The problem: Reducing or getting rid of property taxes would eliminate dollars local governments rely on for needed services.

How well will the Florida Legislature work with Gov. Ron DeSantis?

FLORIDA TODAY’s John Torres discusses the 2025 legislative session with reporters James Call and John Kennedy in this excerpt fro the Florida Pulse.

- Florida lawmakers excluded property tax cuts from the recently approved state budget and tax package.

- House and Senate leaders plan to study the potential impact of property tax reductions on local governments before considering further action.

- While a potential property tax cut proposal could appear on the 2026 ballot, any resulting reductions would not take effect until 2027.

There’s always next year.

That’s the earliest homeowners could see cuts to their bill – at least at the state level – after property tax reductions were left out of a tax package approved by lawmakers June 16.

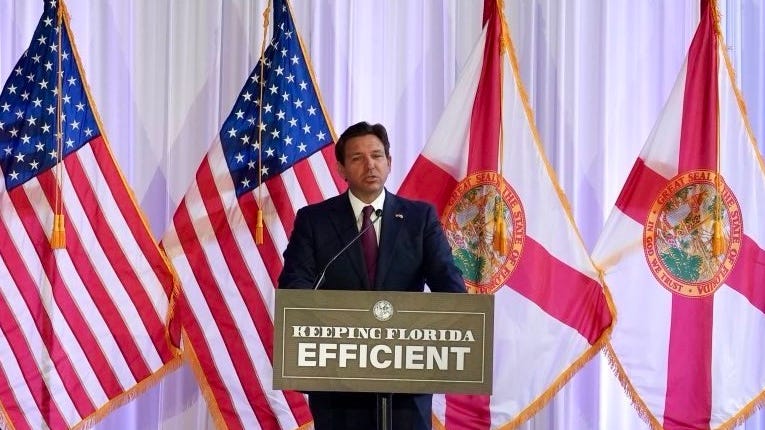

Gov. Ron DeSantis has talked for months about the unfairness of property taxes and his desire to eliminate them. But that ambition, and even his more modest proposal to give $1,000 rebates to homestead property owners, didn’t make it into the budget and tax cut deals hashed out by House and Senate leaders.

“People are not clamoring for sales tax (cuts). They’re clamoring for property tax relief,” DeSantis said March 31 at a gathering of the Florida Realtors in Orlando. His remarks came after House Speaker Daniel Perez, R-Miami, had unveiled a plan to slash the state sales tax from 6% to 5.25%.

But the tax cut bill (HB 7031), though it didn’t include the overall reduction in the sales tax Perez wanted, does include several permanent sales tax exemptions – just not property tax reductions.

Those might come at some point next year, as Perez and Senate President Ben Albritton, R-Wauchula, have shown they want to know more about the possible effects on local governments before moving forward.

Reducing or eliminating property taxes would get rid of dollars governments rely on for essential services. For instance, state Rep. Dean Black, a Jacksonville Republican and former Duval County GOP chair, has called property taxes “a profound and indispensable source of revenue” for financing police and fire protection.

The tax cut bill does include a study of property taxes, pushed by the Senate. Perez, too, has set up a select committee to review five different property tax cut plans.

“We’re going to do everything in our power to make sure that we give the people of Florida the opportunity to decide what they want to do on property taxes,” Perez told reporters June 16. “Me personally, I hope that we are able to abolish them or, at a bare minimum, reduce them for certain people.”

But any proposal would likely be in the form of placing a measure on the 2026 ballot, since property taxes are in the constitution. That means 60% of voters would have to approve it, and then property owners wouldn’t see the cuts until 2027.

DeSantis says property tax bills most dent residents’ wallets

DeSantis has often spoke of the urgency of property tax cuts, which he said are the real culprit “pinching” residents’ pocketbooks, not sales taxes.

As of June 18, DeSantis was still in France on a trade and business development mission and hasn’t spoken publicly about the final budget and tax cut bills. The spending plan (SB 2500) for the fiscal year that starts July 1 is $115.1 billion, about $3.5 billion less than the current year and $500 million less than what DeSantis requested in his budget proposal.

The dispute between DeSantis and Perez grew heated in recent months, and helped lead to the stalemate between the House and the Senate over the tax cuts and budget plans.

Albritton was concerned the massive tax cut Perez envisioned would leave the state unable to pay for vital programs in future years. The chambers deadlocked over the budget, and lawmakers needed an extra 45 days beyond the regular 60 day legislative session to resolve their differences.

DeSantis repeatedly slammed the House and Perez, saying they were “stabbing voters in the back,” even labelling the chamber the “House of Pettiness” at one point. Perez said DeSantis was being “emotional” and throwing “temper tantrums.”

Perez defended his chamber’s actions in the dispute with DeSantis, which included a probe of a $10 million “donation” to the Hope Florida Foundation, a charity connected to an initiative championed by First Lady Casey DeSantis. The money was later funneled to a political committee that opposed a constitutional amendment to legalize recreational marijuana.

“Bumps along the way are healthy. I welcome them. I think it makes this a better process. I think it gives us a better product at the end of the day,” Perez said. “We were able to have a difference of opinions. We were able to reach a conclusion that the maybe the Senate or the Governor didn’t agree with.”

It’s clear DeSantis’ allies in the Legislature will continue to press for property tax cuts. Sen. Blaise Ingoglia, R-Spring Hill, sponsored a bill to increase the homestead exemption from $50,000 to $75,000, but the measure didn’t advance in either chamber.

“I will not rest until we have property tax relief,” Ingoglia posted on X.

Ingoglia, though, could be tapped by DeSantis to become Chief Financial Officer, a position that’s remained vacant since Jimmy Patronis left for Congress on March 31.

For their part, Democrats want to see the details of any property tax proposal and worry a large cut could severely hurt local governments.

“We have a responsibility to put responsible choices before the people,” House Democratic Leader Fentrice Driskell of Tampa said.

Yet she also predicted Republicans are likely to tone down the infighting next year heading into an election cycle: “I don’t think they’re going to want to go through this again in 2026.”

This story contains previously published material. Gray Rohrer is a reporter with the USA TODAY Network-Florida Capital Bureau. He can be reached at grohrer@gannett.com. Follow him on X: @GrayRohrer.