Utilities’ great revaluation might finally be here. After the sector’s 14% drop since mid-September, we think utilities offer a compelling investment opportunity. Valuations recently reached levels that are as attractive as they have been in nearly 15 years, excluding the brief COVID-19-induced crash in 2020. In mid-October, utilities traded at an 11% discount to our median fair value estimate, the largest discount since the COVID-19 crash and the 2008-09 recession.

Utilities’ dividend yields are back near 4%, their long-term average. Balance sheets are as strong as they’ve been in 50 years, and growth opportunities abound. Many high-quality utilities that hit peak valuations six months ago now trade at prices that we think offer investors attractive long-term risk-adjusted returns. We see several good buying opportunities, but we also think there are some warning signs that investors should not ignore.

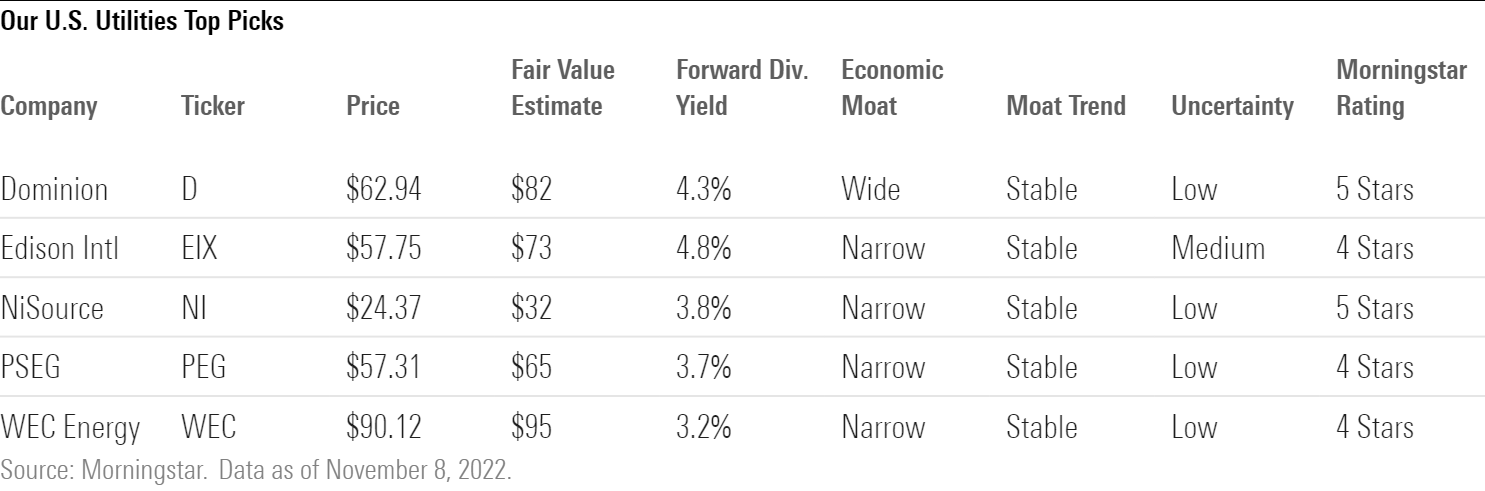

At a Glance

- Utilities recently hit valuations not seen since the COVID-19 crash and the 2008 recession.

- We expect all 38 dividend-paying North American utilities we cover to raise their dividends for 2023 by an average of 6%.

- If higher interest rates and lower valuations stick, we think the best value will be utilities with near-4% dividend yields and infrastructure growth opportunities that could stretch for a decade. Utilities that execute the best should outperform.

- We think consensus remains too bullish even after sharp price target cuts during the last three weeks. Median consensus price targets are 8% above our fair value estimates, on average, down from 15% above our fair value estimates in mid-October.

Utilities Finally Cheap Again

Utilities’ collapse in September has opened a rare window of opportunity for investors. U.S. utilities recently traded at an 11% discount to our fair value estimates on a median basis—a level reached only four times in the last decade. The last time utilities were this cheap was during the 2020 COVID-19-induced market crash. Before that, utilities had not been this cheap since the depths of the 2008 recession.

Few utilities have escaped the carnage. This means many utilities have higher star ratings than they’ve had since the COVID-19 collapse. Utilities with 4- and 5-star ratings now outnumber those with 1- and 2-star ratings for the first time in more than a decade. At the beginning of September, there was only one 4-star-rated utility and no 5-star-rated utilities in our coverage. In contrast, 22 utilities traded with 4- and 5-star ratings at the end of October.

Utilities’ average price/earnings ratio also has come down as stock prices fall and earnings grow. In April, the Morningstar US Utilities Sector Index topped a 24 P/E, a record high in at least 25 years and a 6-point premium to the Morningstar US Market Index’s P/E. Utilities are approaching their historical average 17 P/E and offer little premium to the market.

Relatively Great, but Absolutely Awful

Even though we think some utilities have reached attractive valuations, we also think investors should be cautious about the entire sector, given the mixed signals the market is sending. On a relative basis, utilities have been outstanding performers this year, beating every sector except energy. Utilities are on track to outperform the U.S. market by one of the largest margins in 20 years.

However, utilities’ absolute performance has been woeful, a key potential warning sign. Utilities are on track for their worst calendar-year performance since the 2008 recession.

Is Utilities’ Golden Decade Over?

Low inflation and low interest rates have supercharged all utilities’ returns during the past decade. The sector’s 10% average annual return since 2008 is double its 5% average annual return during the previous 70 years since the Great Depression. But if those tailwinds of the past decade are fading, investors will have to be more discerning with their utilities investments.

Low and falling interest rates boosted utilities’ returns and valuations in two ways.

- Utilities’ dividend yields have been extremely attractive relative to bond yields since 2008.

- Utilities have enjoyed an earnings growth tailwind as their costs of capital fell faster than regulators adjusted customer rates during the last decade. In particular, the allowed return on equity that regulators use to help set customer rates has come down more slowly than interest rates, creating more value for shareholders. Constructive regulation such as timely operating cost recovery, higher-than-average allowed returns on equity, and formulaic rate adjustments help offset inflation, interest-rate risk, and regulatory lag.

Utilities might not offer investors much recession protection, given higher inflation and interest rates. During the 2001 and 2008-09 downturns, inflation never topped 3% and interest rates were on a secular decline, which helped utilities look ultradefensive. During the 2001 recession, utilities fell 14% and the U.S. market fell 23%. During the 2008-09 recession, utilities fell 38% and the U.S. market fell 48%.

As high interest rates erode utilities’ dividend yield premium and cost of capital advantage, dividend growth and financial flexibility will determine which utilities outperform and underperform. We think this is a positive for investors, who can now focus on differentiating companies on the basis of fundamentals and valuation rather than macroeconomic factors like interest rates, which have lifted all utilities.