Several companies in big tech have split their stock in recent years.

As the end of 2025 approaches, it’s looking like another strong year for the stock market. As of this writing (Dec. 2), the S&P 500 (^GSPC +0.19%) and Nasdaq Composite (^IXIC +0.31%) have gained 16% and 21% on the year, respectively.

In a similar fashion to the last couple of years, artificial intelligence (AI) stocks have been some of the biggest gainers in the market. Shares of Nvidia and Alphabet have outperformed the major indexes, while Apple, Meta Platforms, and Microsoft (MSFT +0.48%) have posted double-digit gains.

Throughout the AI revolution, a number of big tech companies have completed stock splits as their valuations soared into the stratosphere.

Let’s explore how stock splits work and why they are important. From there, I’ll review some of the more notable splits in the AI era and reveal my prediction for why Microsoft could be the first big-name stock split of 2026.

Image source: Getty Images.

What are stock splits and how do they work?

When a stock begins to experience outsized momentum, investors generally tend to view the rising share price as expensive. While such a notion could be true, the absolute dollar value of a stock price reveals little about the company’s underlying valuation.

Nevertheless, managers at large corporations understand investor psychology. So, if they notice that trading volume is trending down or that their stock is primarily being bought and held by institutional investors, companies may choose to split their stock.

Right now, shares of Microsoft trade for $490 and the company has an outstanding share count of 7.4 billion shares.

If the company were to complete a 5-for-1 split, for example, Microsoft’s share price would become $98 and its outstanding shares would rise to roughly 37 billion. As investors can see, in a stock split a company’s stock price and share count move by the same ratio.

This is important to understand, as stock splits do not inherently change the market capitalization of a company. Broadly speaking, companies will engage in a stock split in an effort to broaden their investor base — making shares more accessible to retail investors who had been sitting on the sidelines.

In addition, stock splits often garner lots of chatter from talking heads on financial news programs. With that in mind, splits can also act as a subtle form of marketing for a company.

Image source: Getty Images.

What technology companies have split their stock in recent years?

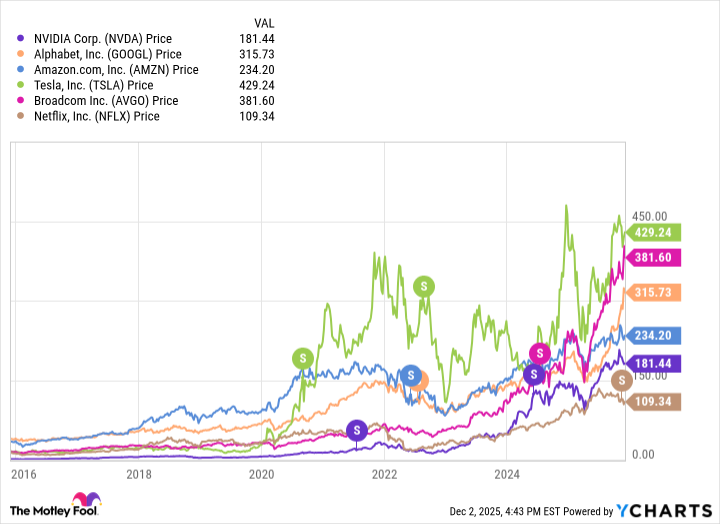

Over the last five years, several members of the “Magnificent Seven” including Nvidia, Alphabet, Amazon, and Tesla have opted to split their stock. More recently, Broadcom and Netflix have also joined big tech stock splits.

As the trends in the chart above illustrate, these stocks had experienced sustained stock price appreciation prior to splitting their shares.

Why Microsoft may consider a stock split in 2026

Microsoft stock has gained 92% during the AI revolution. While that’s an impressive return, the Windows maker has lagged the broader Nasdaq index.

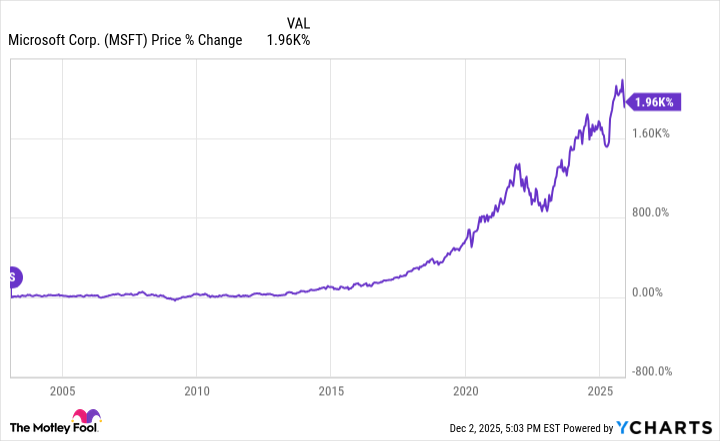

The last time Microsoft completed a stock split was in February 2003. Since then, shares of Microsoft have gained nearly 2,000%.

What’s interesting is that Microsoft stock was relatively flat for a decade. During the early and mid-2000s, innovation was low at Microsoft and the company was largely viewed as a dinosaur compared to the likes of Apple and other internet darlings.

While the company’s cloud unit, Azure, has become a formidable player in the AI landscape, it still lags in market share compared to Amazon Web Services (AWS). Moreover, even though Microsoft has explored designing its own custom chips, it’s unlikely the company is going to dethrone Nvidia or Advanced Micro Devices in the data center accelerator market anytime soon. The chip industry’s latest threat appears to be coming from Alphabet — not Microsoft.

I think part of Microsoft’s problem is that despite all of its progress on the AI front, the company is still perceived as an archaic brand by many. Given several of its cohorts have completed splits in recent years, combined with Microsoft’s respectable but perhaps somewhat pedestrian performance relative to its peers in recent years, I think a stock split could be one mechanism the company uses to rejuvenate enthusiasm from investors.

It’s important to note that a potential Microsoft stock split is merely a fun prediction on my end. Whether the company actually chooses to split its stock next year is irrelevant. While the competitive landscape is intensifying, Microsoft has still proven to be a solid investment choice among megacap AI stocks over the last few years.

I view Microsoft as a compelling opportunity to buy and hold for the long run, and see the company as a nice complement to existing positions in cloud hyperscalers and chip designers alike.