More than 100 Japanese companies have expressed interest in investing in Ghana following a high-profile Presidential Investment Forum held in Yokohama, Japan.

Organised by the Ghana Investment Promotion Centre (GIPC) on the sidelines of the Ninth Tokyo International Conference on African Development (TICAD-9), the forum served as a strategic platform to deepen economic ties between Ghana and Japan.

Held on the theme: “Ghana is Open for Business — Unleashing Investment Opportunities for Shared Prosperity”, it attracted Japanese investors and the business community, various Japanese development and international cooperation organisations and government officials, among others.

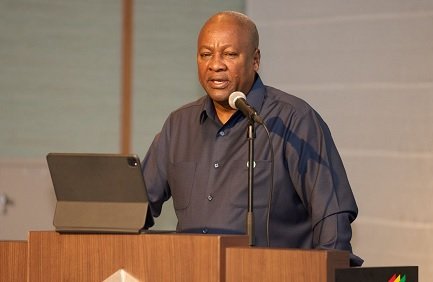

President John Dramani Mahama, in a keynote address at the Presidential Investment Forum yesterday, told the participants that Ghana remained the prime gateway for Japanese businesses seeking entry into the West African and broader African market.

“Ghana is a stable, democratic and business-friendly gateway to West Africa,” President Mahama said.

He pointed to the country’s strategic location, macroeconomic stability, and ongoing reforms designed to significantly improve the ease of doing business.

President Mahama reassured investors that Ghana’s economy was bouncing back, saying inflation, which spiked to a 22-year high of 54.1 per cent in December 2022 and almost 23 per cent in 2024, dropped to 13.7 per cent in June this year and 12.1 per cent last month, with expectations of single digits by the end of this year.

“For those of you who know the history of the Ghanaian cedi, it has been one of the most volatile currencies in Africa. I am happy to announce that this year, Ghana’s cedi has been the best-performing currency in the world,” the President told the investors.

That, President Mahama said, was proof of Ghana’s improving fundamentals and commitment to macroeconomic stability.

To facilitate Japanese investment, the President announced a suite of concrete commitments, including fast-track approvals for projects, readily available industrial sites, sovereign guarantees, and innovative blended financing frameworks.

“In the reviewed Ghana Investment Promotion Centre Act, we’re removing those minimum capital investments.

This will enable any investor, however little money you have, $100,000, $50,000, to be able to come in and set up a business in Ghana,” the President stated.

Under the existing law, foreign investors are required to meet a minimum equity contribution, which must be transferred into an account domiciled in Ghana (Bank of Ghana) before setting up businesses, with higher thresholds for wholly foreign-owned enterprises and trading companies.

Local content key

President Mahama, however, made a pivotal call for reciprocity, urging Japanese investors to commit to local content and technology transfer agreements to build the capacity of Ghanaian workers and managers.

“My three requests are simple. Pilot with us, partner to scale, and invest in people,” President Mahama stressed.

Echoing the President’s assurances, the Chief Executive Officer of GIPC, Simon Madjie, in a detailed investment pitch, outlined the two central pillars of Ghana’s economic strategy: the 24 Hour Economy and Accelerated Export Development Programme (24H+) and the Big Push Agenda.

Big Push Agenda, 24H+

Mr Madjie explained that the 24H+ initiative was designed to extend business operations beyond traditional hours to boost productivity, create jobs and enhance market access.

He assured investors of accompanying financial incentives such as tax rebates, duty waivers and export bonuses.

Elaborating on the Big Push Agenda, Mr Madjie said it was a monumental $10 billion infrastructure plan aimed at closing the nation’s infrastructure deficit and enhancing competitiveness, with a sharp focus on transport, logistics, water systems, agriculture and energy.

The GIPC CEO also detailed a wide array of attractive incentives for investors, including corporate tax holidays for strategic sectors such as agro-processing and renewable energy, location-based tax reductions for businesses established outside Accra and Tema, and customs duty exemptions on machinery and equipment.

He also highlighted specific, ready-to-invest projects such as the Volta Economic Corridor, the Legon Pharmaceutical Innovation Park, and the Kumasi Machinery & Technology Park.

Key sectors identified for Japanese investment included automotive and electric vehicle assembly, agro-industrial parks and food processing, renewable energy, pharmaceuticals, the digital economy, and tourism development.

After the presentation, many Japanese firms took turns to express interest in initiating feasibility studies and pilot projects in Ghana, signalling a renewed momentum in the Ghana-Japan economic cooperation.

Context

TICAD-9 is being held in Yokohama from August 20-22, 2025.

The government of Japan has been leading this conference since 1993, co-hosted by the United Nations, the United Nations Development Programme (UNDP), the World Bank and the African Union Commission (AUC).

Past TICAD conferences have yielded many key outcomes for Africa, including better appreciation of Africa’s development challenges, stronger partnerships between African nations and the international community, and a greater focus on African ownership of development initiatives.

Unlike other such multilateral conferences, TICAD has brought about concrete actions that have translated into financial assistance, particularly in education, water supply, health, and infrastructural development.

The establishment of the African Union’s New Partnership for Africa’s Development (NEPAD) is known to be one of the concrete outcomes of TICAD.

The Japanese government is financing many development projects for Ghana, mostly on concessionary terms, cutting across road infrastructure, education, health and climate change and adaptation.