Longtime soda maker Coca-Cola first paid a dividend more than 100 years ago.

There is no shortage of dividend stocks on equity markets. However, they aren’t all created equal. Some are likely to decrease or suspend their payouts when the going gets rough. Others haven’t raised their dividends for years. Others, still, have very low yields — while a high yield isn’t everything, it can still provide some insight into a company’s dividend program.

The very best dividend stocks tend to avoid all these shortcomings. And that’s why income-seeking investors should seriously consider Coca-Cola (KO -0.50%). The beverage maker doesn’t have a particularly exciting business, but it is one of the smartest dividend stocks to buy today.

A rock-solid business

Coca-Cola has outperformed broader equities this year. One possible reason is that the company appears to have the potential to perform better than most if Trump’s trade policies remain in place and are sustained beyond his administration. Trump’s aggressive tariffs risk increasing manufacturing costs for corporations. Either they have to deal with heavy duties on imported goods, or they must ship their manufacturing back to the U.S., which is typically more expensive.

Image source: Getty Images.

One might think that would also apply to Coca-Cola, since it is a multinational corporation. Coca-Cola operates in nearly every country worldwide, but its manufacturing is largely localized. The majority of products it makes for U.S. consumers are manufactured in the country. Does that mean the company is entirely immune to tariffs? No, hardly any corporation is, regardless of its business structure.

Coca-Cola imports parts and materials from countries abroad, some of which will be subject to tariffs. Still, Coca-Cola looks in a better position than most to handle one of the biggest economic threats Wall Street faces. More generally, Coca-Cola’s business is resilient even amid downturns. The company is a leader in the consumer staples sector, an industry renowned for its defensive characteristics. People continue buying its products even when the going gets rough.

One reason for this is Coca-Cola’s strong brand name, which grants it several advantages, including trust and familiarity with consumers, consistent shelf space in grocery stores, and a degree of pricing power.

Coca-Cola also has an adaptable business. Consumers’ tastes can and do change. If Coca-Cola’s portfolio of beverages had always remained the same, the company might have gone out of business by now. However, thanks to acquisitions and the launch of many new brands, Coca-Cola continues to stay ahead of changing demands and preferences.

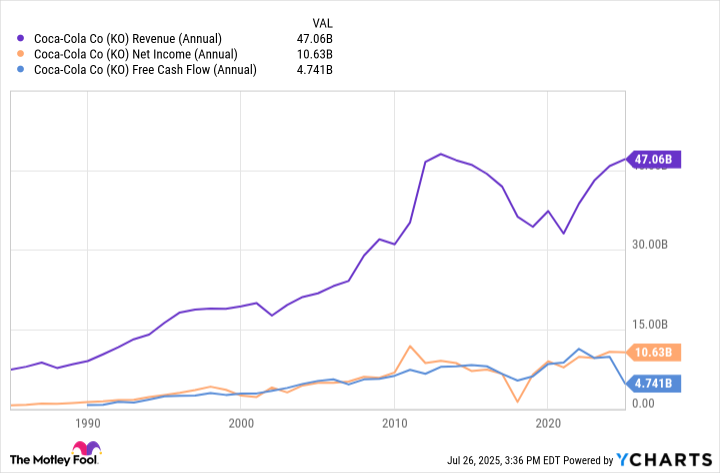

The company owns brands across virtually every major beverage category, including alcoholic beverages, water, soft drinks, juice, coffee, tea, sports drinks, and more. These factors explain why Coca-Cola has generated consistent revenue, earnings, and cash flow for decades.

KO Revenue (Annual) data by YCharts

The company did experience a slowdown in the early days of the pandemic, but it was also able to bounce back from that. That should give investors confidence that, regardless of the challenge it faces, Coca-Cola can find a way to overcome it.

An impeccable dividend track record

Even before examining Coca-Cola’s dividend program, the company’s strong underlying operations and ability to perform relatively well, or at least recover, amid economic challenges, suggest that it can maintain its dividend in both good and bad times. The beverage maker’s actual dividend track record further reinforces the point. Consider that Coca-Cola is a Dividend King, having raised its payout for 63 consecutive years. This streak is as old as some baby boomers.

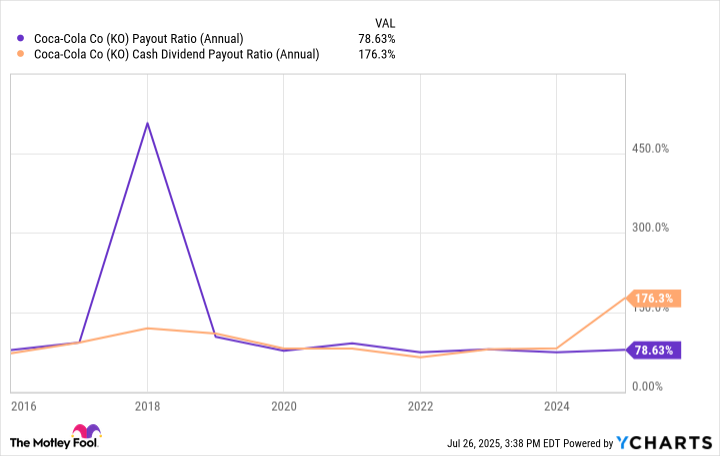

Some might worry that Coca-Cola can’t continue increasing the dividend, given its cash payout ratio of 176% and a payout ratio that approaches 80%. Both look high, but they are not that abnormal for the company when we look at these metrics over the past decade. Coca-Cola has continued to grow its dividend despite that fact.

KO Payout Ratio (Annual) data by YCharts

Meanwhile, the company offers a forward yield of 3% is well above the S&P 500‘s average of 1.3%. Coca-Cola is committed to returning capital to shareholders via increasing payouts. The company’s record in that department, coupled with a robust business that is resilient in challenging economic times and a competitive advantage thanks to its brand name, makes the stock a brilliant pick for income seekers.