Should you buy Bitcoin? Is the bull market about time to start? Is buying Bitcoin now a big brain move?

Bitcoin has held steady for months, showing strength despite market shifts. After a 48% rise in early 2024, it hit a new high in March but hasn’t launched into the bull market many expected.

According to Brave New Coin’s Bitcoin Liquid Index, Bitcoin is still trading below $70,000, after hitting $69,400, raising the question of whether now is the time to buy.

Source: Brave New Coin’s Bitcoin Liquid Index,

One reason for optimism is the Federal Reserve’s recent decision to lower interest rates for the first time in over four years. Lower rates often push investors toward riskier assets, which could increase Bitcoin’s appeal as crypto investors look for higher returns.

In addition, the launch of spot Bitcoin exchange-traded funds (ETFs) have gained popularity. These funds simplify investing in Bitcoin by removing the need to directly buy and store it, which could attract more investors and drive demand higher.

Cumulative net inflows into spot Bitcoin ETFs have surpassed $20 billion since their launch earlier this year. It took gold ETFs 5 years to reach this figure. That makes the Bitcoin ETFs the most successful launch of any ETF in history.

Eric Balchunas, Senior ETF Analyst for Bloomberg wrote on X that “Bitcoin ETFs have crossed $20b in total net flows (the most imp number, most difficult metric to grow in ETF world) for the first time after huge week of $1.5b. For context, it took gold ETFs about 5 years to reach the same number. Total assets now $65b, also a high water mark.”

Source: X

Bitcoin’s regulatory outlook is also improving, regardless of the results of the upcoming White House election. A favorable regulatory environment could strengthen Bitcoin’s legitimacy, making it more attractive to everyday investors.

Bitcoin’s Unique Characteristics and Long-Term Potential

Looking at Bitcoin in isolation, its foundational attributes are impressive. Created 15 years ago, Bitcoin was the first cryptocurrency that enabled two parties to send money electronically without the need for an intermediary like a bank. This breakthrough introduced a new level of financial freedom and efficiency, setting the stage for the future of digital currencies.

A standout feature of Bitcoin is its fixed supply cap. There will only ever be a maximum of 21 million Bitcoins in circulation, with approximately 19.8 million currently in existence. This limited supply contrasts traditional fiat currencies, which can be printed in unlimited quantities. The fixed supply cap is a crucial aspect that underscores Bitcoin’s value proposition as a deflationary asset.

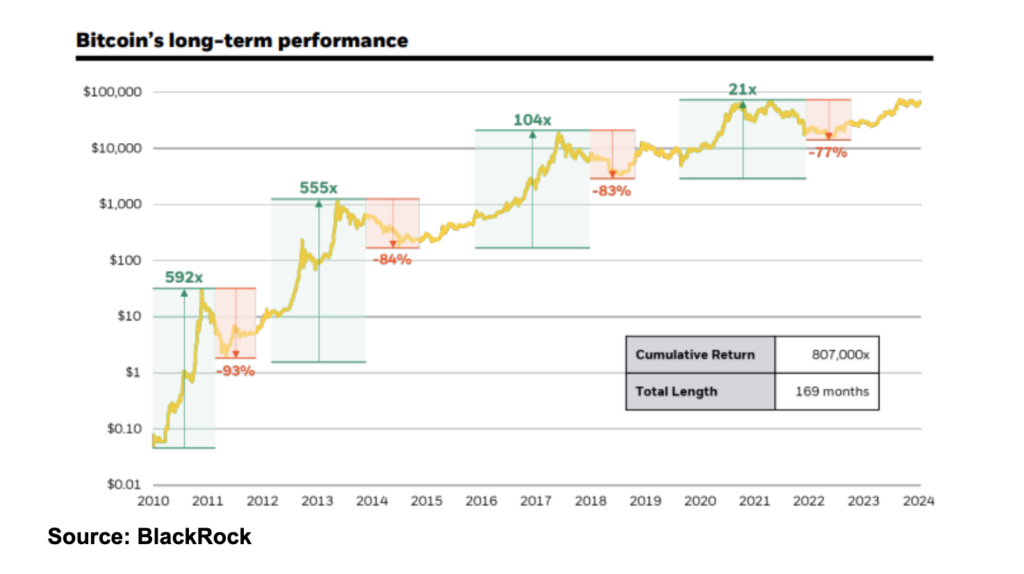

While past performance is not a guarantee of future results, Bitcoin’s historical track record is impressive. According to BlackRock, Bitcoin outperformed every major asset class in seven out of ten years from the start of 2014 through 2023. This strong performance highlights Bitcoin’s potential as a high-yield investment over the long term.

Source: BlackRock

In 2024 alone, Bitcoin has already seen a significant increase of about 60%, outperforming the broader S&P 500 by a substantial margin. This robust performance this year reinforces the argument that Bitcoin remains a viable investment option, even as it trades below the $70,000 threshold.

The 2024 Presidential Election Candidates Support Bitcoin

For the first time, Bitcoin has become a key issue in a presidential campaign. As the November election approaches, former President Donald Trump has positioned himself as a pro-Bitcoin candidate. He is widely seen as someone likely to back Bitcoin if he wins office.

Trump has spoken about supporting the U.S. Bitcoin mining industry. He has floated the idea of creating a national Bitcoin reserve and hinted at Bitcoin’s role in lowering the nation’s $35 trillion debt. Additionally, he has vowed to remove SEC head Gary Gensler, whom many view as blocking Bitcoin’s growth in the country.

If Trump wins, it could be highly favorable for Bitcoin. However, even if he loses, the political climate is clearly shifting in Bitcoin’s favor. Currently, the U.S. presidential race is too close to predict. This uncertainty may explain why many investors are waiting. Nonetheless, the outcome of this election could significantly shape Bitcoin’s future.

Considering all these factors, investing in Bitcoin while it trades below $70,000 appears to be a smart move for many investors, as long as you have a long-term time horizon and are prepared for volatility.

The combination of favorable monetary policy, successful Bitcoin ETFs, and 2024 presidential election candidates’ support for Bitcoin create a compelling case for investment. Additionally, Bitcoin’s historical performance and finite supply provide strong evidence of its potential to deliver significant returns over time.

As the data below shows, on a long enough time horizon, Bitcoin will outperform most other assets.

Source: https://casebitcoin.com/