It’s about striking that perfect balance between chasing growth and protecting what you already have.

Whether you plan on retiring a millionaire or already are one, your investing strategy is likely shifting over time. You spend your working years looking for upside in the name of growing your nest egg as much as possible. But as you age, stability and consistency become more important.

Dividend-paying companies can be a great way to add balance to your portfolio. They pay shareholders a portion of their profits, allowing investors to enjoy gains without having to sell their shares. The best companies can continue to grow while paying you more. That really is the best of both worlds.

Johnson & Johnson (JNJ 1.87%) is a legend among dividend investors. It’s a Dividend King, meaning it has paid and raised its dividend for at least 50 consecutive years. Here’s why it can still be an excellent anchor for a millionaire’s portfolio — or anyone’s, for that matter.

Image source: Johnson & Johnson.

A central figure in an evergreen industry

It’s not easy to grow for decades on end, but Johnson & Johnson sits in a rare seat as a leader in a multitrillion-dollar global healthcare industry that continues to grow year after year. In the United States alone, total healthcare spending surpassed $5.3 trillion in 2024 and continues to grow at a pace in the mid- to high single digits.

Today’s Change

(-1.87%) $-4.62

Current Price

$242.29

Key Data Points

Market Cap

$584B

Day’s Range

$240.29 – $246.88

52wk Range

$141.50 – $246.96

Volume

1.1M

Avg Vol

9M

Gross Margin

67.97%

Dividend Yield

1.61%

J&J develops and sells pharmaceutical drugs and medical devices for a wide range of disciplines, from oncology to immunology and cardiovascular to orthopedics. The products accounting for over 75% of Johnson & Johnson’s sales hold top-two market share positions in their respective applications, giving you an idea of just how strong the brand is across the board.

The financial firepower to help you sleep well at night

Deep pockets are a competitive advantage in the healthcare business. J&J’s size and excellent financials allow it to invest in developing new products, acquire emerging competitors, and raise its dividend simultaneously.

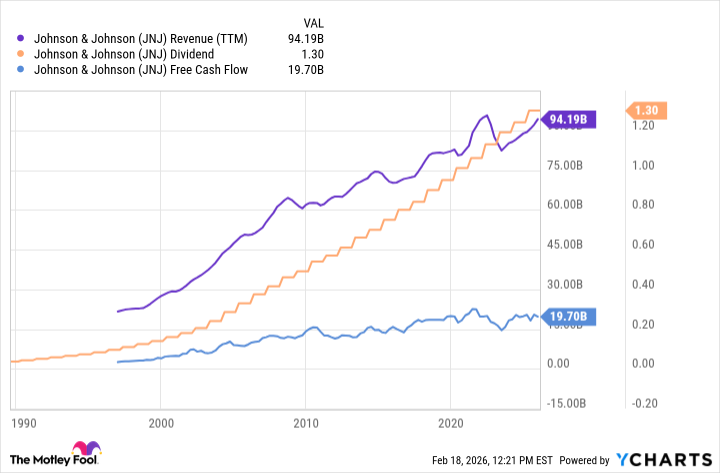

JNJ Revenue (TTM) data by YCharts.

The stock currently yields a solid 2.1%, and management has raised the dividend for 63 consecutive years. The dividend is also about as safe as they come; it costs less than half of this year’s earnings estimates. And Johnson & Johnson is one of only two companies with the highest available credit rating (AAA), which all but guarantees access to debt in a pinch.

Remember that J&J is one of the world’s largest companies, with a market cap approaching $590 billion today. It’s probably not going to make anyone rich overnight. That said, there’s still upside in the stock; management believes the business could accelerate to double-digit growth by the end of this decade.

Johnson & Johnson’s mix of safety and growth potential makes it a fine choice to anchor a portfolio, protecting the wealth you’ve worked hard to accumulate.