than the new price cap, and are likely to protect households from further rises in April.

Read This is Money’s regularly-updated guide to the best fixed energy deals here.

Gallizzi added: ‘If you can switch to a deal cheaper than the January price cap, now is a good time to make the change.

‘We urge customers to run an energy comparison as soon as possible to see how much you could save off your heating bills.’

| Supplier | Tariff | Fix duration | Average annual bill | Saving vs October price cap (£1,755) | Saving vs January price cap (£1,758) | Exit fees | Availability |

|---|---|---|---|---|---|---|---|

| Fuse Energy | December 2025 Fixed (13m) V2 | 13 months | £1,525 | £230 | £233 | £50 per fuel | Uswitch.com and direct via Fuse Energy |

| Outfox Energy | Merry Fix-Mas 2025 12M V1.0 | 12 months | £1,525 | £230 | £233 | £75 per fuel | Direct via Outfox Energy |

| Outfox Energy | Fix’d Dual Dec25 12M v3.0 – Family Advantage+ | 12 months | £1,526 | £229 | £232 | £75 per fuel | Direct via Outfox Energy |

| Ecotricity | EcoFixed – 1 Year Oct 25 v1* | 12 months | £1,527 | £228 | £231 | £75 per fuel | Direct via Ecotricity |

| Fuse Energy | December 2025 Fixed (12m) V2 | 12 months | £1,544 | £210 | £214 | £50 per fuel | Uswitch.com and direct via Fuse Energy |

| Eon Next | Next Fixed 18m v25 | 18 months | £1,554 | £201 | £204 | £50 per fuel | Uswitch.com and direct via Eon Next |

| Eon Next | Next Fixed 12m v107 | 12 months | £1,578 | £177 | £180 | £50 per fuel | Uswitch.com and direct via Eon Next |

| So Energy | So Kings One Year – Green | 12 months | £1,580 | £175 | £178 | £50 per fuel | Uswitch.com, Confused and direct via So Energy |

| Sainsbury’s Energy | Sainsbury’s Fix and Reward Fixed12m v64 | 12 months | £1,587 | £168 | £171 | £50 per fuel | Direct via Sainsbury’s Energy |

| British Gas | Fixed Tariff Dec26 v3 | 12 months | £1,643 | £112 | £115 | £50 per fuel | Uswitch.com and direct via British Gas |

| Source: Uswitch.com. Prices correct as of 8:00am on 17 December 2025. Tariffs included within the table are the cheapest non-bundle fixed tariffs, not variable or tracker. All energy tariffs and prices mentioned are subject to change without notice, and rates vary upon region. These are the cheapest tariffs available based on suppliers who have updated Uswitch with their rates. *requires customers to have a smart meter | |||||||