Dividend stocks are a blessing to investors because they provide income and don’t rely on stock price appreciation to reward shareholders. You can’t go wrong with dividend payouts at any time, but they’re especially helpful when there’s a lot of uncertainty in the stock market. Or, more uncertainty than usual, at least.

That’s been the story with the stock market so far in 2025 for U.S. stocks. Both the S&P 500 and Nasdaq Composite are down year to date (YTD), spending time in correction territory and the Dow Jones Industrial Average is barely in the green, up less than 1% as of March 25.

If you want investment income without worrying too much about stock price movements, the following two dividend stocks are worth adding to your stock portfolio.

After struggling for the better part of five years, AT&T‘s (NYSE: T) stock has rallied over the past 12 months, up over 60%. I figured a turnaround for AT&T’s stock wasn’t far-fetched, but even I must admit that the past year surprised me a bit.

In early 2022, AT&T slashed its dividend by almost half, going from $0.52 quarterly to $0.2775. This move was made so it could have extra cash to pay down its debt and make needed investments as it shifted its focus back to its core telecom business.

During the period after the dividend slash, there were concerns that AT&T would do away with the dividend, but that no longer seems like a realistic (or smart) move.

AT&T’s free cash flow has reached a level ($17.6 billion in 2024) where it supports its dividend and debt obligations, with enough left over for the investments needed in its broadband and fiber businesses.

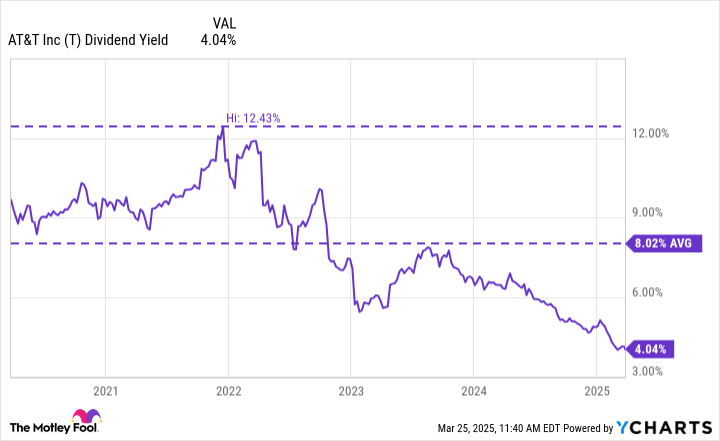

AT&T’s current dividend yield isn’t as attractive at its 8% average over the past five years, but the 4% yield is still around three times the S&P 500 average.

AT&T’s growth will depend a lot on expanding its fiber business. Luckily, that’s been a positive area for AT&T. In the fourth quarter, fiber revenue grew 18% year over year, and in 2024, it added 1 million customers, marking the seventh consecutive year it has added at least 1 million.

Telecom is an industry that’s not going anywhere, and AT&T will be one of its top players for the foreseeable future. It’s a good buy-and-hold dividend stock for those not expecting its recent stock price growth to be the norm.

Coca-Cola‘s (NYSE: KO) products and brands are known and loved worldwide, distributed in over 200 countries and with Coca-Cola soda ranking as an iconic product.