BY BRADEN CARTWRIGHT

Daily Post Staff Writer

Palo Alto’s Utilities Advisory Commission wants to soften the blow of raising utility rates by $536 a year for the average customer by offering an on-bill credit.

But the money for a $73 credit would come from a reserve that Palo Alto City Council has spent on projects to reduce greenhouse gas emissions — putting commissioners in between two conflicting city priorities.

“In general, I don’t support subsidizing gas,” Commissioner Rachel Croft said at a meeting on Wednesday (April 2). “I only support the (reserve) used for this purpose just to decrease hardship – literally because the jump is so high in one year.”

“It’s a really huge increase, and I think we should mitigate that,” Commissioner Greg Scharff said.

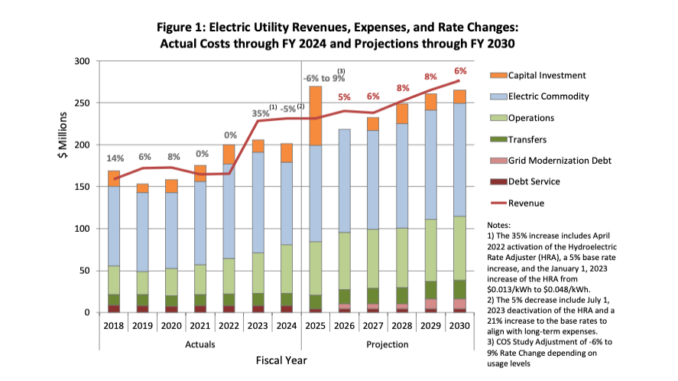

The city is considering an 11% rate hike across six utilities on July 1, bringing median monthly bills from $404 to $448.70.

The largest rate hike is for natural gas – 22% for the average resident so the city can build back depleted reserves.

The city can spend $1.6 million from the state’s

“cap-and-trade” program to offset the rate hike, Senior Resource Planner Lisa Bilir said in a report for commissioners.

An on-bill credit would bring the rate hike down from 11% to 9% for the next fiscal year, Bilir said.

“It would be enough funding to fund whole-home electrification incentives for about 182 homes,” Bilir said.

Commissioners voted 6-1 to recommend council give customers the credit, with Commissioner Utsav Gupta voting no.

“I just don’t support the use of green funds to subsidize the use of fossil fuels,” Gupta said.

The money comes from a “cap-and-trade” gram, started by the state in 2013 as a day do fight climate change.

The program sets a statewide cap on greenhouse gas emissions that goes down each ycar. Companies can pay to pollute above their limits by purchasing “allowances” at a private auction.

The profits from the auction are then distributed to utilities that can use the money for on-bill credits or projects that reduce emissions.

Council has spent the money to help homeowners replace their natural gas water heaters with electric heat pumps. PG&E is using some of its cap-and-trade revenue to give households a $125 credit this month.

Palo Alto’s Climate Action and Sustainability Committee voted 3-0 on March 21 to give another $6.6 million from cap and trade to six affordable housing complexes to replace their aging natural gas appliances with electric appliances.