Amid looming expectations that the Federal Reserve could cut interest rates in September, tech companies generally stand to benefit exponentially, especially those in growth phases or with high future earnings potential.

This scenario aligns well with Nvidia (NVDA), as rates reduce borrowing costs and will make it easier to fund massive capital expenditures surrounding its AI ambitions. To that point, Nvidia’s capital expenditures are expected to hit an all-time high of over $3 billion this year, continuing its record-breaking investment streak in AI infrastructure from data centers to next-generation chip development.

Positioning itself as the backbone of the AI revolution, Nvidia’s aggressive investments have included venture capital (VC) and private equity endeavors, which also tend to flow more freely when borrowing is cheaper and market conditions are favorable.

AI momentum + Rate cuts = Acceleration

Most intriguing to Nvidia’s storied success is that with lower rates the tech giant can potentially double down on expanding its AI data center footprint, while funding AI startups directly or through its corporate VC subsidiary NVentures. Additionally, lower rates would help with scaling production of Nvidia’s much-coveted Blackwell GPUs and future AI chips.

Keeping in mind that Nvidia recently reported a 55% spike in Q2 sales at $46.74 billion, it’s noteworthy that its data center segment contributed to nearly 88% of its revenue at $41 billion, driven by Blackwell GPUs, which brought in $27 billion.

Regarding Nvidia’s growing AI investments, outside of investing in cloud infrastructure provider and AI hyperscaler CoreWeave (CRWV), the tech leader participated in OpenAI’s $6.6 billion funding round and was a strategic investor in Elon Musk’s artificial intelligence company xAI, which had a $6 billion funding round. Of course, lower rates can spark bullish sentiment for the private sector and tech IPOs, meaning Nvidia could be a prime beneficiary if OpenAI and xAI were to eventually follow in CoreWeave’s footsteps and go public.

Nvidia’s strong balance sheet

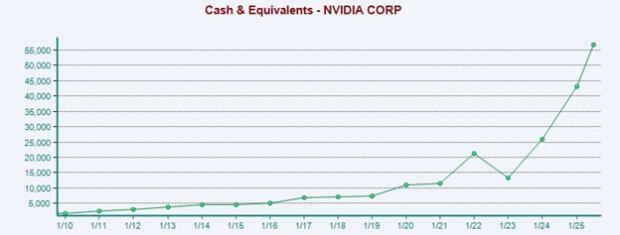

What may further boost Investor sentiment amid rate cut hopes is that Nvidia already has a very strong balance sheet, having more than $56 billion in cash & equivalents at the end of Q2. Notably, Nvidia’s cash & equivalents have ballooned nearly 400% in the last five years from just over $11 billion in 2021.

Image Source: Zacks Investment Research

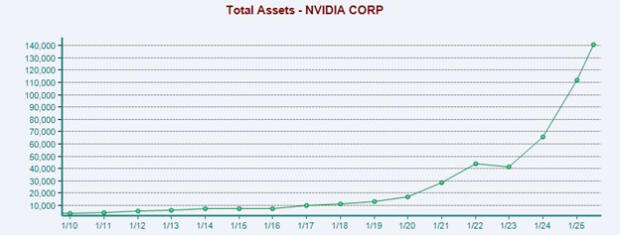

Despite Nvidia’s plan to vastly increase its spending on AI, the company’s long-term debt is very manageable at $8.46 billion. Overall, Nvidia’s total liabilities sit at $40.6 billion, which is pleasantly beneath its total assets of $140.74 billion.

Image Source: Zacks Investment Research

Key metrics to watch for NVDA stock

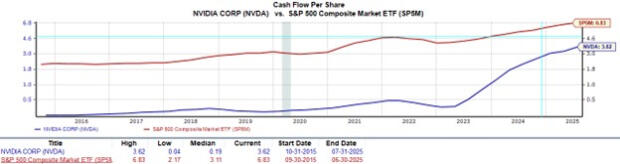

Nvidia’s increased spending will have investors watching its cash flow metrics, and lower interest expenses would mean net operating cash flow improvements, boosting liquidity measures like Cash Flow Per Share (CFPS) and lowering valuation metrics like Price to Cash Flow (P/CF).

Calculating the amount of incoming cash vs. the amount of outgoing cash in correlation with the number of shares outstanding, Nvidia stock currently has a CFPS ratio of 3.6X. This is slightly above its Zacks Semiconductor-General Industry average, but noticeably below the S&P 500’s 6.8X, with a higher number preferred.

Image Source: Zacks Investment Research

Furthermore, at over $170 a share, Nvidia stock is expensive when considering price to cash flow, as a lower metric is preferred and is often important to investors because the net income of the cash flow portion adds depreciation and amortization back in, since these are not cash expenditures.

In this case, NVDA has a high P/CF ratio of 55.4X, compared to its industry average of 48.4X and the S&P 500’s 25.5X. Similar to the P/E ratio, a P/CF ratio closer to 20X or less is generally considered good.

Image Source: Zacks Investment Research

Bottom line

Nvidia certainly looks poised to benefit immensely if interest rates are lowered. Considering such, it would be no surprise if NVDA shares surged if the Fed were to cut rates in September, although this has historically been one of the worst months for the stock market. For now, Nvidia stock lands a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report