The key to building wealth in the stock market is finding high-quality companies and holding on to them for years. One stock that has provided stellar returns for its shareholders since its 2016 initial public offering (IPO) is Kinsale Capital (NYSE: KNSL).

Kinsale Capital isn’t exactly a household name, but it has all the makings of a quality investment for the long haul. The specialty insurance company has a strong position in a highly competitive industry and has rewarded shareholders handsomely in the process.

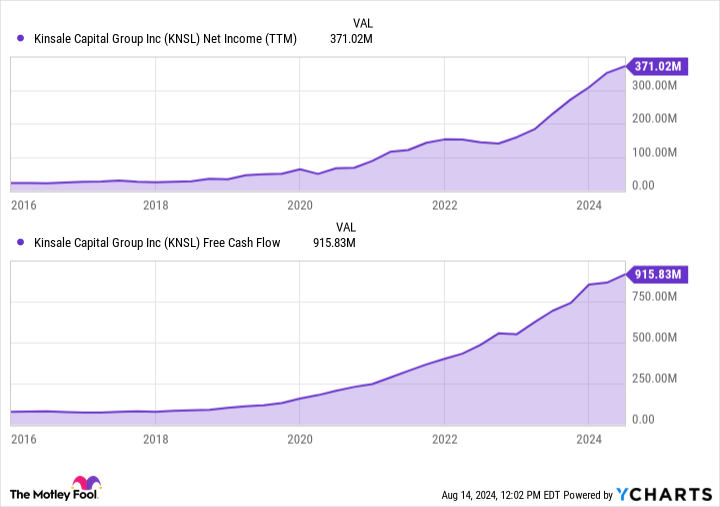

Since its IPO, Kinsale has returned more than 50% annually, or enough to turn $10,000 into $263,690 during the past eight years. Here’s why it can continue to be a stellar stock for patient investors today.

Insurers’ pricing power makes them appealing investments

Insurance companies aren’t terribly exciting investments, but they can be an excellent choice for building long-term wealth. Don’t take my word for it, though. Berkshire Hathaway Chief Executive Officer Warren Buffett is a big fan of buying insurance companies, which have been a key component of the conglomerate’s long-term success.

Insurance stocks are appealing for a few reasons. For one, these companies enjoy consistent demand. That’s because people and businesses are always looking to protect themselves from risks such as weather-related events, liability protection, or cybersecurity attacks. Additionally, insurers can grow alongside an expanding economy but also during times of inflation, when their pricing power becomes more pronounced.

However, one thing to keep in mind is that the insurance industry is hyper-competitive. Insurers collectively break even on their policies when you look across the entire industry. Therefore, you want to pay close attention to how well an insurer balances risks and rewards and invest in those that can consistently underwrite profitable policies.

One way to measure this is with the combined ratio, which is the losses plus an insurer’s expenses divided by premiums written. Last year, property and casualty insurers across the industry had a combined ratio of 101.5%, meaning that collectively they were unprofitable. During the past decade, the average industry combined ratio was 99.6%, meaning insurers collected $0.40 for every $100 in premiums written — showing just how competitive the business is.

Kinsale leverages deep expertise to generate an impressive underwriting profit

Kinsale Capital is a unique insurance company because it covers an area of the market called excess and surplus (E&S) insurance. It underwrites policies outside of traditional insurance, like automotive and homeowners insurance, and instead focuses on hard-to-place risks that regular insurers decline to cover. Its coverage includes small business casualty, construction, professional liability, and product recalls, to name a few.

What makes the E&S market appealing is that these companies don’t face the same stringent regulations like traditional insurers. For example, regulations specify what standard insurers must cover and how much they can charge. These rigorous restrictions can make it harder for an insurer to squeeze out attractive margins.

On the other hand, Kinsale has more flexibility about what risks it is willing to cover and how much it will charge. What gives Kinsale a robust advantage is its deep expertise across different areas of coverage, thanks to its experienced management team and a trove of data that it uses to dial in its risk models.

While some insurers may say they too have these advantages, Kinsale actually delivers. Since its IPO in 2016, Kinsale’s average annual combined ratio is 81%, meaning it earns $19 in underwriting profit for every $100 in premiums taken in. In the highly competitive insurance industry, these are excellent results that others wish they could produce.

Why Kinsale could continue to deliver for investors

Insurers must continuously balance risk and reward on the policies they write. It’s not always easy, especially with so much uncertainty today. It’s a constant dance for insurers to figure out which risks to cover, how much to cover, and what to charge for doing so.

Market conditions today remain favorable for companies like Kinsale Capital. That’s because losses have continued to rise year after year due to weather-related events, economic and social inflation, and less availability of reinsurance coverage. As a result, insurers have more flexibility in raising premiums and what policies they are willing to cover.

Experts call this a “hard market” in the industry, which could remain hard for the foreseeable future. Geopolitical conflict, cybersecurity risks, climate-related catastrophes, and unrest are all risks that will continue to linger. Another possible risk is higher inflation and interest rates during the next decade. If that’s the case, owning some insurance stocks could be a great hedge, and Kinsale Capital is an excellent stock to consider.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,001!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,511!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $357,669!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 12, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Kinsale Capital Group. The Motley Fool has a disclosure policy.

This Stock Turned $10,000 Into $263,690 Since Its 2016 IPO. Here’s Why It’s Not Too Late to Buy. was originally published by The Motley Fool