Property taxes are the primary tool for financing local governments. In fiscal year 2021, property taxes comprised 30 percent of total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

collections in the United States, more than any other source of tax revenue, despite being levied almost exclusively at the local (not state) level. Local governments rely heavily on property taxes to fund schools, roads, police departments, fire and emergency medical services, and other services associated with residency and property ownership. Property taxes accounted for 72.5 percent of local tax collections in fiscal year 2021.

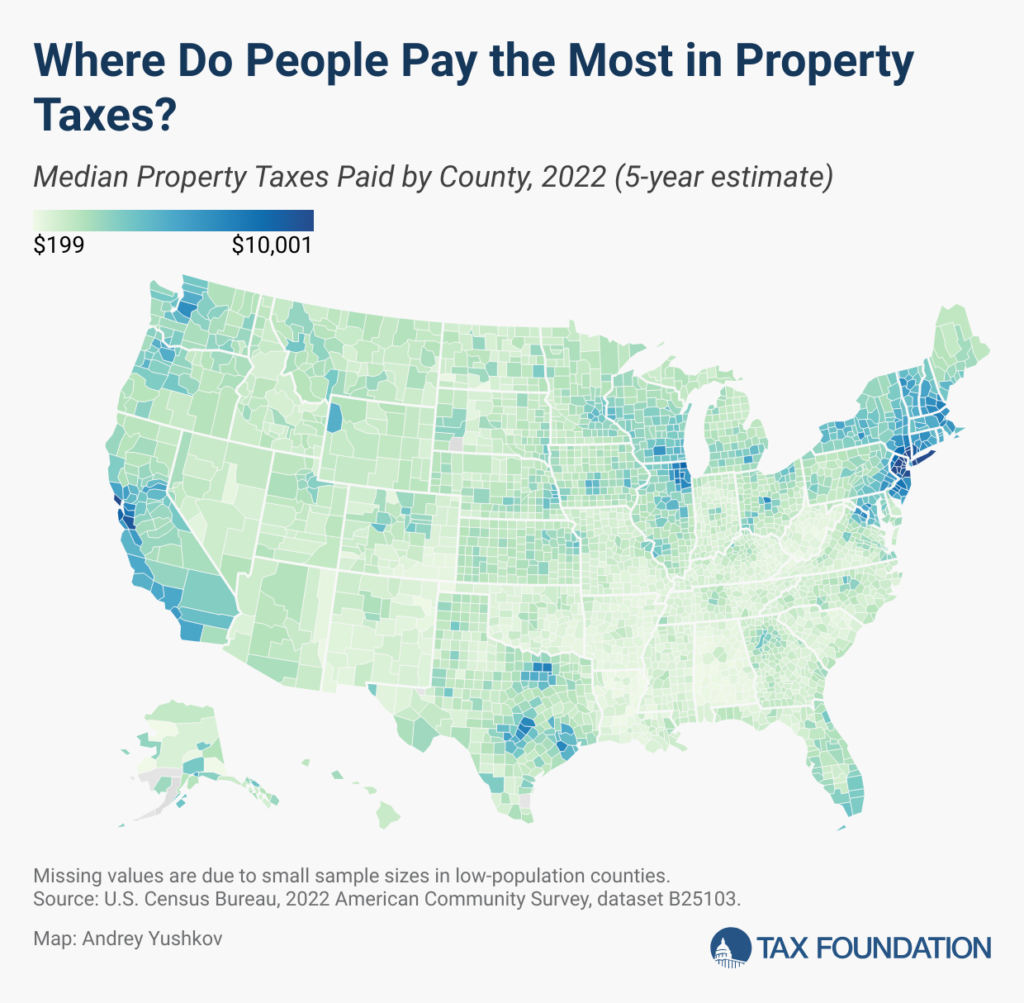

Because property taxes are almost invariably levied locally, and millages (rates) are not directly comparable with each other across states, providing a useful state-level comparison can be difficult. In an effort to present a multifaceted view, today’s blog post features two maps focused on the property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

. The first looks at median property tax bills in each county in the United States, and the second compares effective property tax rates across states.

Median property taxes paid vary widely across (and within) the 50 states. The average level of property taxes paid in 2022 across the United States was $1,815 (with a standard deviation of $1,388). The lowest property tax bills in the country are in ten counties or county equivalents with median property taxes of less than $250 a year:

- Alaska: Northwest Arctic Borough, the Kusilvak Census Area, and the Copper River Census Area*

- Louisiana: Allen, Avoyelles, Bienville, East Carroll, Madison, and West Carroll Parishes

- Alabama: Choctaw County

(*Significant parts of Alaska have no property taxes, though most of these areas have such small populations that they are excluded from federal surveys.)

Additionally, nine counties in Alabama, four counties in Louisiana, Harding County in New Mexico, Sioux County in North Dakota, and McDowell County in West Virginia all have median property taxes paid below $300.

The 15 counties with the highest median property tax payments all have bills exceeding $10,000:

- California: Marin County

- New Jersey: Bergen, Essex, Hunterdon, Morris, Passaic, Somerset, and Union Counties

- New York: Nassau, New York, Putnam, Rockland, Suffolk, and Westchester Counties

- Virginia: Falls Church City

All but Falls Church and Marin County are near New York City. Additionally, three counties in New Jersey, Santa Clara County in California, and the Western Connecticut Planning Region in Connecticut all have median property taxes paid above $9,000.

Property tax payments also vary within states. In some states, typically those with low property tax burdens, this variation is not high. In Alabama, for instance, median property taxes range from below $222 in Choctaw County to $1,282 in Jefferson County (central county of the Birmingham–Hoover metropolitan area), with an average tax bill of $485. In Virginia, by contrast, median property taxes range from $473 in Dickenson County to more than $10,000 in Falls Church City (part of the Washington metropolitan area), with an average tax bill of $1,893.

Another feature of property taxes is that higher median payments tend to be concentrated in urban areas. Median property taxes paid in Manhattan (New York County), San Francisco, Chicago (Cook County), and Miami (Miami-Dade County) are two to three times higher than their state’s average. This is partially explained by the prevalence of above-average home prices in urban centers. Because property taxes are assessed as a percentage of home values, it follows that higher property taxes are paid in places with higher housing prices. However, because millages—the amount of tax per thousand dollars of value—can be adjusted to generate the necessary revenue from a given property tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

, the higher payments also reflect an overall higher cost of government—and commensurately higher taxes—in these areas. (More expensive homes might correlate with a higher cost of government services, but they don’t necessarily cause it. If homes in a community doubled in value but nothing else in the economy changed, local government wouldn’t necessarily need to capture twice as much revenue.)

While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, it’s worth noting that property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services (think about K-12 education or local parks). As argued by Joan Youngman in her book, A Good Tax, the well-designed property tax, despite being the target of frequent political attacks, can be considered a good tax since it is usually visible, transparent, simple, and stable, satisfying most of the principles of sound tax policy.

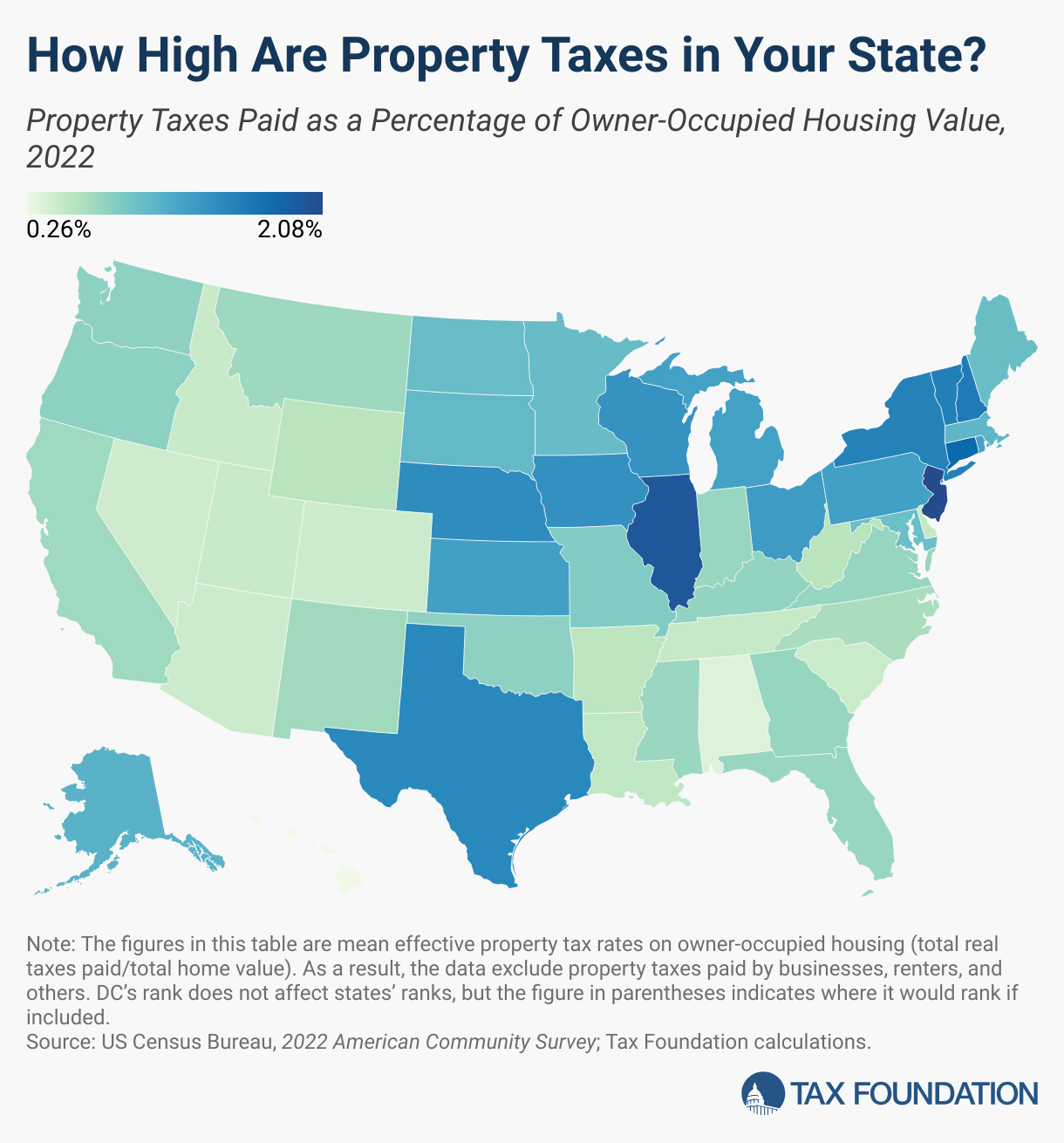

Because the dollar value of property tax bills often fluctuates with housing prices, it can be difficult to use this measure to make comparisons between states. Further complicating matters, rates don’t mean the same thing from state to state, or even county to county, because the millage is often imposed only on a percentage of actual property value, as is discussed below. However, one way to compare is to look at effective tax rates on owner-occupied housing—the average amount of residential property taxes actually paid, expressed as a percentage of home value.

In calendar year 2022 (the most recent data available), New Jersey had the highest effective rate on owner-occupied property at 2.08 percent, followed by Illinois (1.95 percent) and Connecticut (1.78 percent). Hawaii was at the other end of the spectrum with the lowest effective rate of 0.26 percent, followed closely by Alabama (0.36 percent), Nevada (0.44 percent), Arizona (0.45 percent), and Colorado (0.45 percent).

Governments tax real property in a variety of ways: some impose a millage on the fair market value of the property, while others impose it on a percentage (the assessment ratio) of the market value. While values are often determined by comparable sales, jurisdictions also vary in how they calculate assessed values. Property taxes tend to be imposed at the local level, although their basic framework is typically set by state law.

Some states have equalization requirements, ensuring uniformity across the state. Sometimes property tax limitations restrict the degree to which one’s property taxes can rise in a given year, and sometimes rate adjustments are mandated after assessments to ensure uniformity or revenue stability. Abatements (i.e., reductions or exemptions) are often available to certain taxpayers, like veterans or senior citizens. Also, residential property is usually taxed at a lower level than commercial property. And of course, property tax rates are set not only by cities and counties, but also by school boards, fire departments, and utility commissions.

Some states with high property taxes, like New Hampshire and Texas, rely heavily on them in lieu of other major tax categories. This often involves greater devolution of authority to local governments, which are responsible for more government services than they are in states with greater reliance on state-level revenues like income or sales taxes. Other states, like New Jersey and Illinois, impose high property taxes alongside high rates in the other major tax categories.

How does your state compare?

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share