The demand-supply data is provided by the World Gold Council, the international trade association for the gold industry.

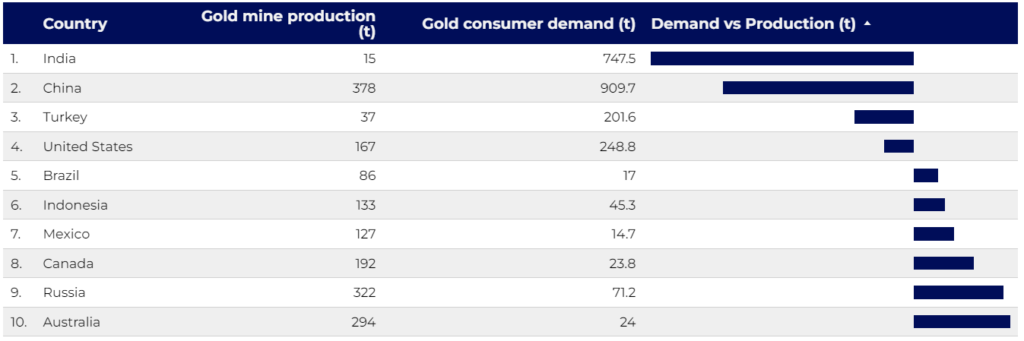

The analysts tabulated the 10 countries with the largest gaps between consumer gold demand and mined production (see below).

India tops the ranking in first place. With a population of over a billion, India has a substantial demand for gold, amounting to more than 747 tonnes in 2023 — made up of jewellery and gold bar demand. This works out at roughly 0.52 gram per person. However, there has been significantly lower mine production at 15.1 tonnes, meaning that demand was 50 times the supply in 2023.

Behind in second place is China. With a population of over 1.4 billion, the country has a yearly gold demand of 909.7 tonnes. Although the mine production figure is the highest seen in all 10 countries, it still falls short of the demand by two times.

Rounding out the top 3 is Turkey. Mine production in 2023 stood at 36.5 tonnes, which is six times lower than the demand of 201.6 tonnes. Gold demand has also been rising, going from 1.13 grams per person in 2021 to 1.43 grams in 2022 and 2.34 grams in 2023.

Also falling behind in its production is the United States. The world’s No.1 economy mined roughly 166.7 tonnes of gold in 2023 but still fell about 80 tonnes short of its demand.

Rick Kanda, managing director at The Gold Bullion Company, commented on the importance of sustainable metal production:

“Sustainable metal production is vital for environmental, economic, and social reasons. Environmentally, it helps conserve finite resources, reduces energy consumption, and minimizes pollution, thereby mitigating climate change and protecting ecosystems.”

“Overall, sustainable metal production supports a balanced approach to resource utilization, benefiting the planet, economy and society,” he concluded.