The semiconductor giant shows renewed life after a new CEO took over.

Artificial intelligence (AI) has been a boon for many businesses, but not Intel (INTC +2.25%). The tech veteran should have been able to benefit, as many other companies in the semiconductor industry have done, including rival Taiwan Semiconductor Manufacturing Company.

However, Intel’s history of product delays, failed projects, and missed opportunities, such as recognizing society’s shift toward mobile devices, left the semiconductor giant behind. But after Lip-Bu Tan took over the CEO role in March, the company has performed a strategy reset and is slowly bouncing back.

This can be seen in Intel stock’s abrupt about-face from a 52-week low of $17.67 in April to a high of $44.02 by December. Does this suggest now is the time to buy shares? Let’s dig into the company to find out.

Image source: Getty Images.

Intel’s approach to a recovery

Following Lip-Bu Tan’s CEO appointment, one of the initial steps in Intel’s turnaround was to, as Mr. Tan put it, eliminate the “unnecessary bureaucracy that slows us down.” This was achieved by removing layers of management and flattening the organizational structure.

Another key step was a renewed focus on artificial intelligence. In October, Mr. Tan laid out Intel’s strategy in this area, which prioritized solutions for AI inference, a term describing an AI’s ability to analyze and draw conclusions from data. He stated that inference “will be a far larger market than that for AI training workloads.”

Mr. Tan’s strategy makes sense. Over the last few years, AI training has been the priority for tech companies, such as ChatGPT creator OpenAI, as they have built their AI models. Now, the focus is on making them smarter and more capable, resulting in the rise of agentic AI.

But the tech’s evolution goes even further. OpenAI has declared a goal of achieving artificial general intelligence, a theoretical level of AI considered equivalent to human-level intellectual capabilities, such as creativity and original thoughts. This goal can take years and lots of computing power, providing Intel with an opportunity to capture a piece of the growing inference market.

Mr. Tan’s commitment to Intel’s AI success is such that, after the company’s chief technology officer and AI leader departed for OpenAI in November, the CEO took over direct oversight of the artificial intelligence division.

Today’s Change

(2.25%) $0.91

Current Price

$41.41

Key Data Points

Market Cap

$198B

Day’s Range

$41.15 – $42.83

52wk Range

$17.66 – $44.02

Volume

103M

Avg Vol

114M

Gross Margin

35.58%

Dividend Yield

N/A

Tangible results in Intel’s turnaround

To advance its AI goals and strengthen its balance sheet, Intel secured funding and partnerships. These efforts include an $8.9 billion investment from the U.S. government and a $2 billion contribution from SoftBank Group. The company also struck a deal with Nvidia, which pledged a $5 billion investment in Intel.

The collaboration with Nvidia includes ambitious plans. Together, they aim to create custom data center and PC products for AI. Mr. Tan stated that the partnership will “provide a beachhead for Intel in the leading AI platforms of tomorrow.”

With Mr. Tan’s new AI strategy in hand, Intel is making fast progress in terms of business performance. For example, through the first half of 2025, the semiconductor giant’s revenue of $25.5 billion was essentially flat year over year, and it wasn’t profitable, suffering a net loss attributable to Intel of $3.7 billion, an increase from the prior year’s loss of $2 billion.

But by the third quarter, Intel’s revenue edged up 3% year over year to $13.7 billion, and it turned a profit. Its net income attributable to Intel was $4.1 billion, an impressive 124% year-over-year increase from 2024’s net loss of $16.6 billion.

To buy or not to buy Intel stock

Under Mr. Tan’s leadership, Intel is looking like a promising long-term investment in AI. That said, these successes drove the company’s stock skyward, and shares received another boost on recent news that Intel will provide semiconductor chips to Apple. As a result, its share price valuation has become incredibly high.

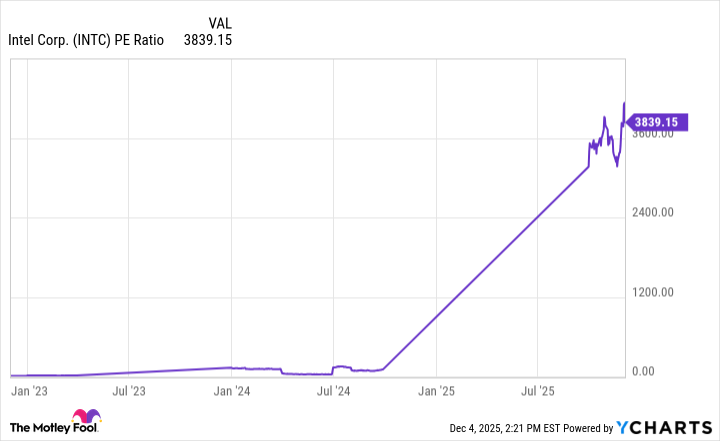

This can be seen in Intel stock’s price-to-earnings (P/E) ratio, which reflects what investors are paying for every dollar of earnings based on the trailing 12 months.

Data by YCharts. PE Ratio = price-to-earnings ratio.

The chart shows Intel’s earnings multiple has skyrocketed in 2025. For comparison, its competitor, Taiwan Semiconductor Manufacturing Company, sports a P/E ratio of 30. Consequently, while Intel looks like a compelling AI investment under the leadership of Mr. Tan, now is not the best time to buy. Wait for the stock price to drop before deciding to invest.